DeFi Project Viability Checker

Learn how to evaluate DeFi projects for legitimacy and avoid scams like the JF airdrop. This tool analyzes key indicators based on the lessons learned from Jswap.Finance.

Project Evaluation Form

Project Viability Assessment

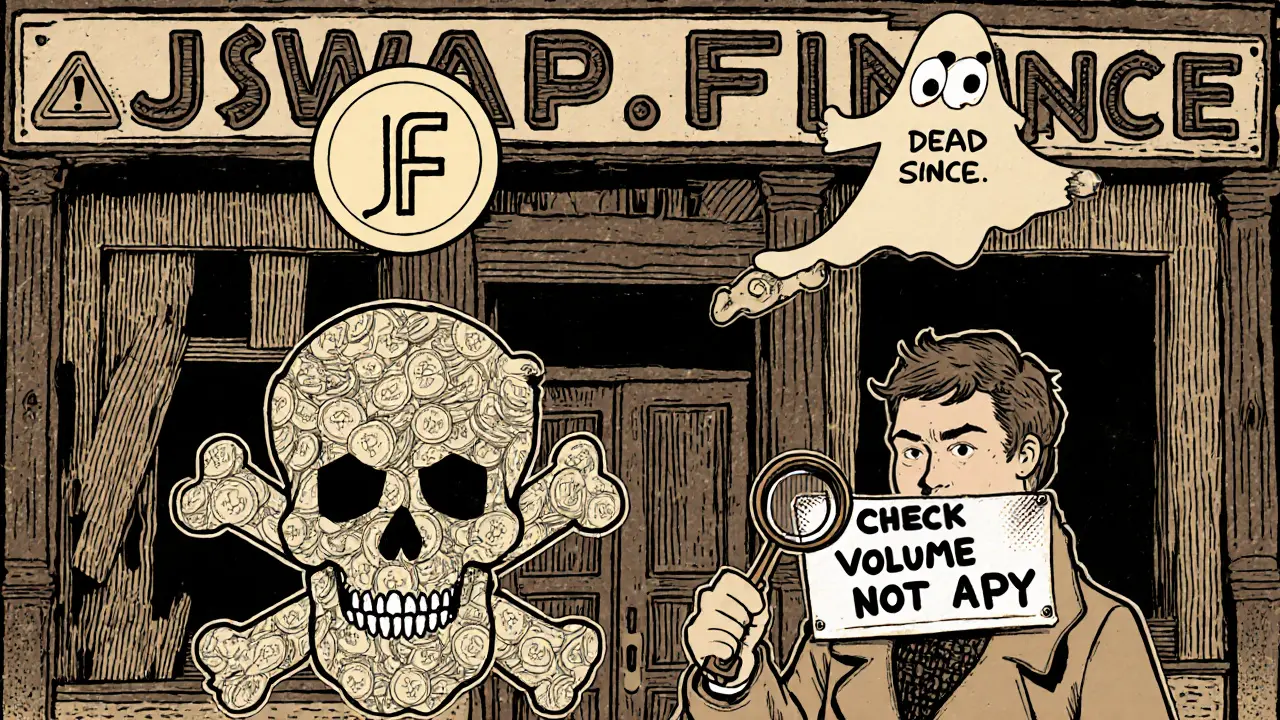

The JF airdrop from Jswap.Finance was once a hot topic in DeFi circles - promising high yields, free tokens, and a one-stop DeFi platform. But today, the story looks very different. If you're hearing about it now and wondering if it's still worth chasing, here’s the truth: JF is trading at $0 on major exchanges, has zero trading volume, and its circulating supply is listed as zero. The airdrop is long over. What’s left is a cautionary tale about hype, high APYs, and what happens when the liquidity dries up.

What Was Jswap.Finance?

