IMF Bitcoin Reversal

When working with IMF Bitcoin reversal, the phenomenon where International Monetary Fund announcements trigger a swing in Bitcoin’s market direction. Also known as IMF‑driven Bitcoin pullback, it shows how International Monetary Fund policy shifts can reshape Bitcoin sentiment across exchanges and wallets.

Key Factors Behind the Reversal

The reversal hinges on three main forces. First, IMF fiscal guidance often changes global liquidity, which directly influences the supply‑demand balance for digital assets. Second, macroeconomic policy – interest‑rate forecasts, sovereign debt outlooks, and currency stability – feeds into trader risk appetite, making Bitcoin a proxy hedge or a risk‑off asset. Third, market psychology reacts to the IMF’s credibility; a hawkish tone can spur sell pressure, while dovish language may boost buying. Together, these elements create a feedback loop: IMF statements affect macro policy, macro policy moves crypto markets, and crypto moves reshape investor sentiment. This chain of cause‑and‑effect mirrors the semantic triple “IMF Bitcoin reversal requires macroeconomic policy insight”.

Beyond policy, technical tools amplify the effect. Liquid staking platforms, for example, let users earn yield on staked Bitcoin without locking the asset, increasing on‑chain activity during reversal periods. Cross‑chain bridges also play a role, as capital can flow from Ethereum or Solana into Bitcoin‑based protocols when the IMF’s stance signals macro risk. Risk‑management principles, such as position sizing and stop‑loss placement, become crucial when the reversal spikes volatility. Understanding tokenomics – supply dynamics, halving cycles, and inflation rates – helps traders gauge whether the reversal is a short‑term correction or a longer trend shift.

What you’ll find in the collection below reflects this multi‑layered landscape. The posts cover exchange reviews that highlight how platforms handle sudden Bitcoin price moves, deep dives into proof‑of‑stake versus proof‑of‑work security during market stress, and guides on protecting digital signatures when volatility spikes. You’ll also see analyses of stablecoin behavior during IMF‑driven reversals, liquidity pool token ratios that matter when capital shifts, and real‑world smart‑contract use cases that backstop crypto activity. Armed with this context, you can spot the next IMF‑related price swing, adjust your staking strategy, and keep risk under control. Let’s jump into the curated articles that break down each piece of the puzzle.

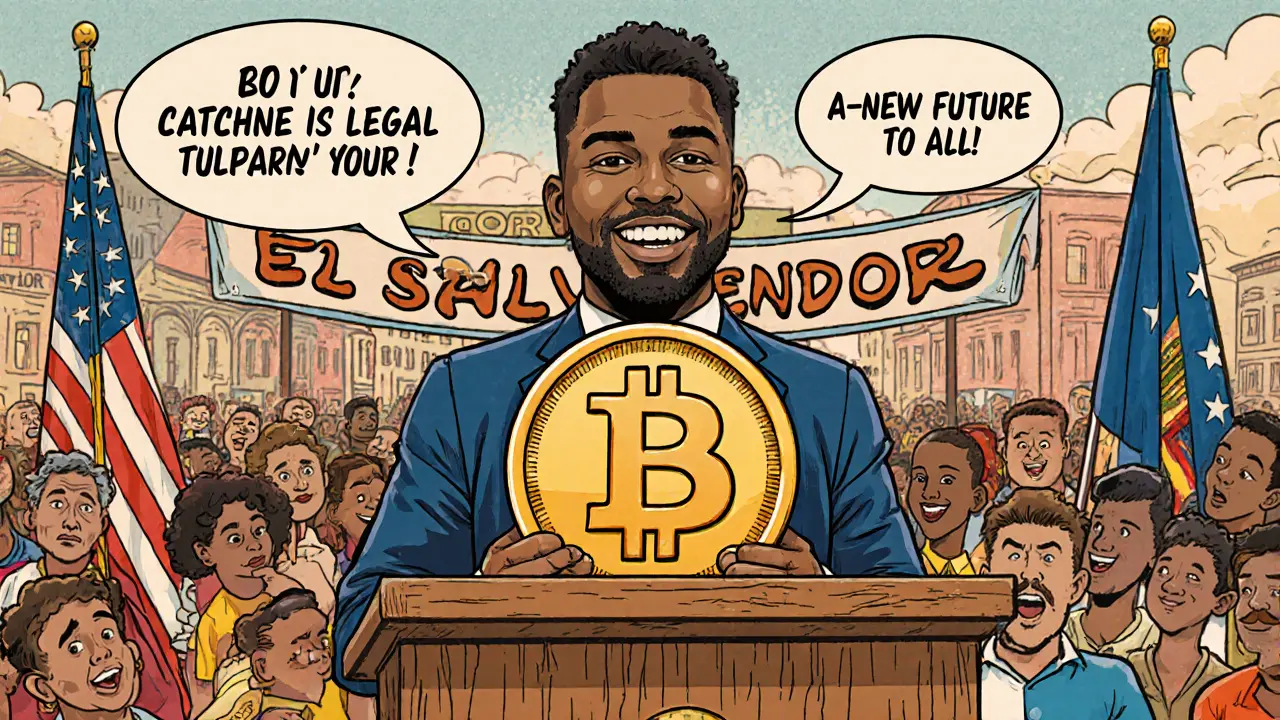

Bitcoin Legal Tender in El Salvador: Complete Guide 2025

by Johnathan DeCovic Oct 20 2025 23 CryptocurrencyA comprehensive guide to Bitcoin as legal tender in El Salvador, covering its 2021 launch, the 2025 policy reversal, impact on businesses, and lessons for future crypto adoption.

READ MORE