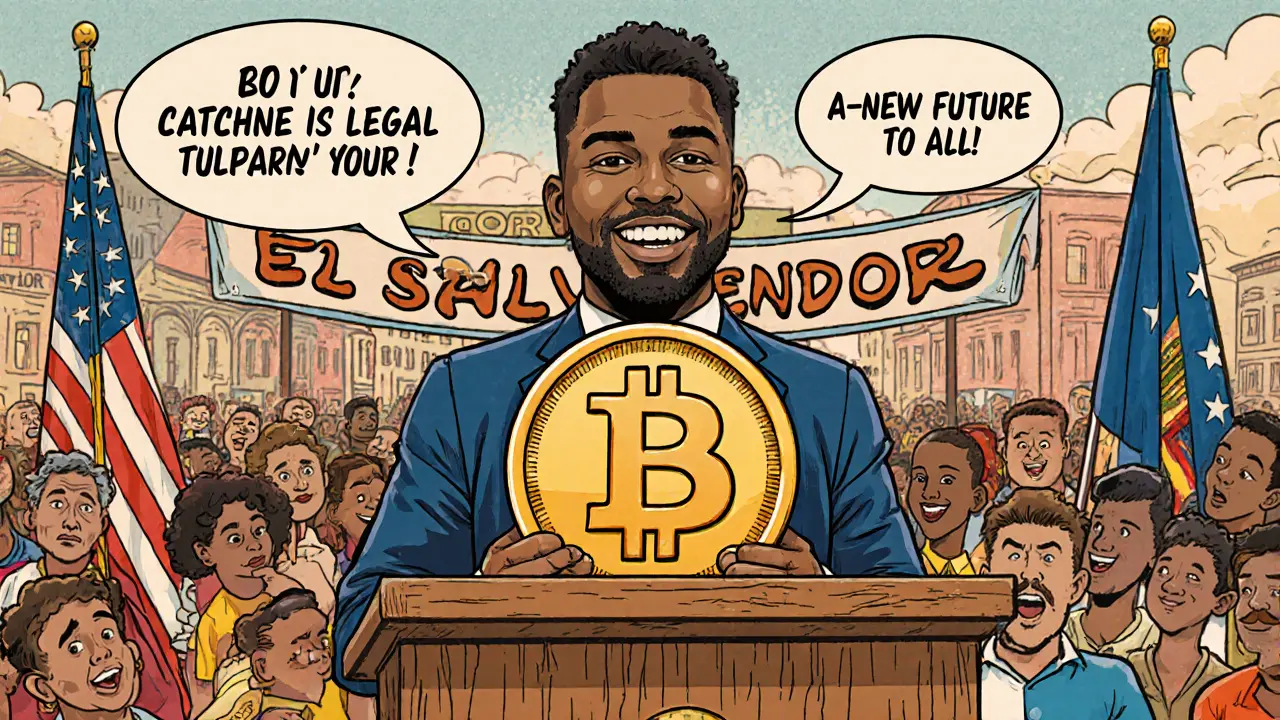

El Salvador Bitcoin Law: What It Means for Crypto Users

When talking about El Salvador Bitcoin law, the 2021 legislation that made Bitcoin legal tender in the country. Also known as Bitcoin as legal tender, it established a framework for using Bitcoin alongside the US dollar. The law sits at the intersection of Bitcoin, the first decentralized cryptocurrency and broader cryptocurrency regulation, government rules that govern digital assets. In plain terms, the government said: you can pay taxes, buy groceries, or settle a salary in Bitcoin, and merchants must accept it unless they lack the technology. This move sparked a global debate – some call it a bold experiment, others a risky gamble.

Key aspects of the law

The law requires businesses to accept Bitcoin for everyday transactions, but it also gives them a three‑year grace period to set up a digital wallet. It creates a state‑run wallet called Chivo, which lets citizens convert Bitcoin to dollars instantly. By doing so, the law aims to lower remittance costs – El Salvador receives over $2 billion each year from Salvadorans abroad, and faster, cheaper transfers could boost disposable income. The legislation also mandates that tax returns can be filed in Bitcoin, meaning the tax authority must recognize crypto gains and losses. These provisions form a chain of cause and effect: legal tender status → wallet adoption → reduced remittance fees → potential increase in foreign investment.

Another important piece is the law’s stance on volatility. Critics argue that a wildly fluctuating asset can’t serve as a stable medium of exchange. To address this, the government promised a reserve fund backed by Bitcoin and US dollars to stabilize prices. In practice, the fund’s size and transparency remain unclear, leaving businesses to bear the risk of sudden price swings. The law also interacts with existing financial regulations – banks must now consider crypto exposure when assessing credit risk, and anti‑money‑laundering frameworks have been updated to cover Bitcoin transactions. This blend of new rules and old oversight creates a hybrid regulatory environment that’s still evolving.

International reaction has been mixed. Some governments, like the United States, warned that the move could expose citizens to fraud and tax complications. Meanwhile, crypto‑friendly jurisdictions see an opportunity to attract startups and developers eager to experiment with blockchain‑based services. On the ground, many Salvadorans remain skeptical, fearing that daily price drops could erode savings. Yet a growing community of developers is building wallets, point‑of‑sale integrations, and educational tools to make the transition smoother. The law therefore acts as both a catalyst for innovation and a testbed for how societies manage digital money.

Below you’ll find a curated set of articles that dig deeper into each of these angles – from detailed reviews of crypto exchanges that support Chivo, to guides on how to claim airdrops in a regulated environment, and analysis of how proof‑of‑stake systems compare to Bitcoin’s proof‑of‑work in a legal‑tender context. Whether you’re a developer, an investor, or just curious about how a tiny nation reshaped the global crypto conversation, the posts ahead give you practical insights and real‑world examples to help you navigate the landscape shaped by the El Salvador Bitcoin law.

Bitcoin Legal Tender in El Salvador: Complete Guide 2025

by Johnathan DeCovic Oct 20 2025 23 CryptocurrencyA comprehensive guide to Bitcoin as legal tender in El Salvador, covering its 2021 launch, the 2025 policy reversal, impact on businesses, and lessons for future crypto adoption.

READ MORE