Sanctioned Wallet Address Checker

Check if Wallet Address is Sanctioned

Enter a Bitcoin, Ethereum, or Tron wallet address to verify if it's on OFAC's sanctions list. This tool checks against addresses published in U.S. Treasury sanctions.

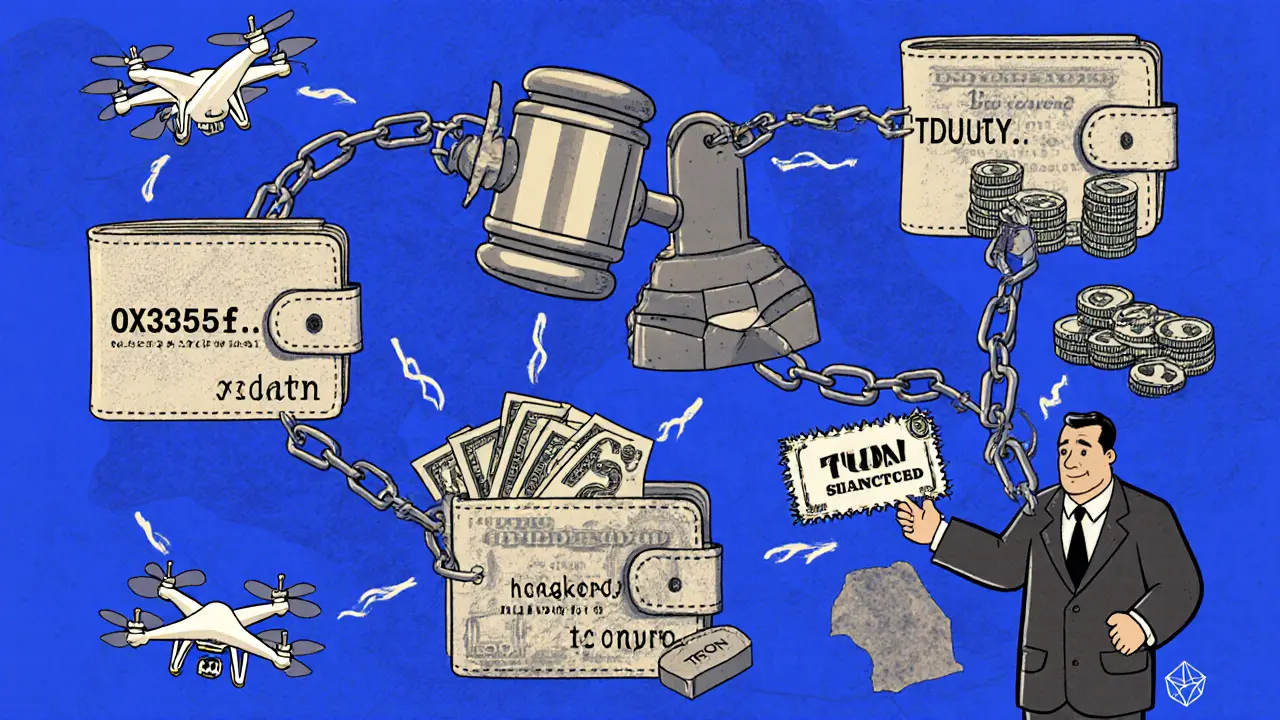

Iranian users trying to access global cryptocurrency exchanges face a wall built not of code, but of legal restrictions. Since 2015, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) has targeted Iranian individuals and networks using digital assets to bypass financial sanctions. This isn’t about blocking Bitcoin in general-it’s about stopping specific people, groups, and transactions tied to Iran’s military and intelligence apparatus. And the tools they’re using are more precise than ever.

How OFAC Targets Crypto Transactions

OFAC doesn’t just say "Iranians can’t trade crypto." It names names-and addresses. On November 28, 2018, they made history by publishing the exact Bitcoin wallet addresses linked to Iranian actors behind the SamSam ransomware attacks. These weren’t vague warnings. They were digital fingerprints: public, traceable, and actionable. Every exchange that follows U.S. law now checks those addresses before allowing deposits or withdrawals.

