Singapore Cryptocurrency Tax

When dealing with Singapore cryptocurrency tax, the set of rules that Singapore’s tax authority applies to digital‑asset transactions. Also known as crypto tax in Singapore, it determines how profits from buying, selling, staking, or earning crypto are treated for tax purposes. The body that enforces these rules is IRAS, the Inland Revenue Authority of Singapore that administers tax law, and it expects accurate tax filing, the process of reporting income and deductions to the tax authority each year. Unlike many jurisdictions, Singapore does not impose a traditional capital gains tax, a tax on profit from the sale of assets", but it treats crypto gains as either trading income or taxable receipt depending on the activity. Whether you are a casual crypto trader, someone who buys and sells digital assets for profit or a holder who earns rewards, understanding these distinctions is the first step to staying compliant.

Key Considerations for Crypto Taxpayers in Singapore

Singapore cryptocurrency tax covers a wide range of activities, and each one creates a different tax trigger. When you buy crypto and later sell it at a higher price as part of a regular trading pattern, IRAS views the profit as ordinary income, which means you must include it in your tax filing and may be liable for income tax. If you receive tokens from an airdrop, the market value at receipt is considered taxable income, so you need to record that amount as soon as the airdrop lands in your wallet. Staking rewards work similarly: the reward’s fair market value at the time it’s credited counts as taxable income, even though you might later sell the reward for a profit. Mining, running a validator, or providing liquidity in DeFi protocols also generates taxable receipts because the earned crypto represents a service rendered. Each of these scenarios creates a semantic link: Singapore cryptocurrency tax encompasses crypto trading income, staking rewards, airdrop receipts, and mining earnings. At the same time, IRAS requires accurate record‑keeping of every transaction, and tax filing demands that you report those amounts in the correct category. The practical impact is clear – you need a disciplined approach to tracking dates, amounts, and fair market values.

To keep things manageable, start by using a dedicated spreadsheet or a crypto‑tax software that can import exchange CSVs, wallet addresses, and DeFi transaction logs. Tag each entry as “trade,” “staking,” “airdrop,” or “mining” so you can later sum the taxable portions and separate any non‑taxable capital gains (if you can prove a genuine investment‑holding motive). Remember that Singapore’s tax year runs from 1 January to 31 December, and the filing deadline for individuals is typically 15 April of the following year. Missing the deadline may trigger penalties, and under‑reporting can lead to audits or fines, so it’s wise to double‑check your numbers before submitting the Form IR8A or the appropriate self‑assessment return. If your crypto activity is complex—say you’re dealing with cross‑chain bridges, wrapped tokens, or NFT sales—consider consulting a tax professional who specializes in digital assets. They can help you interpret IRAS guidelines, identify any potential exemptions, and ensure that you’re not over‑paying. By treating each crypto event as a distinct taxable event and keeping thorough documentation, you’ll turn a potentially confusing obligation into a straightforward part of your annual financial routine.

Now that you have a solid overview of how Singapore handles crypto income, the next step is to dive into the specific guides, reviews, and deep‑dive articles we’ve gathered for you. Below you’ll find practical breakdowns of stablecoin mechanics, cross‑chain bridge basics, exchange reviews, and a range of tax‑related topics that will help you apply these rules to real‑world scenarios. Whether you’re looking for a quick checklist or an in‑depth analysis, the collection below is organized to give you actionable insights right away.

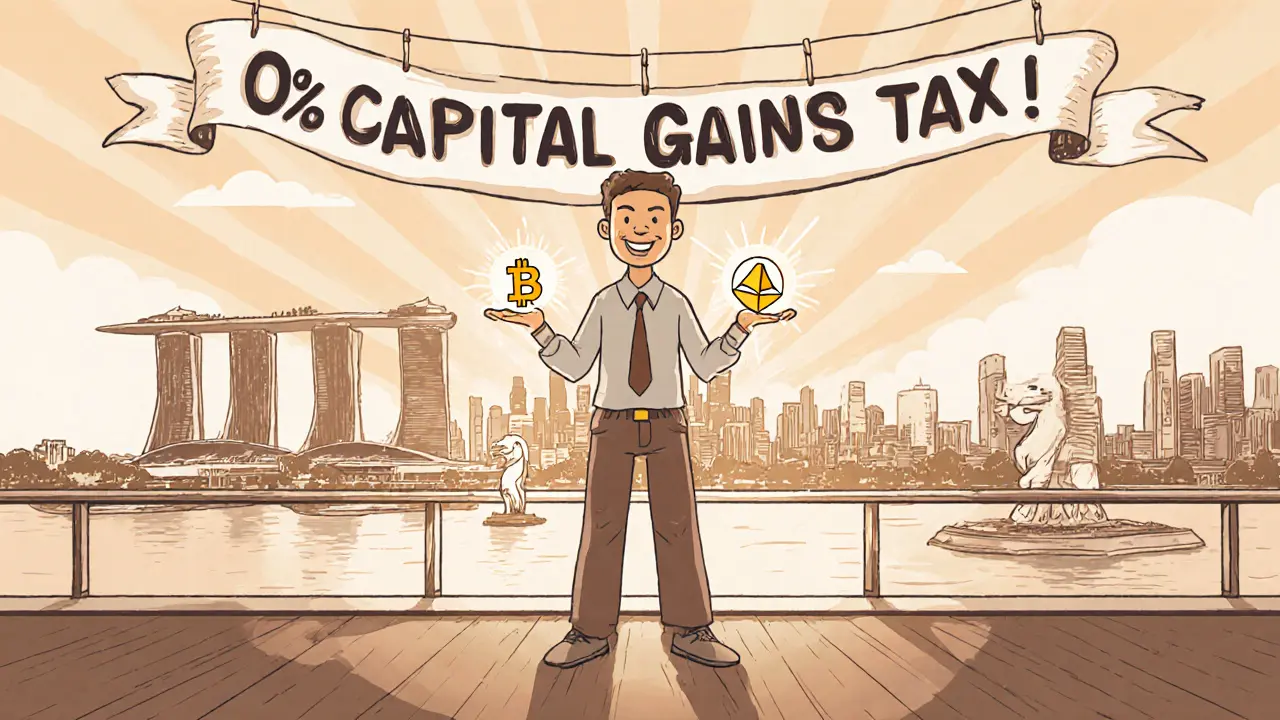

Why Singapore Has No Capital Gains Tax on Crypto (and How It Benefits Investors)

by Johnathan DeCovic Sep 22 2025 17 CryptocurrencyDiscover why Singapore imposes no capital gains tax on cryptocurrency, who benefits, residency requirements, and how its regulatory framework compares globally.

READ MORE