MAS Crypto Regulation: A Practical Overview

When navigating MAS crypto regulation, the set of rules issued by Singapore's Monetary Authority of Singapore that govern digital assets, token offerings, and crypto‑related services. Also known as Singapore crypto regulation, it aims to protect investors, curb money‑laundering, and foster innovation in a clear legal framework.

Key Related Frameworks

MAS crypto regulation does not exist in a vacuum. It works alongside MiCA, the European Union’s Markets in Crypto‑Assets regulation that sets continent‑wide standards for digital assets, offering a useful comparison for issuers eyeing both markets. Another important piece is Singapore’s regulatory sandbox, a controlled environment where fintech startups can test innovative products under MAS supervision. Together, these frameworks shape how projects design token economics, manage AML/KYC checks, and interact with traditional finance.

At its core, MAS crypto regulation requires crypto service providers to obtain a license under the Payment Services Act. This includes exchanges, custodians, and wallet providers. The Act mandates robust anti‑money‑laundering (AML) and counter‑terrorist financing (CTF) procedures, continuous risk assessments, and clear disclosure of fees and risks to users. For token issuers, the regulation distinguishes between securities‑type tokens, which fall under securities law, and utility tokens, which are treated more like commodities. This classification influences prospectus requirements, advertising limits, and the need for a prospectus‑like document if the token is offered to the public.

Because of these rules, many projects choose to incorporate in Singapore or launch token sales there to signal compliance. The sandbox program further lowers the entry barrier: start‑ups can run a pilot for up to two years, receive guidance from MAS, and only later transition to full licensing. This approach helps firms fine‑tune AML/KYC protocols, test cross‑border payment flows, and validate smart‑contract security before scaling.

In practice, complying with MAS crypto regulation means setting up a dedicated compliance team, integrating real‑time transaction monitoring tools, and preparing detailed reports for periodic MAS audits. Firms also need to stay updated on evolving guidance—MAS frequently publishes FAQs and circulars that clarify gray areas, such as the treatment of NFTs or decentralized finance (DeFi) protocols. By aligning with these expectations, businesses can avoid hefty fines, protect their reputation, and tap into Singapore’s thriving crypto ecosystem.

Below you’ll find a curated collection of articles that break down these topics further. From deep dives on how Indian exchanges adapt to local rules, to step‑by‑step guides on launching a token under Singapore’s licensing regime, the posts offer actionable insights you can apply right away. Whether you’re a developer, marketer, or investor, the resources below will help you understand the practical impact of MAS crypto regulation and keep you ahead of the compliance curve.

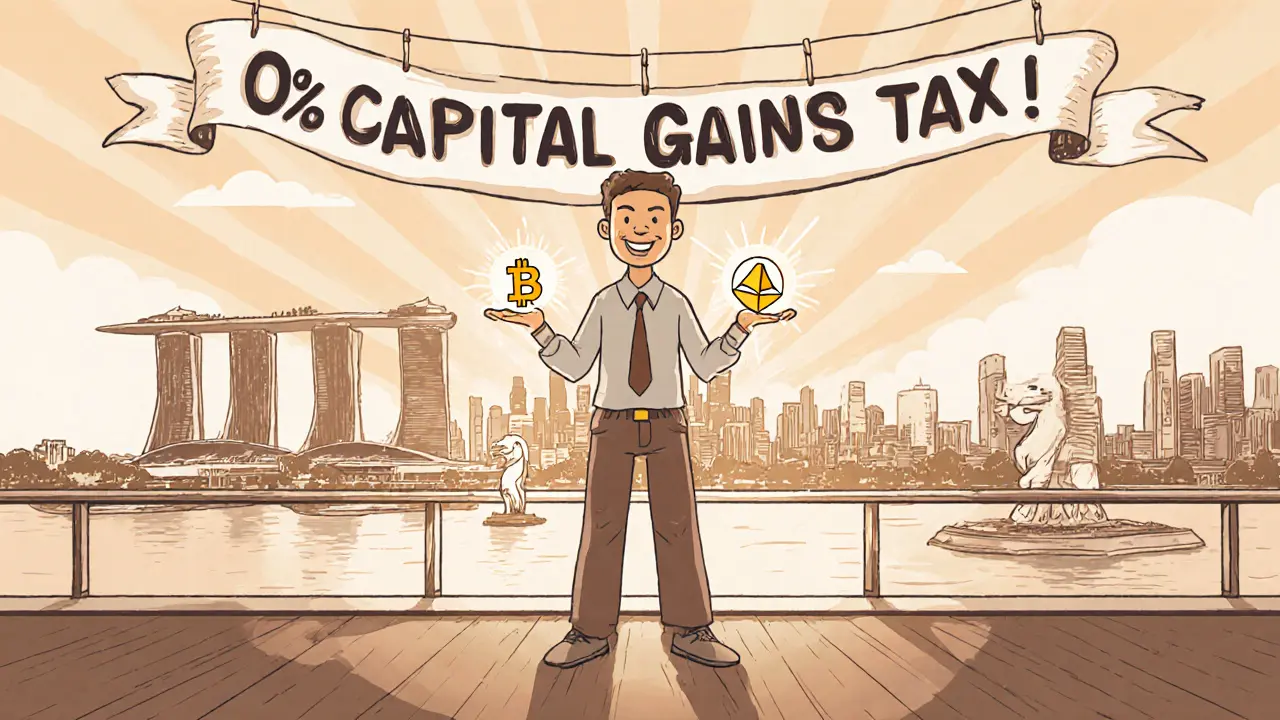

Why Singapore Has No Capital Gains Tax on Crypto (and How It Benefits Investors)

by Johnathan DeCovic Sep 22 2025 17 CryptocurrencyDiscover why Singapore imposes no capital gains tax on cryptocurrency, who benefits, residency requirements, and how its regulatory framework compares globally.

READ MORE