blockchain P2P Overview

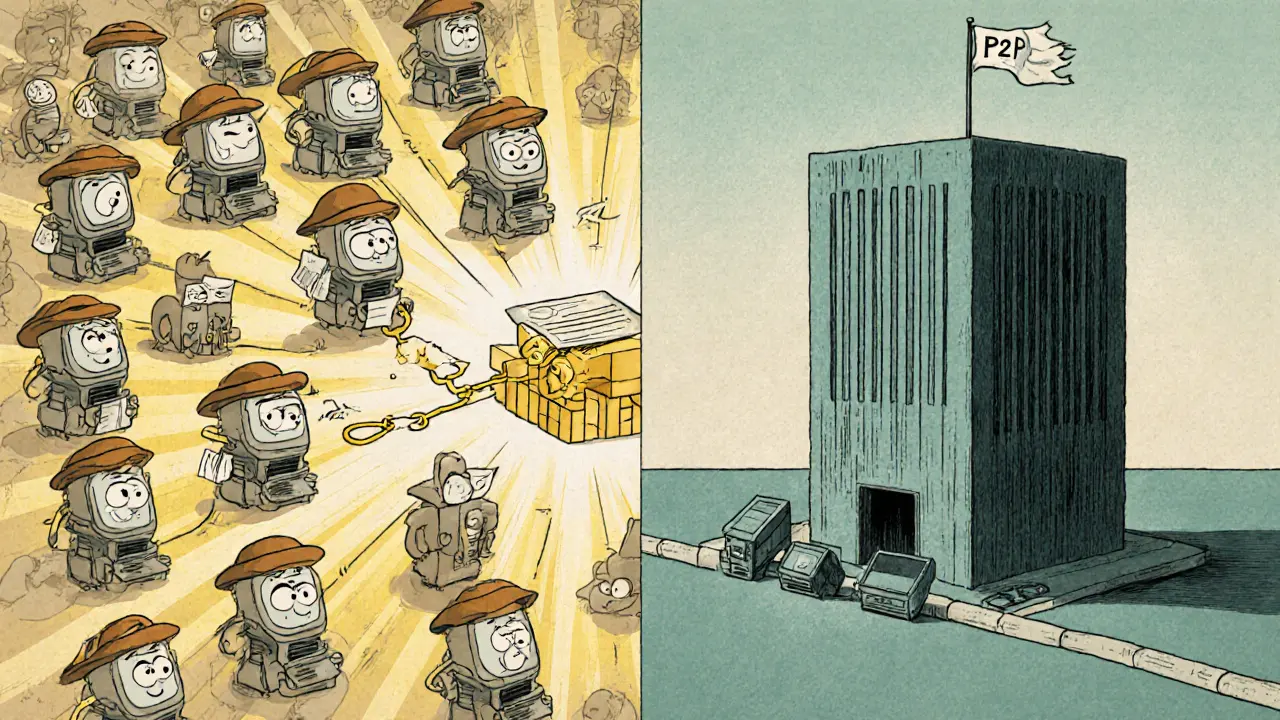

When you think about blockchain P2P, the network layer that lets users exchange cryptocurrencies directly without a central intermediary, you’re actually looking at the backbone of many modern crypto services. Peer-to-peer trading, a method where buyers and sellers match on‑chain, bypassing exchanges uses this layer to keep transactions fast and cheap. Cross-chain bridges, protocols that connect separate blockchains and enable asset movement rely on P2P messaging to lock, verify, and release tokens across networks. Finally, decentralized finance, the ecosystem of lending, borrowing, and yield‑generating services built on smart contracts would lose its composability without a reliable P2P fabric. In short, blockchain P2P enables direct crypto swaps, requires trustless bridge mechanisms, and supports DeFi’s open market dynamics. This trio of connections sets the stage for everything from token launches to stablecoin pegging.

Beyond the core tech, blockchain P2P shapes how tokenomics are designed. When a project launches a new coin, its supply distribution, reward schedules, and fee structures all assume that users can move tokens peer‑to‑peer without bottlenecks. That assumption fuels the rise of liquidity pool token ratios, where automated market makers count on fast P2P swaps to keep prices balanced. Smart contract audits also focus heavily on P2P pathways, checking for replay attacks or bridge exploits that could drain funds. Meanwhile, crypto exchanges like OKX or Virtuse embed P2P layers in their custodial services to offer near‑instant withdrawals, blurring the line between centralized and decentralized experiences. Airdrop campaigns—think MDX, RACA, or WMX—depend on users claiming tokens through P2P claim contracts, making the network’s reliability a direct factor in campaign success. All these pieces—from tokenomics to audits—interlock through the same peer‑to‑peer messaging protocol.

Regulators are catching up, too. Countries such as Tunisia, Kuwait, or India are drafting rules that specifically address P2P crypto trading, demanding KYC on‑ramp points while trying not to stifle cross‑border interoperability. Stablecoins, which promise low volatility, lean on blockchain P2P to maintain their peg by allowing rapid arbitrage across platforms. Risk‑management guides stress the need to monitor bridge health and peer‑to‑peer network congestion as part of a trader’s toolkit. By understanding how blockchain P2P underpins these varied facets—exchanges, bridges, DeFi, tokenomics, and regulation—you’ll be better equipped to navigate the space. blockchain P2P will appear throughout the articles below, each diving deeper into a specific angle of this essential technology.

P2P vs Client-Server: Why Blockchain Chooses Peer-to-Peer

by Johnathan DeCovic Sep 26 2025 21 CryptocurrencyExplore why blockchain relies on peer-to-peer networks over client-server models, covering decentralization, cost, security, and scalability.

READ MORE