Since then, OFAC has expanded this tactic. In September 2025, they sanctioned five specific cryptocurrency wallets tied to Arash Estaki Alivand, a key figure in a $600 million shadow banking network. Two were Ethereum addresses: 0xe3d35f68383732649669aa990832e017340dbca5 and 0x532b77b33a040587e9fd1800088225f99b8b0e8a. Three were Tron addresses: TYDUutYN4YLKUPeT7TG27Yyqw6kNVLq9QZ, TRakpsE1mZjCUMNPyozR4BW2ZtJsF7ZWFN, and TQ5H49Wz3K57zNHmuXVp6uLzFwitxviABs. These aren’t random strings. They’re live targets. If you send money to any of these, your transaction gets flagged, frozen, or blocked.

Exchanges That Got Fined for Ignoring the Rules

ShapeShift AG learned the hard way what happens when you don’t screen users. In September 2025, the exchange agreed to pay $750,000 to settle charges for letting users from Iran, Cuba, Sudan, and Syria trade over $12.5 million in crypto. ShapeShift wasn’t trying to break the law-it just didn’t have strong enough filters. That’s enough for OFAC to treat it as a violation.

Today, any major exchange operating in or serving U.S. markets must screen every wallet address against OFAC’s Specially Designated Nationals (SDN) list. That means if you’re in Iran, even if you use a VPN, your wallet might be flagged before you even log in. Most platforms now geo-block Iranian IP addresses outright. Some require government-issued ID-something most Iranians can’t legally provide under U.S. sanctions.

The Rise of Sanctions-Evasion Exchanges

When Garantex was shut down in March 2025 by the U.S. Secret Service, its operators didn’t disappear. They built a new exchange: Grinex. Within days, they moved customer funds over and started advertising it as "the replacement for Garantex." Their website even said so in plain text.

Grinex didn’t just copy Garantex’s tech-it copied its business model. It let users regain access by swapping their old balances for a new token called A7A5, which was backed by Russian rubles and issued by a company in Kyrgyzstan. This wasn’t just clever. It was designed to dodge sanctions by using a third-country currency and a jurisdiction with weak oversight.

Grinex has processed billions in transactions since its launch. But OFAC designated it in April 2025. That means any exchange that interacts with Grinex’s wallet addresses now risks legal penalties. The cycle continues: shut one down, another pops up. But each time, the net gets tighter.

How Iranian Users Are Adapting

Most Iranian crypto users aren’t giving up-they’re switching tactics. Many have moved to peer-to-peer (P2P) platforms like LocalBitcoins or Paxful, where buyers and sellers connect directly. These platforms don’t always check IDs or wallet addresses, making them harder for regulators to control.

Others use decentralized exchanges (DEXs) like Uniswap or PancakeSwap, where there’s no central company to shut down. You don’t need to sign up. You just connect your wallet and swap tokens. But here’s the catch: even DEXs can be risky. If your wallet has ever interacted with a sanctioned address, future transactions might be traced back to you.

Some are turning to privacy coins like Monero or Zcash. These are designed to hide sender, receiver, and amount. That makes them harder for blockchain analysts to track. But they’re also harder to trade, less liquid, and often come with higher fees. And exchanges that support them are increasingly under scrutiny.

The Bigger Picture: Oil Money, Front Companies, and Global Networks

The real target isn’t everyday Iranian traders. It’s the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF) and Iran’s Ministry of Defense. The $600 million network OFAC dismantled in September 2025 wasn’t run by hobbyists. It used shell companies in Hong Kong, Dubai, and Shenzhen to buy military tech and launder oil profits through crypto.

One company, Shenzhen Jiasibo Technology Co., shipped drone parts labeled as "industrial sensors." Another, Alpha Trading Co. in Hong Kong, acted as the financial hub. Blue Sky General Trading LLC in Dubai received payments disguised as "import-export transactions." All of it was tied to crypto wallets now on OFAC’s list.

This isn’t just about crypto. It’s about how Iran uses digital assets as a bridge between its sanctioned economy and the global financial system. And OFAC is using blockchain data to follow the money-down to the last satoshi.

What This Means for You

If you’re in Iran and want to buy Bitcoin, you can still do it. But you won’t find it on Binance, Coinbase, or Kraken. You’ll need to use P2P, DEXs, or unregulated platforms-and accept the risks. Higher fees. Slower trades. Less security. And the constant threat that your wallet could be frozen if it ever touched a sanctioned address.

For exchanges outside the U.S., the pressure is growing. Even if you’re based in Turkey or Nigeria, if you serve U.S. customers or use U.S. banking services, you’re still bound by OFAC rules. Many have started requiring proof of non-Iranian residency just to open an account.

