Liquidity Provision: Why It Matters and How to Master It

When dealing with Liquidity Provision, the act of supplying assets to a market so traders can buy or sell without huge price swings, liquidity supply, you’re basically keeping the engine running. It’s the backbone of DeFi because without enough funds, swaps would slip, fees would sky‑rocket, and users would look elsewhere. The first place you’ll see it in action is a Liquidity Pool, a smart contract that locks two (or more) assets together and issues LP tokens to providers. Those pools are powered by an Automated Market Maker (AMM), an algorithm that sets prices based on the ratio of assets in the pool, which means you don’t need an order book or a market maker sitting behind the screen. Adding a Stablecoin, a token pegged to a fiat currency that reduces price volatility to a pool can further smooth trades, especially when volatility spikes on the main chain. In short, liquidity provision enables AMMs to function, liquidity pools to hold value, and stablecoins to keep price swings in check – a triple connection that keeps the DeFi world humming.

Key Concepts and Tools Behind Effective Liquidity Provision

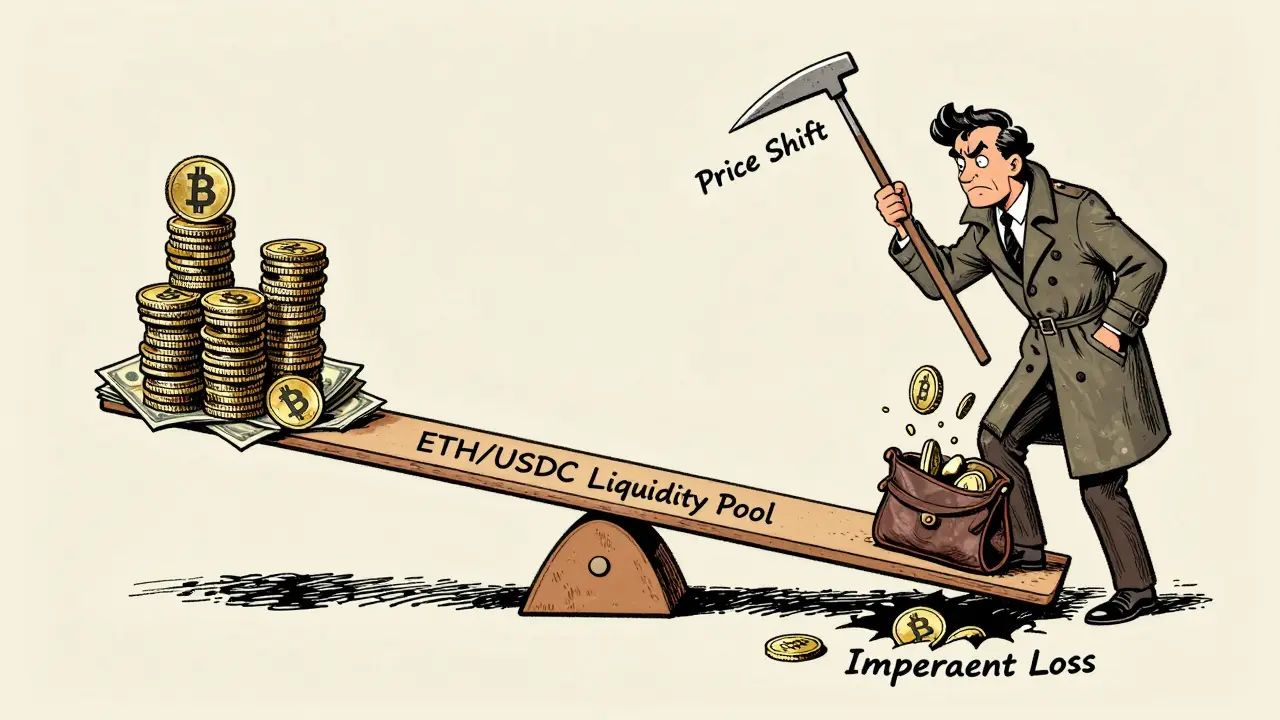

Understanding tokenomics is the first step. Every token has a supply schedule, utility, and incentive model that directly affects how much liquidity it can attract. For instance, a deflationary token that burns a portion of each trade may offer higher fee returns but also higher impermanent loss risk. Speaking of risk, impermanent loss is the hidden cost when the price of one asset in a pool moves away from the other. By monitoring pool token ratios – the math behind constant product AMMs and newer weighted or stable‑swap designs – you can estimate that loss before you jump in. Tools like on‑chain analytics dashboards or DeFi risk scanners let you see depth, volume, and fee APY in real time. If you want to stretch your capital across multiple chains, cross‑chain bridges come into play. A bridge links Ethereum, Binance Smart Chain, Solana and others, letting you move assets and seed pools on new networks without swapping back to fiat first. That expansion can boost your overall returns, but you also need to vet bridge security because a hack can wipe out pooled assets instantly.

Putting theory into practice means picking the right pool, timing your entry, and keeping an eye on fee structures. High‑volume pools on big chains often offer lower APY but more stability; niche pools on emerging chains may crank up fees but carry higher smart‑contract risk. Diversify your LP tokens just like you would diversify a stock portfolio – spread across different assets, networks, and AMM designs. Re‑balance periodically; if a pool’s ratio drifts too far, you can withdraw, rebalance, or add more of the under‑weighted asset to minimize loss. Lastly, stay updated on protocol upgrades, governance votes, and new incentive programs – they can instantly shift fee rates or introduce new reward tokens. Armed with these insights, you’re ready to navigate the liquidity provision landscape and turn your capital into a steady stream of DeFi earnings. Below you’ll find a curated set of articles that dive deeper into each of these topics, from stablecoin mechanics to bridge security, so you can build a robust liquidity strategy step by step.

How to Minimize Impermanent Loss in DeFi Liquidity Pools

by Johnathan DeCovic Jan 2 2026 22 CryptocurrencyLearn how to minimize impermanent loss in DeFi by choosing stablecoin pools, using concentrated liquidity wisely, and ensuring your fees beat your losses. Real strategies for 2026.

READ MOREUniswap V3 (Blast) Review: Features, Fees, and Yield Potential

by Johnathan DeCovic Apr 18 2025 24 CryptocurrencyA detailed review of Uniswap V3 (Blast) covering its L2 advantages, fees, yield hooks, user experience, and how it compares to other DEXs in 2025.

READ MORE