MiCA License Cost Calculator

Calculate Your MiCA License Costs

Estimate the total costs and requirements for obtaining a MiCA license in the EU based on your business type and scale.

Starting in December 2024, any company offering crypto services in the European Union must be licensed under MiCA - the Markets in Crypto-Assets Regulation. This isn’t a suggestion. It’s the law. If you’re running a crypto exchange, custody service, or trading platform and you want to serve customers in any of the 27 EU countries, you need official authorization. No exceptions. No loopholes. And the bar is high.

What Exactly Is a Crypto Asset Service Provider (CASPs)?

Under MiCA, a CASP is any legal entity that provides one or more crypto services professionally. That includes:- Custody and administration of crypto-assets for clients

- Operating trading platforms where users buy or sell crypto

- Exchanging crypto for euros, dollars, or other fiat currencies

- Executing client orders for crypto trades

- Placing new crypto tokens with investors

- Giving financial advice on crypto investments

If your business touches any of these, you’re a CASP. Even if you’re based outside the EU but serve EU customers - you still need a license. There’s no way around it.

The Passport System: One License, 27 Countries

Before MiCA, companies had to apply for separate licenses in each EU country. That meant dealing with 27 different regulators, 27 sets of rules, and 27 sets of fees. Some firms spent over €350,000 just to get licensed in one country. Now, MiCA gives you a single passport. Get approved by one national authority - say, France’s AMF or Germany’s BaFin - and you can offer services across the entire EU. No more repeating the same paperwork in Spain, Italy, or Poland. That’s the big win.But here’s the catch: you still have to get approved by one of them first. And that’s where things get messy.

Minimum Capital Requirements - It’s Not Cheap

MiCA doesn’t just ask for paperwork. It asks for money. Serious money.- €125,000 minimum capital for custody services

- €150,000 for exchange services

- €730,000 for operating a trading platform

These aren’t just buffer funds. They’re hard requirements. You have to prove you have this capital locked up and available before your application is even reviewed. For small startups, this is a major barrier. Many can’t raise this kind of capital without institutional backing.

And that’s not all. You also need to hire at least one director who lives in the EU. If your company is based in Canada or Singapore, you now need a local legal representative in the EU. That means setting up a legal entity - not just a PO box - with real office space, local staff, and local compliance officers.

Environmental Reporting: The Surprising Requirement

Most people don’t expect this, but MiCA forces CASPs to publicly report their energy usage. Yes, you read that right.If you run a mining operation or a high-throughput exchange, you have to disclose how much electricity your servers consume - using the EU’s Blockchain Observatory methodology. This isn’t just a one-time filing. It’s an ongoing requirement, updated quarterly.

Why? Because the EU wants to tie crypto’s environmental impact to its regulatory framework. Critics argue this penalizes proof-of-stake networks like Ethereum, which use 99% less energy than Bitcoin mining. But the rule applies regardless. And the cost to build and maintain these reporting systems? Up to €500,000 per year for mid-sized firms.

Who Gets Scrutinized More? The ‘Significant CASPs’

If your platform has more than 15 million active EU users on average per year, you’re labeled a “significant CASP” (sCASPs). That’s not just a label - it’s a whole new level of oversight.sCASPs must:

- Submit to quarterly stress tests

- Undergo mandatory third-party audits

- Implement real-time transaction monitoring systems

- Report to both national regulators and ESMA directly

These are the firms that regulators are watching most closely - think Kraken, Bitstamp, or Coinbase if they expand fully into the EU. The systems needed for real-time monitoring can cost over €1.2 million to build and maintain. Many firms don’t realize how expensive this is until they’re already in the application process.

How Long Does It Take to Get Licensed?

MiCA says regulators have six months to process applications. In theory. In practice? Not even close.As of August 2025:

- Germany’s BaFin: 6-8 months

- Spain’s CNMV: 8-9 months

- Estonia: 11 months

- France’s AMF: 5-7 months (fastest so far)

Why the delays? Most national regulators don’t have enough staff. Only 42% of NCAs report having dedicated crypto teams as required by MiCA. One founder on Reddit said they submitted in January 2025 and still had no response by July - even though MiCA’s timeline says they should’ve been approved by July.

And if your application is incomplete? You’ll get a rejection letter with a list of 20 missing items. Fix them. Resubmit. Start the clock again.