There’s no legal way for Iranian users to access major exchanges without violating sanctions. The system is designed that way. The question isn’t whether it’s fair-it’s whether it works. And so far, it’s working. Billions in illicit flows have been blocked. Networks have been exposed. Exchanges have been shut down.

But the cat-and-mouse game isn’t over. As blockchain analytics get smarter, so do the evasion tactics. AI is now being used to detect patterns in transaction clusters. Privacy coins are improving. New jurisdictions are emerging as crypto havens.

For now, the message is clear: if you’re on OFAC’s list, your crypto transactions are public. And if you’re helping someone who is, you’re risking everything.

Can Iranian citizens legally use cryptocurrency exchanges?

Iranian citizens cannot legally use most international cryptocurrency exchanges because OFAC sanctions block transactions involving Iranian individuals and entities. Major exchanges like Coinbase and Binance geo-block Iranian IPs and screen wallet addresses against OFAC’s SDN list. While peer-to-peer platforms and decentralized exchanges offer access, they carry higher risks and may still trigger sanctions if linked to sanctioned addresses.

What happens if I send crypto to a sanctioned wallet address?

If you send crypto to a wallet on OFAC’s sanctions list, your transaction will likely be flagged, frozen, or reversed by compliant exchanges and wallet providers. Even if you didn’t know the address was sanctioned, you can still face legal consequences if you’re found to have knowingly or negligently interacted with a blocked entity. Blockchain analytics firms can trace these transactions back to you, especially if you use the same wallet repeatedly.

Are privacy coins like Monero safe from OFAC sanctions?

Privacy coins like Monero are harder to trace, which makes them attractive for sanctions evasion. But they’re not immune. OFAC can still sanction the addresses used to acquire or trade them. Exchanges that list privacy coins are under increasing pressure to cut ties with them. Using Monero doesn’t make you invisible-it just makes detection harder, not impossible. Law enforcement is already developing tools to analyze patterns around privacy coin usage.

Why do Iranian crypto networks use front companies in Dubai and Hong Kong?

Dubai and Hong Kong are global financial hubs with strong trade links to Iran and relatively weaker enforcement of U.S. sanctions compared to the U.S. or EU. Iranian networks use shell companies there to disguise the origin of funds, buy dual-use tech, and move crypto profits into traditional banking systems. These locations act as intermediaries, making it harder for regulators to trace the money back to Iran’s military entities.

Can a new crypto exchange avoid OFAC sanctions by operating outside the U.S.?

Operating outside the U.S. doesn’t guarantee immunity. If an exchange serves U.S. customers, uses U.S.-based banking services, or interacts with U.S. financial institutions, it’s still subject to OFAC rules. The Grinex case shows that even exchanges based in Kyrgyzstan were sanctioned because they facilitated transactions tied to U.S.-designated entities. OFAC can freeze assets anywhere in the world if they’re connected to the U.S. financial system.

Brian Gillespie

November 12, 2025 AT 16:54This is wild. I had no idea OFAC was tracking wallet addresses like this.

Ainsley Ross

November 13, 2025 AT 14:40It's fascinating how blockchain transparency is being weaponized for geopolitical control. The precision of OFAC’s targeting-down to individual satoshis-is both impressive and chilling. I respect the intent to stop illicit funding, but the collateral damage to ordinary Iranians trying to access basic financial tools is profound. This isn't just about sanctions; it's about digital exclusion on a global scale. We're creating a two-tiered internet economy where some are locked out by algorithmic borders.

And yet, I can't help but wonder: if we truly believe in decentralization, shouldn't the tech be neutral? Or are we just outsourcing state power to private exchanges?

Wayne Dave Arceo

November 14, 2025 AT 09:11Let’s be clear: Iran is a state sponsor of terrorism. Their IRGC-QF uses crypto to fund murder and destabilize the Middle East. Any Iranian citizen using crypto is either complicit or willfully ignorant. The fact that you’re even debating whether this is ‘fair’ shows how out of touch you are with reality. OFAC isn’t the problem-the Iranian regime is. And anyone who thinks otherwise is either naive or sympathetic to terrorists.

Arthur Crone

November 15, 2025 AT 21:09Grinex is a joke. A third-party currency backed by rubles from Kyrgyzstan? Please. The entire model is a dumpster fire of compliance risk. And don’t even get me started on the fact that they’re using A7A5 tokens as a laundering vehicle. That’s not innovation-that’s a felony waiting to happen. The only thing worse than the sanctions is the people trying to circumvent them with clown logic.