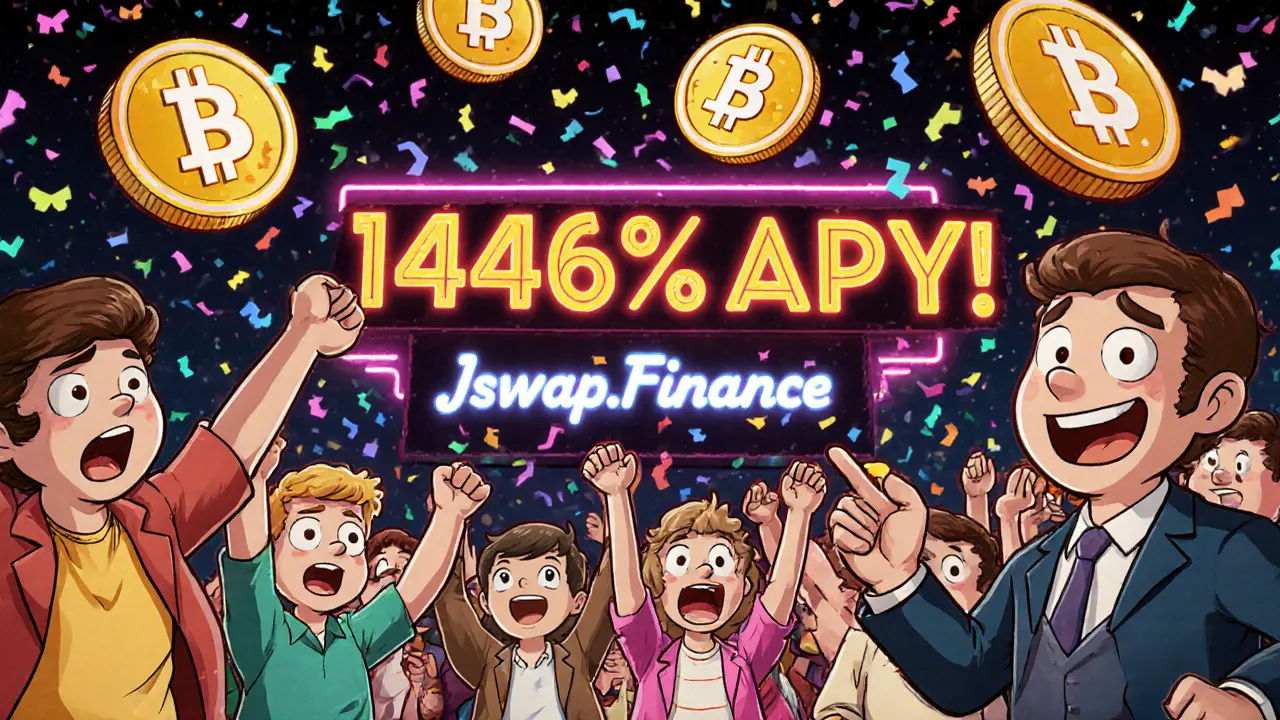

Jswap.Finance launched in late 2021 on OKExchain as a decentralized exchange built for users who wanted to swap tokens, earn yields, and participate in governance - all in one place. It wasn’t just another DEX. It promised swap mining, liquidity mining, single-token vaults (called "machine gun pools"), DAO dividends, and even a cross-chain bridge. Its native token, JF, had a max supply of 100 million and was designed to be deflationary: the platform used its profits to buy back and burn JF tokens, theoretically making them scarcer over time. At its peak, Jswap.Finance hit over $60 million in Total Value Locked (TVL). That’s not small change. Around 100,000 users were active on the platform. The JF/USDT liquidity pool was offering APYs as high as 1,476% for a single day. Those numbers caught attention - and they were the main reason people jumped in.How Did the JF Airdrop Work?

The JF airdrop wasn’t a random giveaway. It was tied to exchange listings and user participation. The biggest and most documented airdrop happened through MEXC in November 2021. Here’s how it worked:- Users had to contribute MX tokens (MEXC’s native token) to vote for JF to be listed on the exchange.

- Over 23 million MX tokens were contributed by the community.

- Those who participated received JF tokens as a reward - typically 35,200 JF per eligible user.

What Happened After the Airdrop?

The momentum didn’t last. Within months, trading volume dropped off a cliff. Today, Binance, CoinMarketCap, and CoinGecko all show JF at $0 USD. Zero. Not $0.0001. Not a penny. $0. The 24-hour trading volume is also $0. The circulating supply is listed as zero - even though 100 million JF tokens were supposed to exist. The platform’s market cap is $0. The All-Time High is marked as "NaN" - meaning the data system can’t even calculate it. The token doesn’t rank on any popularity chart. It’s not just dead - it’s invisible to tracking tools. The reason? Liquidity vanished. When users stopped swapping JF, the pools dried up. Without trading, there was no fee revenue. Without fee revenue, the buyback and burn mechanism stopped working. And without burns, the deflationary promise meant nothing. The token became a ghost.Why Did It Fail?

Three things killed Jswap.Finance:- High APYs weren’t sustainable. A 1,476% APY isn’t a feature - it’s a red flag. It’s what happens when a project pays early adopters with newly minted tokens, not real revenue. Once the initial rush faded, the yield collapsed.

- No real utility. Swap mining and vaults sounded cool, but users didn’t stick around because they had no reason to. There was no unique product, no strong community governance, no real-world use case. It was a yield farm with bells and whistles.

