Bank Al-Maghrib Licensing

When dealing with Bank Al-Maghrib licensing, the official process by which Morocco’s central bank grants, limits, or revokes permission for crypto‑related services. Also known as Moroccan crypto licensing, it dictates who can offer digital‑asset wallets, exchanges, or staking platforms within the kingdom. Bank Al-Maghrib licensing is a cornerstone for any project eyeing the North‑African market because it directly interacts with broader crypto licensing, the set of rules many jurisdictions use to control token issuance and crypto‑service providers. In practice, the central bank looks for anti‑money‑laundering safeguards, consumer‑protection mechanisms, and clear taxation pathways before issuing a licence.

How Regional Frameworks Shape the Moroccan Landscape

One major influence comes from the EU’s MiCA, the Markets in Crypto‑Assets regulation that standardises crypto‑asset rules across Europe. Although Morocco is not an EU member, many Moroccan firms pattern their compliance programs after MiCA to ease cross‑border operations. This creates a semantic link: MiCA influences Bank Al-Maghrib licensing by providing a template for risk‑assessment and disclosure requirements. Another critical piece is stablecoin regulation, the set of policies that govern fiat‑pegged tokens like USDC or Tether. Stablecoins often serve as a bridge for Moroccan traders to move value without exposing themselves to local fiat volatility, so the central bank’s stance on these assets directly impacts licensing decisions. In short, stablecoin regulation requires clear licensing pathways, and the Moroccan authority often mirrors best‑practice guidelines from larger economies.

Technical infrastructure also plays a role. Cross‑chain bridges, protocols that let assets move between blockchains such as Bitcoin, Ethereum, or Solana depend on regulatory approval because they can become conduits for illicit flows. The relationship can be expressed as: cross‑chain bridges depend on Bank Al-Maghrib licensing to operate legally within Morocco. When a bridge provider seeks to serve Moroccan users, it must demonstrate that its AML/KYC layers meet the central bank’s standards. This creates a practical loop: the licensing framework shapes the tech choices of projects, while emerging technologies push regulators to adjust their criteria. Below you’ll find articles that break down each of these angles – from the nitty‑gritty of Moroccan crypto licences to how stablecoins and bridges fit into the bigger compliance puzzle.

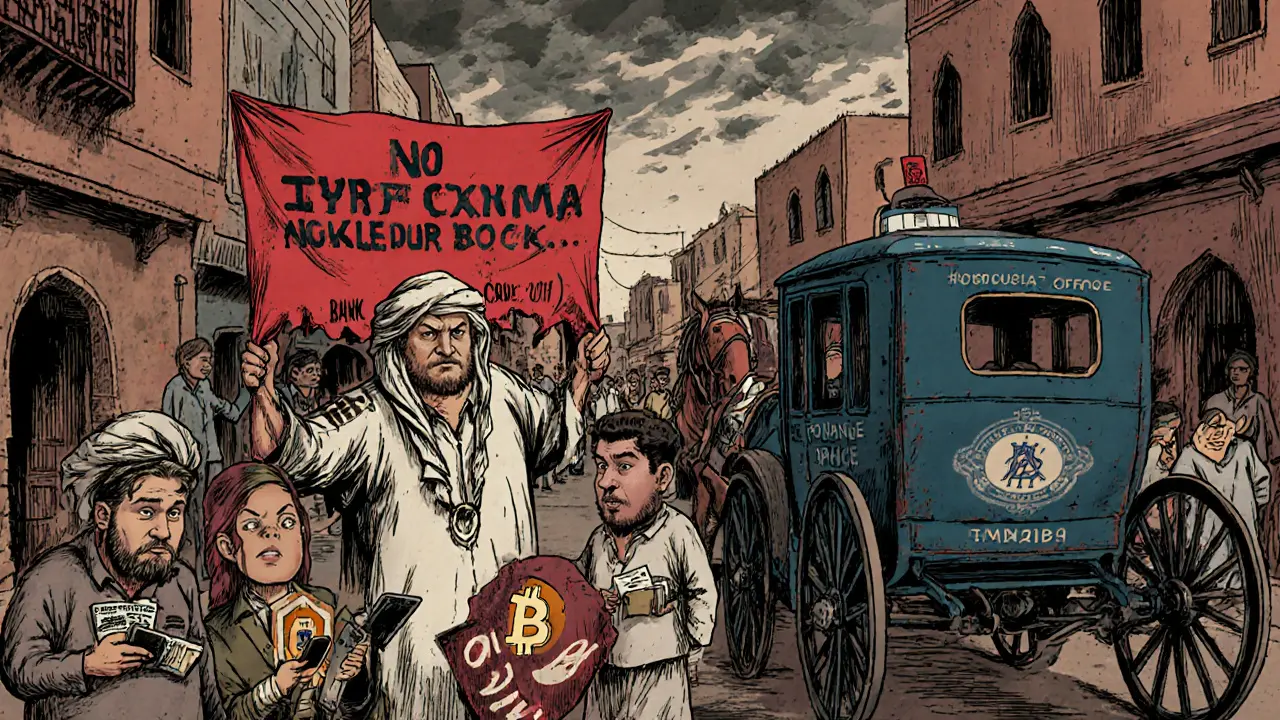

Understanding Morocco's Crypto Foreign Exchange Violations and New Regulations

by Johnathan DeCovic Oct 31 2024 14 CryptocurrencyLearn how Morocco's new crypto regulations tackle foreign‑exchange violations, licensing rules, penalties, taxes, and the future of e‑Dirham in a clear, practical guide.

READ MORE