Crypto Tax Morocco: Everything You Need to Know

When dealing with crypto tax Morocco, the set of rules that govern how cryptocurrency transactions are reported and taxed in Morocco. Also known as Moroccan crypto taxation, it impacts anyone who trades, mines, or earns digital assets within the country. Crypto tax Morocco has become a hot topic as more locals jump into Bitcoin, DeFi and NFTs.

Key Elements of Moroccan Crypto Taxation

The Moroccan tax authority, Direction Générale des Impôts (DGI) that handles tax collection and compliance requires clear reporting of every crypto sale, swap or reward. capital gains tax, a rate applied to profits from disposing of crypto assets kicks in once you exceed the annual exemption threshold, so accurate profit calculations are a must. Activities on DeFi, decentralized finance platforms where users earn yields, stake tokens, or lend assets are treated the same as traditional trading – earnings are taxable and must be declared. Likewise, any transaction on crypto exchanges, local or international platforms used by Moroccans to buy, sell, and trade digital coins generates data that the DGI can request, so keeping exchange statements is essential.

Understanding these connections—how the tax authority enforces reporting, how capital gains rates apply, and how DeFi and exchange activity feed into your return—gives you a solid foundation to stay compliant. Below you’ll find a curated list of articles that break down filing steps, explain common pitfalls, and share real‑world examples of Moroccan crypto users navigating the tax landscape.

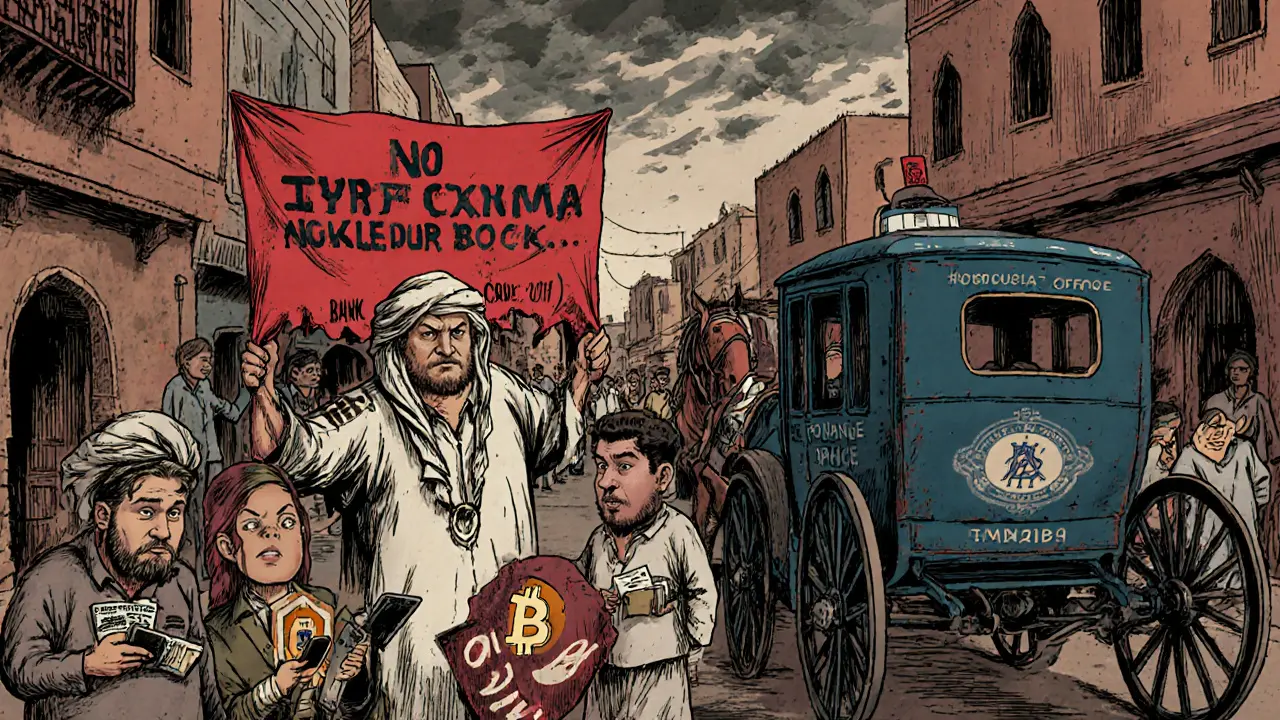

Understanding Morocco's Crypto Foreign Exchange Violations and New Regulations

by Johnathan DeCovic Oct 31 2024 14 CryptocurrencyLearn how Morocco's new crypto regulations tackle foreign‑exchange violations, licensing rules, penalties, taxes, and the future of e‑Dirham in a clear, practical guide.

READ MORE