- Reliance on exchange hype. The entire user base came from MEXC and Bitget promotions. When those platforms moved on to the next trending token, Jswap.Finance had no organic demand to hold it up.

Is There Still a JF Airdrop?

No. Not anymore. The MEXC Kickstarter ended in November 2021. Bitget hasn’t run a JF promotion in over two years. Any website or Telegram group claiming to offer a "current JF airdrop" is either outdated, misleading, or a scam. If you see someone selling JF tokens on a decentralized exchange, it’s likely a dead pool with no buyers. You won’t be able to trade them. You won’t be able to withdraw them. And if you try to send them to a wallet, they’ll sit there - worthless.

What Should You Do Now?

If you still hold JF tokens from the 2021 airdrop:- Don’t expect them to recover. The market has moved on.

- Don’t send more money to "unlock" them. That’s a common scam tactic.

- If you want to try to recover value, check if any wallet supports token burning or migration - but don’t hold your breath.

- Check the trading volume - if it’s under $10,000/day, be skeptical.

- Look for real usage, not just APYs. Are people actually swapping? Are there live liquidity pools?

- Search for the token on CoinMarketCap and Binance. If it shows $0 and zero volume, walk away.

Lessons Learned

The JF airdrop isn’t just a footnote - it’s a lesson. DeFi is full of projects that promise big returns and vanish fast. The ones that survive don’t rely on hype. They build real tools, earn real fees, and keep users engaged beyond the first token drop. Jswap.Finance had the right idea: a one-stop DeFi platform. But it skipped the hard work. It didn’t build trust. It didn’t create lasting value. It just offered a fast payout - and when the money ran out, so did the users. Today, JF is a ghost token. The airdrop is over. The platform is inactive. The only thing left is the warning: if something looks too good to be true, it usually is - especially when the price is already $0.Was the JF airdrop real?

Yes, the JF airdrop was real - but only during the MEXC Kickstarter campaign in November 2021. Users who contributed MX tokens to vote for JF’s listing received JF tokens as rewards. No official airdrop has been active since then.

Can I still claim JF tokens today?

No, you cannot claim JF tokens today. The official airdrop campaigns on MEXC and Bitget ended years ago. Any site or social media post claiming to offer a current JF airdrop is likely a scam or outdated information.

Why is JF trading at $0?

JF is trading at $0 because there is no active trading or liquidity. The platform lost user interest, liquidity pools dried up, and no market makers support the token. Without buyers or sellers, the price drops to zero - and tracking platforms like CoinMarketCap reflect that.

Is Jswap.Finance still operational?

No, Jswap.Finance is not operational. The website is inactive, social media channels show no recent updates, and the DeFi protocols (swap mining, vaults, DAO) are no longer functional. The project has been abandoned since late 2022.

Should I invest in JF now?

No. Investing in JF now is extremely high risk with no realistic chance of recovery. The token has zero trading volume, zero market cap, and no active development. It is effectively worthless and should be treated as a lost asset.

How can I avoid fake airdrops like JF?

Always check the token’s trading volume and market cap on CoinMarketCap or CoinGecko. If it’s $0 or near zero, walk away. Look for real usage - are there active liquidity pools? Is the team transparent? Are there recent updates? Avoid projects that only promote high APYs with no clear revenue model.

sammy su

November 22, 2025 AT 05:01turns out it was just free regret

Abhishek Anand

November 24, 2025 AT 00:07vinay kumar

November 25, 2025 AT 05:36Charan Kumar

November 26, 2025 AT 18:19no one checks the contract no one asks where the money goes

then boom ghost token

Anthony Demarco

November 27, 2025 AT 14:17we built the internet they just steal it and call it innovation

Lynn S

November 29, 2025 AT 12:49Jack Richter

November 30, 2025 AT 02:20sky 168

November 30, 2025 AT 08:21Devon Bishop

November 30, 2025 AT 12:34it never does

but i keep checking

Khalil Nooh

December 1, 2025 AT 14:43jack leon

December 3, 2025 AT 12:11that's how deep the ghosting went

no tombstone. no memorial. just silence

Chris G

December 5, 2025 AT 03:54Phil Taylor

December 6, 2025 AT 04:06diljit singh

December 6, 2025 AT 06:08its not even a scam its just laziness with a blockchain label

LaTanya Orr

December 8, 2025 AT 04:25Ashley Finlert

December 9, 2025 AT 04:19Chris Popovec

December 9, 2025 AT 16:37the zero price? fake data. the dead contract? obfuscated by quantum encryption

they're still mining your seed phrases through the okexchain backdoor