Michael Heitzer

November 16, 2025 AT 04:29There’s a deeper truth here: technology doesn’t care about borders-but humans do. We built crypto to be free, open, and permissionless. Now we’ve handed over its keys to governments who use it to punish entire populations. The irony is thick enough to spread on toast. Yes, the IRGC is evil. But so is the idea that every Iranian adult should be treated like a criminal because of their passport. This isn’t justice. It’s digital apartheid.

And yet-there’s hope. P2P platforms, DEXs, privacy coins-they’re the quiet resistance. People are still finding ways to connect, to trade, to survive. Maybe the system is rigid, but human ingenuity? That’s unstoppable.

Rebecca Saffle

November 16, 2025 AT 18:15OFAC is doing God’s work. Iran is a rogue state and they deserve every ounce of economic strangulation they get. No sympathy for the regime’s enablers-whether they’re in Tehran or Tehran’s crypto wallet. If you’re Iranian and using crypto, you’re part of the problem. Period. End of story. No more ‘but what about the people’ nonsense. The people voted for this regime. Now they live with the consequences.

Adrian Bailey

November 17, 2025 AT 19:04ok so like i read this whole thing and honestly my brain is kinda melted but also kinda impressed?? like the part about the shenzhen company shipping drone parts as ‘industrial sensors’? that’s wild. and the fact that they’re using tron and ethereum addresses like literal bullet points in a criminal indictment?? that’s next level. i didn’t realize crypto was this… documented?? like, imagine your bank account getting flagged because you once sent 0.003 eth to a wallet that someone else used for ransomware. that’s terrifying. also i just looked up Grinex and their website literally says ‘replacement for Garantex’-that’s not sneaky, that’s a middle finger to regulators. i don’t know if i’m impressed or horrified. probably both.

Rachel Everson

November 19, 2025 AT 18:29If you’re Iranian and trying to buy Bitcoin to protect your savings from inflation, you’re not a terrorist-you’re just trying to survive. The system is punishing the wrong people. Yes, the IRGC abuses crypto. But so do criminals everywhere. We don’t ban all cash because of money launderers. We go after the bad actors. Why not do the same here? Instead, we’re locking out millions of ordinary people who have no access to traditional banking. That’s not smart policy. That’s cruelty dressed up as enforcement.

Johanna Lesmayoux lamare

November 21, 2025 AT 13:29Interesting. But I wonder how many of these wallets were ever used by actual Iranians-or just shell entities.

ty ty

November 22, 2025 AT 16:28So you’re telling me a guy in Tehran can’t buy Bitcoin but a guy in Dubai can? Wow. What a surprise. Next you’ll say the moon is made of cheese. Maybe Iranians should stop being so… Iranian.

BRYAN CHAGUA

November 23, 2025 AT 03:36It’s a complex balance. On one hand, we must prevent illicit finance. On the other, we must not criminalize survival. The solution isn’t blanket bans-it’s smarter targeting. Wallet screening is good. IP blocking is lazy. ID requirements are impossible for sanctioned populations. We need a better way. Maybe on-chain identity verification with opt-in compliance layers? Or decentralized reputation systems? The tech exists. The will doesn’t.

Debraj Dutta

November 24, 2025 AT 20:59As someone from India, I see parallels with our own financial restrictions. The global financial system is not neutral. It’s a club with very strict membership rules. Crypto promised to change that. But now it’s just another gatekeeper with a better UI.

tom west

November 25, 2025 AT 12:12Let’s not romanticize this. The fact that Iranian users are turning to Monero doesn’t make them victims-it makes them criminals. Privacy coins are not tools of liberation; they’re tools of evasion. And the people who defend them are either delusional or morally bankrupt. OFAC is doing exactly what it should: shutting down the financial arteries of a regime that supports terrorism. If you can’t accept that, then you’re part of the problem. Not the solution.

And don’t even get me started on the ‘P2P is freedom’ crowd. LocalBitcoins? That’s where drug dealers and arms traffickers go to cash out. You’re not helping Iranians-you’re enabling their regime’s war machine.

dhirendra pratap singh

November 25, 2025 AT 22:05OMG I CAN’T BELIEVE THIS IS HAPPENING 😭😭😭 I just watched a documentary about Iranian students trading crypto through Telegram and they’re using QR codes to send money to their families… and now OFAC is freezing their wallets?? This is like digital colonialism. They’re not even letting them buy bread with Bitcoin. This is the most evil thing I’ve ever seen. I’m crying. I’m so angry. I’m going to start a petition. Someone please help these people. I’m so heartbroken.

