Crypto Residency Singapore: A Practical Guide

When working with crypto residency Singapore, a legal framework that lets individuals and businesses set up a tax‑efficient base for digital assets in Singapore. Also known as Singapore crypto domicile, it blends low taxes, clear regulation, and easy market access.

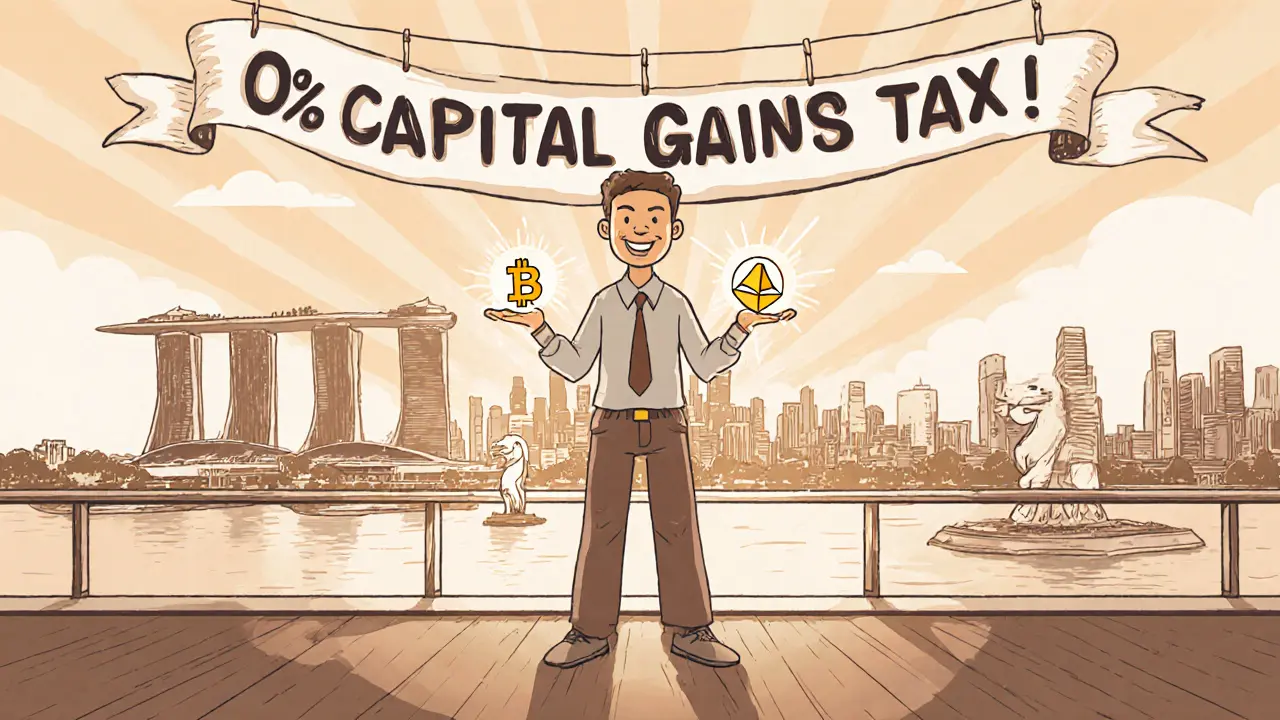

Understanding Singapore’s tax regime, which offers a 0% capital gains tax and a flat corporate tax rate for qualifying crypto activities is the first step. Next, the Monetary Authority of Singapore (MAS) licensing, the authority that issues digital asset service provider licences and enforces AML/KYC standards dictates how you can operate exchanges or staking services. Compared with global crypto residency programs, Singapore stands out for its political stability and strong fintech ecosystem. Finally, digital asset compliance, the set of reporting, audit, and security requirements tied to tokenized assets ensures you stay on the right side of regulators while accessing DeFi, staking, and exchange opportunities.

Key Elements of a Singapore Crypto Residency

If you’re hunting for a crypto residency Singapore solution, you’ll need to align three pillars: tax efficiency, regulatory licensing, and operational compliance. The tax pillar means you can keep profits from staking, liquid staking, or trading mostly tax‑free, as long as the activity qualifies under the Income Tax Act. The licensing pillar forces you to apply for a MAS digital asset service provider licence if you plan to run an exchange, a custodial service, or a staking pool—this licence also signals credibility to investors. The compliance pillar covers everything from Know‑Your‑Customer checks to regular audits of smart‑contract security, which ties back to the security reviews we cover in articles like “Smart Contract Audit: A Complete Security Guide for 2025”.

Below you’ll find a curated set of posts that dive into the details you’ll need. We’ve got exchange deep‑dives (Hibt, OKX, KoinBX), technical breakdowns (Proof of Stake vs Proof of Work, consensus mechanisms), and practical guides on stablecoins, cross‑chain bridges, and risk management. Together they paint a full picture of what it looks like to run a crypto‑focused business from Singapore, from choosing the right exchange to securing your smart contracts and managing tax liabilities.

Ready to see how the pieces fit? The articles that follow will walk you through exchange fees, security audits, staking reward tracking, and even how Singapore’s regulatory stance compares to other jurisdictions. Use them as a checklist while you set up your crypto residency, and you’ll avoid common pitfalls before they happen.

Why Singapore Has No Capital Gains Tax on Crypto (and How It Benefits Investors)

by Johnathan DeCovic Sep 22 2025 17 CryptocurrencyDiscover why Singapore imposes no capital gains tax on cryptocurrency, who benefits, residency requirements, and how its regulatory framework compares globally.

READ MORE