Who’s Getting Approved - And Who’s Not

As of August 2025, 89 firms have been authorized under MiCA. That’s just a fraction of the 217 active applications. The approved ones? Mostly established players with deep pockets:- Kraken - licensed by France’s AMF in March 2025

- Bitstamp - approved by Czech National Bank in February 2025

- Bybit, OKX, and Binance - still waiting or avoiding EU entry entirely

What do the approved firms have in common? They spent 9-12 months preparing. They hired full-time compliance teams. They built new tech infrastructure. They didn’t try to cut corners.

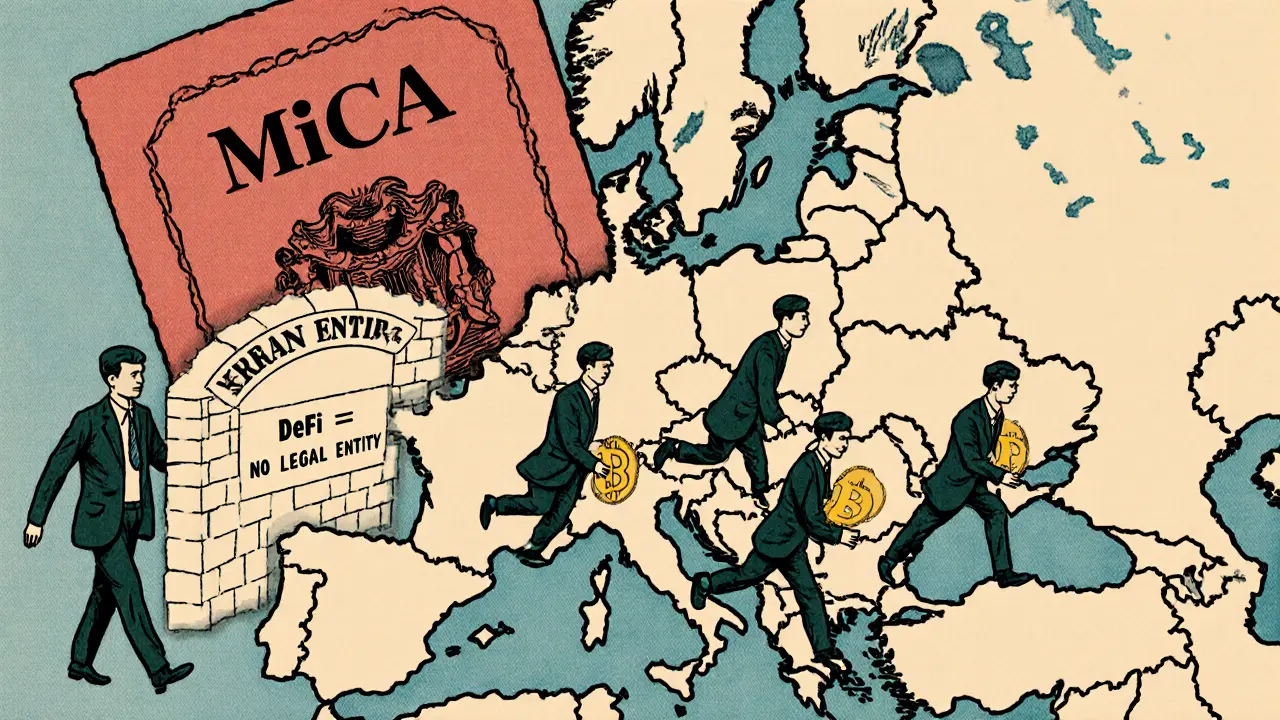

Meanwhile, DeFi protocols? Almost none made it. MiCA requires identifiable legal entities. If your protocol is fully decentralized - no CEO, no company, no registered office - you’re out. A University of Zurich study found 68% of DeFi platforms won’t even try to enter the EU market.