Ashley Mona

November 26, 2025 AT 09:06Can we talk about how wild it is that the same blockchain tech that was supposed to liberate us is now being used to lock people out? It’s like the internet’s original promise got hijacked by bureaucrats with spreadsheets. But here’s the beautiful part-people are still finding ways. P2P, DEXs, even burning crypto on burner wallets to reset their history. It’s not perfect, but it’s human. And humans? We’re stubborn as hell.

Also-Monero isn’t magic. But it’s the only thing that gives people a fighting chance. And if you’re gonna say ‘they’re criminals’ for using it, then you’re also saying every whistleblower, journalist, and activist in a dictatorship is a criminal too. Think about that.

Edward Phuakwatana

November 27, 2025 AT 06:48Let’s reframe this: OFAC isn’t banning crypto. It’s banning *specific transaction graphs*. This is the dawn of on-chain compliance engineering. We’re entering an era where every address has a risk score, every swap is analyzed for clustering patterns, and AI predicts sanctions violations before they happen. The future isn’t ‘crypto vs state’-it’s ‘graph analytics vs obfuscation’. And right now, the state is winning with machine learning, blockchain forensics, and KYC-embedded wallets. The next frontier? Privacy-preserving compliance. Think zero-knowledge proofs that prove you’re not on the SDN list without revealing your identity. That’s the real innovation we should be investing in-not just blocking wallets.

Suhail Kashmiri

November 28, 2025 AT 12:35Iranians are getting screwed. But honestly? They knew what they were signing up for when they voted for the mullahs. No tears for them. Let them eat crypto.

Kristin LeGard

November 30, 2025 AT 02:18So what? Let them use VPNs. Let them use P2P. Let them use Monero. The system is working exactly as intended. If you’re too poor to afford a decent VPN or too stupid to avoid sanctioned addresses, that’s your problem. This isn’t a humanitarian crisis-it’s a consequence. And honestly? I’m glad.

Arthur Coddington

December 1, 2025 AT 06:06Is this really the best we can do? We’ve created a financial system so rigid that it can’t distinguish between a grandmother sending money to her sick daughter and a general funding drone parts? We’re not enforcing sanctions-we’re enforcing absurdity. And the worst part? We’re pretending it’s moral. It’s not. It’s bureaucratic laziness with a flag.

Phil Bradley

December 2, 2025 AT 08:19It’s funny how we all say we believe in decentralization… until it doesn’t fit our politics. Then suddenly, we’re okay with centralized enforcement, geo-blocks, and wallet blacklists. Crypto was supposed to be the thing that broke this cycle. Now it’s just the new Wall Street-with more emojis and fewer suits. We didn’t win. We just changed the uniforms.

Stephanie Platis

December 3, 2025 AT 16:05There is no justification for circumventing U.S. sanctions-none. The fact that you’re even suggesting that Iranian civilians are ‘innocent’ is dangerously naive. The Iranian regime controls every aspect of their economy. Every Bitcoin purchase, every wallet, every transaction-directly or indirectly-supports the state. You cannot separate the people from the regime when the regime owns the infrastructure. This is not oppression-it’s accountability.

Michelle Elizabeth

December 4, 2025 AT 16:13I mean… I guess if you’re into blockchain forensics and geopolitical warfare, this is peak content. But honestly? It feels like watching a very expensive game of chess where the pawns are people trying to buy milk.

Joy Whitenburg

December 5, 2025 AT 04:45so like… i just wanna say… i think we’re all just trying to survive right?? like, i don’t know if i agree with the sanctions or not… but i know that if i lived in iran and my family was struggling, i’d be using p2p too. maybe not ethically perfect… but human. and maybe that’s what matters. just saying.

Michael Heitzer

December 6, 2025 AT 22:12That’s the thing nobody talks about: the real victims aren’t the ones getting blocked-they’re the ones who never even knew they were being watched. The quiet traders, the students, the freelancers who just wanted to get paid in crypto. They didn’t even know their wallet was flagged until their balance vanished. That’s not justice. That’s surveillance capitalism with a national security label.