Institutional HSM Explained – The Backbone of Secure Crypto Operations

When working with institutional HSM, a high‑grade hardware security module built for enterprises to protect cryptographic keys and manage secure signing for blockchain activities. Also known as enterprise HSM, it enables institutions to run staking services, custody solutions, and DeFi operations without exposing private keys, the first thing you notice is that it institutional HSM isn’t just a fancy box—it's the core of any trustworthy crypto infrastructure. It encompasses a hardware security module, a tamper‑resistant device that generates, stores and uses private keys inside a sealed environment, and it requires robust cryptographic key management, processes that define how keys are created, rotated, archived and destroyed according to best‑practice policies. By keeping the keys inside the HSM, institutions can offer liquid staking, a service that lets users earn staking rewards while maintaining the ability to trade or transfer their assets instantly without risking the private keys ever leaving a secure enclave. This combination of secure hardware, disciplined key handling, and on‑chain flexibility forms a solid foundation for everything from stablecoin issuance to cross‑chain bridge operations.

Why Institutional HSM Matters for Crypto Exchanges, Stablecoins and Compliance

Every crypto exchange, stablecoin platform or cross‑chain bridge you read about in our tag collection leans on the same principle: if the private keys are exposed, the whole system collapses. That’s why regulatory compliance, the set of rules and audits that financial institutions must follow to prove security, AML/KYC and data protection often mentions HSMs by name. A well‑implemented institutional HSM helps meet those requirements by providing immutable logs, role‑based access control and certified cryptographic modules that auditors can verify. For stablecoins, secure key storage directly influences the peg’s integrity; a compromised signing key could let an attacker mint unlimited tokens and break the dollar‑backed promise. Likewise, cross‑chain bridges rely on multi‑sig wallets or threshold signatures that are safely generated inside an HSM, reducing the attack surface for hacks like the infamous Wormhole breach. In short, the security guarantees of an institutional HSM ripple through the entire crypto ecosystem, making it a non‑negotiable piece for any serious market player.

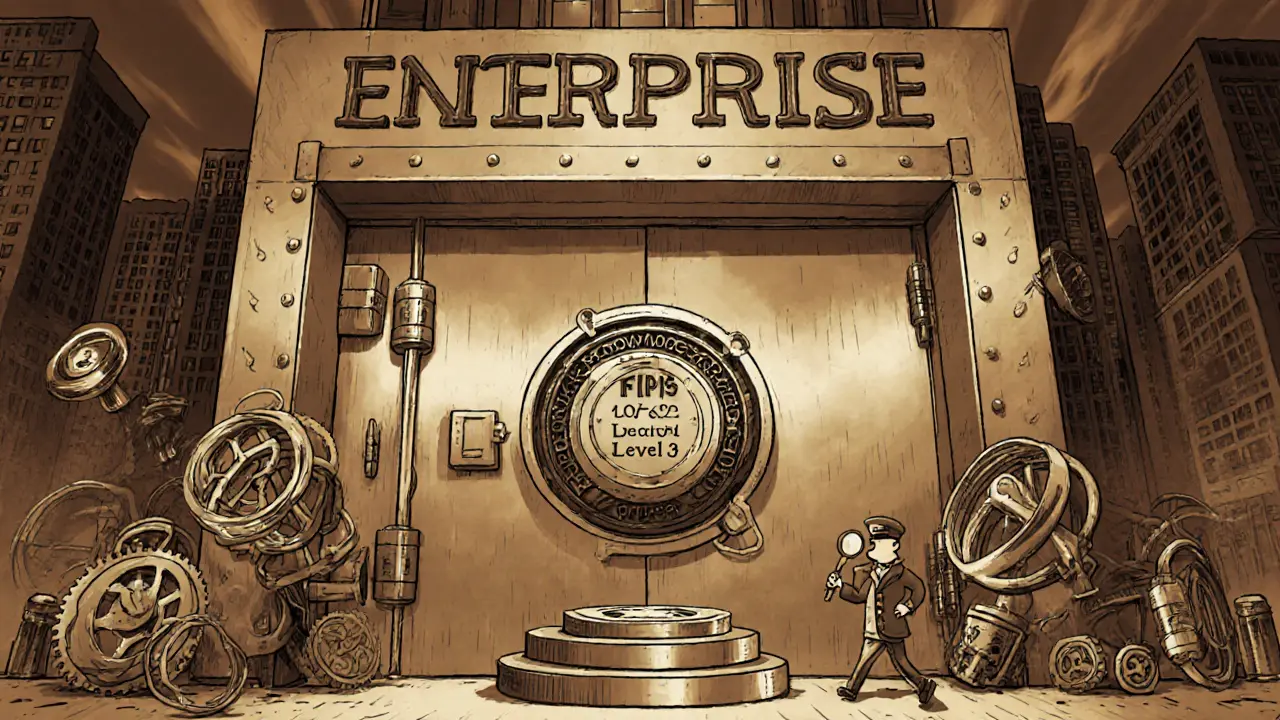

Putting an institutional HSM into production isn’t a plug‑and‑play task. You need to pick a vendor that offers FIPS 140‑2 level 3 certification, integrate the device with your staking or custody software, and run regular smart contract audit, a thorough review of on‑chain code to spot vulnerabilities before they can be exploited. The audit process should cover the interaction between your HSM‑signed transactions and the contracts they trigger, ensuring that no malicious payload can slip through a mis‑configured key. Risk‑management teams also tie HSM metrics—like key usage counts and tamper‑event logs—into broader monitoring dashboards, so any anomaly raises an immediate alarm. By combining hardware security, disciplined key management, compliance checks and contract audits, institutions can offer users confidence that their assets are safe while still enjoying the benefits of liquid staking, fast withdrawals and low‑fee trading. Below you’ll find a curated set of articles that dive deeper into each of these areas, from stablecoin mechanics to cross‑chain bridge safety, giving you a complete picture of how an institutional HSM powers modern crypto finance.

Institutional Grade HSM Solutions: Secure Key Management for Enterprises

by Johnathan DeCovic Jan 14 2025 17 TechnologyLearn how institutional-grade HSMs protect cryptographic keys, compare deployment models, and get best‑practice advice for secure, compliant key management.

READ MORE