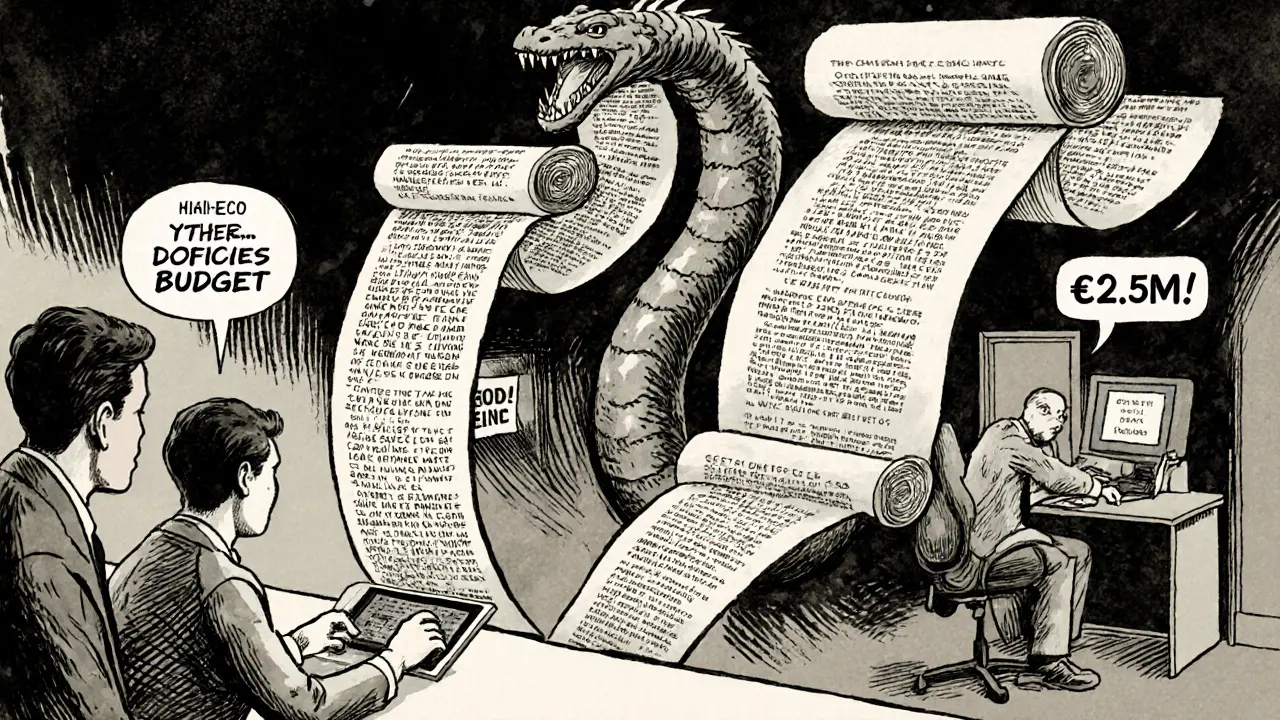

The Hidden Costs: More Than Just Fees

The total cost to get licensed isn’t just the capital requirement. It’s everything else:- Legal fees: €150,000-€300,000

- Compliance software and monitoring systems: €500,000-€1.5 million

- Environmental reporting setup: €100,000-€500,000

- Hiring EU-based staff: €300,000+ annually

- Internal audit and documentation: €200,000+

PwC’s August 2025 study found the average total cost:

- €750,000 for basic custody services

- €2.5 million for full trading platform authorization

That’s not a startup budget. That’s institutional money.

What About User Experience? The Trade-Offs

Once licensed, you’re forced to show users mandatory risk warnings before every trade. These aren’t optional disclaimers. They’re long, legal, and hard to skip.Trustpilot reviews of MiCA-licensed exchanges show 63% of users praise the improved security. But 29% complain - and the biggest complaint? The warnings.

“It feels like every trade is a lawsuit waiting to happen,” wrote one user. “I just want to buy Bitcoin, not read a 500-word legal document.”

There’s also less choice. MiCA restricts which tokens can be listed. Tokens without clear whitepapers, team info, or legal structure get banned. That’s good for safety - but bad for users who want access to newer or experimental projects.

The Future: MiCA 2.0 and What’s Coming Next

The EU isn’t done. In June 2025, the European Commission proposed MiCA 2.0 - aimed at bringing DeFi, NFTs, and stablecoins under tighter control.Stablecoins? Already under scrutiny. The European Banking Authority warned that the 1:1 reserve requirement for asset-referenced tokens might not hold during a market crash - referencing the USDC depegging in March 2023.

By January 2026, all CASPs must implement real-time transaction monitoring. That means tracking every crypto movement in and out of their systems - a massive technical lift.

And by June 2026, the new Anti-Money Laundering Authority (AMLA) will take over cross-border AML supervision. That means even more layers of oversight.

Should You Try to Get Licensed?

If you’re a small crypto business with no EU presence - and no €2 million to spend - the answer is probably no.If you’re a mid-sized exchange with global ambitions and institutional backing - then yes. MiCA is your golden ticket to the entire EU market. Once you’re in, you’re in everywhere.

