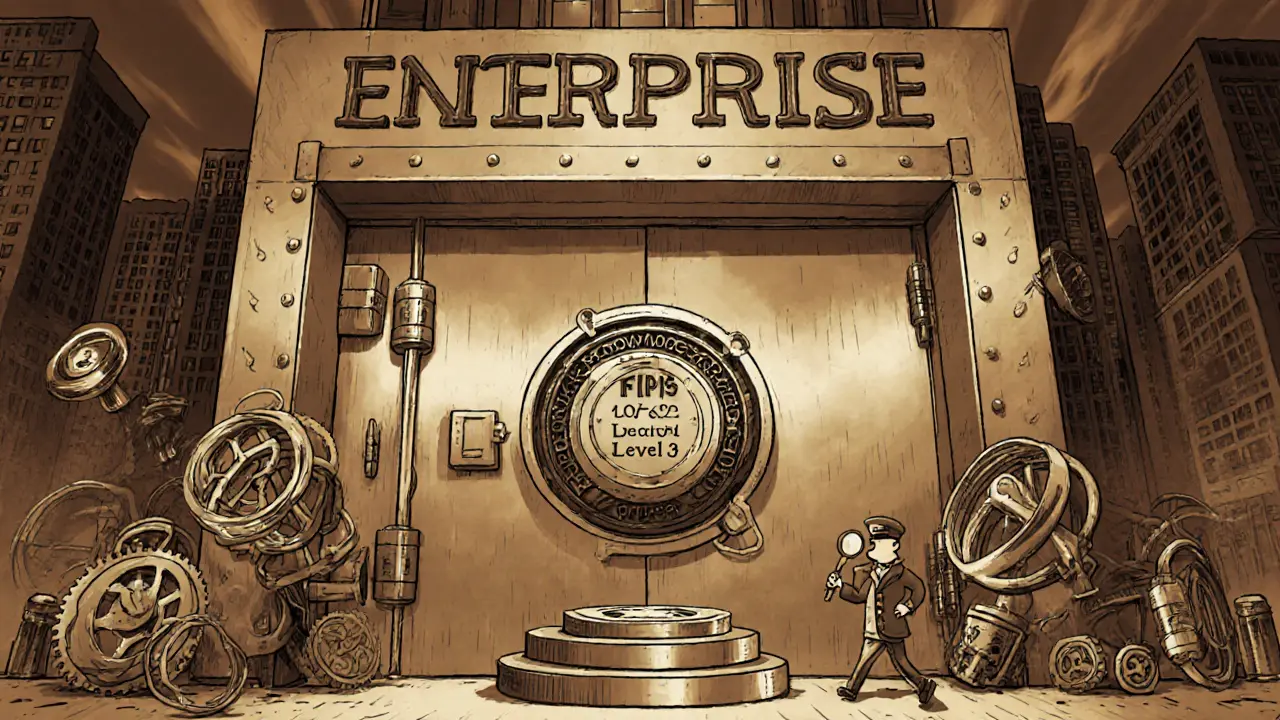

FIPS 140-2: Understanding the Standard for Crypto Security

When working with FIPS 140-2, the U.S. government’s security standard for cryptographic modules. Also known as Federal Information Processing Standard 140‑2, it sets baseline requirements for encryption, key management, and tamper‑resistance in hardware and software. The standard is published by NIST, the National Institute of Standards and Technology, which defines the testing levels and documentation needed for compliance. In the crypto world, meeting FIPS 140-2 often means a platform can claim its wallets, staking services, or exchange APIs protect user funds with vetted cryptography.

Why FIPS 140-2 Matters for Crypto Projects

At its core, FIPS 140-2 encompasses cryptographic modules, the building blocks that perform encryption, decryption, and digital signatures. A module that passes Level 2 or Level 3 testing offers proven resistance against side‑channel attacks and physical tampering, which is crucial for custodial wallets and DeFi protocols that lock large sums of value. Many crypto exchanges list their compliance status as part of a broader security audit, a systematic review of code, infrastructure, and operational procedures. Auditors often reference FIPS 140-2 when evaluating key management practices, ensuring that private keys are generated, stored, and rotated in line with the standard’s requirements. The ripple effect extends to smart contract audits as well. When a DeFi platform like StakeLiquid advises users on liquid staking or token swaps, the underlying infrastructure must handle cryptographic operations securely. Auditors check whether the platform’s signing services rely on FIPS‑validated modules, which reduces the risk of malicious key leakage. Compliance also feeds into regulatory conversations; entities operating in regions with strict data protection laws cite FIPS 140-2 to demonstrate they meet recognized security baselines. This ties directly into the broader ecosystem of crypto exchange security, where users compare fee structures, trading features, and the presence of certified cryptographic hardware before trusting a platform with their assets. In practice, implementing FIPS 140-2 means selecting hardware security modules (HSMs) that have passed NIST’s validation, configuring TLS libraries to enforce FIPS‑approved cipher suites, and documenting every step in a compliance package. Projects that overlook these details may face audit failures or, worse, jeopardize user funds during a breach. By aligning with the standard, developers gain a clear checklist: use approved algorithms (AES, SHA‑2), enforce role‑based access to key material, and maintain audit logs that can survive forensic analysis. This disciplined approach not only satisfies auditors but also builds confidence among investors watching the volatile crypto market. Our collection below pulls together guides, reviews, and deep dives that show how FIPS 140-2 fits into real‑world crypto operations—from exchange security assessments to smart contract audit best practices. Whether you’re a developer looking to harden a staking service or an investor vetting a platform’s security claims, the articles ahead give you actionable insights and concrete examples of the standard in action.

Institutional Grade HSM Solutions: Secure Key Management for Enterprises

by Johnathan DeCovic Jan 14 2025 17 TechnologyLearn how institutional-grade HSMs protect cryptographic keys, compare deployment models, and get best‑practice advice for secure, compliant key management.

READ MORE