The biggest mistake? Thinking MiCA is just another compliance checklist. It’s not. It’s a full organizational overhaul. You need new people, new tech, new systems, and new patience.

And if you’re still waiting for a license? You’re not alone. But the clock is ticking. The transitional period ends July 1, 2026. After that, unlicensed operators will be blocked from serving EU customers. No grace period. No warnings.

Those who prepared are already expanding. Those who didn’t? They’re watching from the sidelines.

Do I need a MiCA license if I’m based outside the EU?

Yes. If you serve customers in any EU country, you must be licensed under MiCA. Location doesn’t matter - customer location does. Even if your servers are in Canada or Singapore, you still need an EU-registered legal entity and authorization from an EU national authority.

How long does the MiCA licensing process usually take?

Officially, regulators have six months. In practice, it takes 6-11 months, depending on the country. Germany and Spain are slowest (8-9 months), while France and the Czech Republic are faster. Delays are common due to understaffed regulators and incomplete applications.

Can DeFi projects get MiCA licensed?

No. MiCA requires identifiable legal entities with directors, registered offices, and accountability structures. Fully decentralized protocols without a company or legal representative cannot comply. As a result, 68% of DeFi platforms have chosen not to enter the EU market.

What happens after July 1, 2026?

After July 1, 2026, the transitional period ends. All crypto asset service providers operating in the EU must be fully licensed under MiCA. Unlicensed firms will be blocked from serving EU customers. There will be no extensions or grace periods.

Is MiCA better than U.S. crypto regulation?

It’s more predictable. The U.S. has no unified crypto rulebook - firms must deal with the SEC, CFTC, and 50 state regulators. MiCA gives one set of rules across 27 countries. For firms wanting pan-European access, MiCA is clearer and more efficient - even if it’s stricter. But for small players, the U.S. still offers more flexibility.

Which EU country is the easiest to get licensed in?

France’s AMF and the Czech National Bank have been the fastest and most transparent so far. Germany’s BaFin has the most detailed guidance but takes longer. Malta and Estonia have been inconsistent and slower. Lithuania is emerging as a contender with a more agile approach.

What’s the biggest mistake companies make applying for MiCA?

Underestimating the organizational changes. Most firms think it’s about paperwork. It’s not. It’s about hiring EU-based leadership, building new compliance systems, setting up local offices, and training staff. 73% of applicants didn’t realize how deep the changes needed to be - and got rejected for missing non-document items.

Kathleen Bauer

November 16, 2025 AT 01:48so like... i just wanted to buy dogecoin and now i need a lawyer and a bank account in france? 😅

Laura Lauwereins

November 16, 2025 AT 04:08France’s AMF is fast? Interesting. I wonder if they’re also the ones who approved the café that serves ‘crypto lattes’ with QR codes on the cups. 🤔

Gaurang Kulkarni

November 16, 2025 AT 18:05Capital requirements are arbitrary and economically illiterate. The entire premise assumes that liquidity equals stability which is false. The 730k requirement for trading platforms ignores that many platforms operate with 90% margin efficiency and zero reserve exposure. This is regulatory theater not risk management. Also why is environmental reporting mandatory but not carbon footprint of fiat banking systems? Double standard. Always.

Nidhi Gaur

November 18, 2025 AT 11:50lol i tried applying through estonia last year. they asked for a notarized letter from my dog. i sent a photo of my golden retriever with a hat on. they replied ‘not valid’. i gave up. 🐶

Usnish Guha

November 19, 2025 AT 05:23DeFi can't get licensed because it's decentralized? That's like saying democracy can't be regulated because people vote. The entire point of blockchain is removing middlemen and now the EU wants to force them back in. This isn't innovation-it's nostalgia for 1990s banking. And don't even get me started on how they treat stablecoins like they're magic beans.

satish gedam

November 20, 2025 AT 20:39Hey everyone, I know this feels overwhelming but hear me out-you CAN do this! 💪 I helped a friend in Bangalore get licensed through the Czech Republic. Took 8 months, cost €1.8M, but now they’re serving 50k EU users. You don’t need to be big-you just need to be prepared. Hire a local compliance officer, even if it’s part-time. Use open-source AML tools. And don’t skip the environmental reporting-it’s easier than you think! You got this!

rahul saha

November 22, 2025 AT 19:40Ah yes, the EU-where philosophy meets paperwork. MiCA isn’t about crypto-it’s about the epistemology of trust. You see, when you tokenize an asset, you’re not just moving value-you’re redefining ontology. And the state, in its infinite wisdom, demands a legal entity to anchor this existential leap. How quaint. We’ve moved from ‘to the moon’ to ‘submit Form 7B/Δ with notarized biometric proof of your CTO’s EU residency’. The poetry of bureaucracy.

Marcia Birgen

November 23, 2025 AT 00:45Guys, I get it’s scary-but look at the positives! 🌟 My cousin runs a small exchange and after getting licensed, her users stopped getting hacked. Like, zero breaches in 10 months. And the warnings? Yeah they’re long… but maybe that’s a good thing? People actually read them now. It’s not perfect, but it’s safer. Let’s not throw the baby out with the bathwater 💕

Jerrad Kyle

November 24, 2025 AT 02:30Let’s be real-MiCA is the first time any government actually tried to build a coherent crypto framework instead of just yelling at startups. Sure it’s expensive. Sure it’s slow. But at least you know what the rules are. In the US? You get sued by the SEC for selling a token that looks like a security… even if it’s just a meme. MiCA gives you a map. Even if it’s drawn in Comic Sans.

Usama Ahmad

November 24, 2025 AT 14:14my friend in germany applied in january. still waiting. he says the regulator called him twice to ask if his office has a window. no joke.

Nathan Ross

November 25, 2025 AT 02:40The regulatory architecture of MiCA reflects a profound epistemological commitment to institutional legitimacy over decentralized autonomy. The requirement for a legal entity constitutes a metaphysical imposition upon the ontological structure of blockchain networks. Furthermore, the capital thresholds are not economic instruments but symbolic acts of sovereign consolidation. One must ask: is the preservation of centralized control more valuable than the liberation of financial sovereignty? The answer, in the EU’s calculus, is unequivocally yes.

garrett goggin

November 26, 2025 AT 12:35MiCA is a psyop. The EU doesn’t want to regulate crypto-they want to kill it. Why? Because they know crypto exposes how worthless the euro really is. They’re scared of people using Bitcoin to bypass inflation. That’s why they made it impossible. They want you to give up. They want you to go back to your bank account that charges you 12% for a $5 transfer. Don’t fall for it. This isn’t regulation. It’s economic warfare.

Bill Henry

November 28, 2025 AT 05:00so i just got my license through france and honestly? it was a nightmare but worth it. my users are happier, my bank account doesn’t get frozen every other week, and i finally stopped getting DMs from people asking if i’m a scam. also i bought a new chair. it’s nice. 🪑

Jess Zafarris

November 28, 2025 AT 13:52Interesting that they’re forcing environmental reporting but ignoring that the entire EU banking system uses more energy than all crypto networks combined. Also, why is it only crypto? Where’s the audit for Wall Street data centers? Hmm. Maybe because they’re not regulated? Or maybe because the regulators are cozy with the big banks? Just saying.

jesani amit

November 29, 2025 AT 03:35bro i work in compliance in hyderabad and we’ve been helping 3 startups get MiCA ready. the hardest part isn’t the money-it’s the mindset shift. they think ‘we’re tech people’ so we don’t need lawyers. nah. you need a legal team like you need oxygen. also-get a local director ASAP. don’t wait. i’ve seen 7 applications get rejected because the director lived in Mumbai. not in the EU. big mistake.

Peter Rossiter

November 29, 2025 AT 12:28the 1.2 million for real time monitoring is a joke. any decent dev team could build a basic system in 3 months for under 200k. this is just rent-seeking disguised as security.

Mike Gransky

November 30, 2025 AT 12:02if you're a small team and you're reading this: don't give up. find a local accountant in Lithuania. they're cheaper than Germany. hire a freelancer for compliance docs. use Notion to track everything. it's not glamorous but it works. i've seen it happen.

Ella Davies

November 30, 2025 AT 20:07the environmental reporting requirement is actually kinda smart. if you're running a server farm, you should know how much power you're using. it's not about punishing crypto-it's about transparency. and honestly? most crypto companies don't even track this. so yeah, it's a good nudge.

Aayansh Singh

December 2, 2025 AT 05:04Anyone who thinks MiCA is fair is delusional. This is financial apartheid. Only the top 1% of crypto firms can afford it. The rest? They’re supposed to vanish. This isn’t regulation-it’s class warfare dressed in legal jargon. And the EU thinks they’re the moral high ground? Please. They’re just protecting their banking cartel.

Rebecca Amy

December 3, 2025 AT 23:07so… i’m just gonna wait until someone else pays for it? 😴