51% Attack: What It Is and Why It Matters

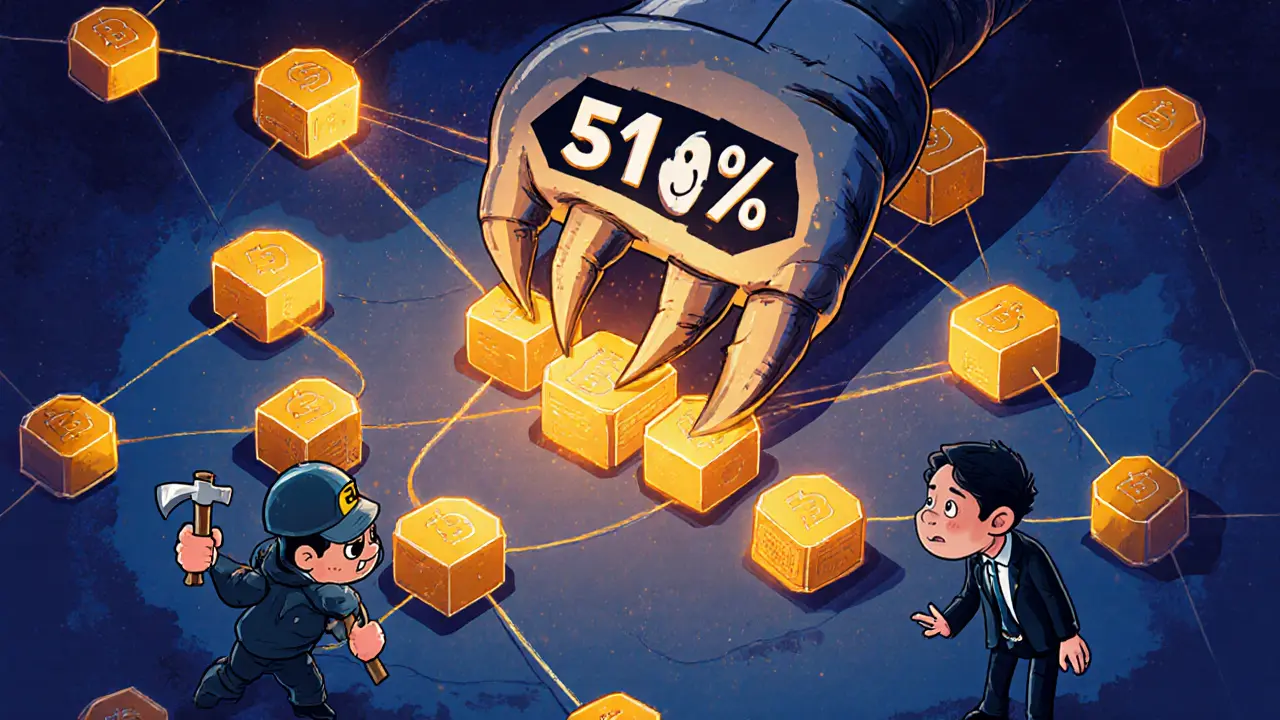

When a 51% attack, refers to a situation where one entity gains control of more than half of a blockchain’s mining or staking power occurs, the entire network’s security is at risk. This threat is rooted in the blockchain consensus mechanisms, rules that decide how blocks are added and how agreement is reached that most public chains use, especially proof of work, the mining‑based system that powers Bitcoin and many early blockchains. By controlling the majority hash power, an attacker can rewrite transaction history, enabling a double spend, the act of spending the same coins twice and potentially censor other users. Robust network security, the combination of cryptographic and economic safeguards that protect a blockchain measures lower the chance of a successful breach.

How a 51% Attack Unfolds

First, the attacker amasses enough mining rigs or stakes enough tokens to exceed the 50% threshold. Next, they start mining a private fork of the chain while the honest network continues on the public fork. Because they control the majority, the private chain will outpace the public one, giving the attacker the power to decide which blocks become part of the official history. At that point they can execute a double spend by sending coins to a merchant, waiting for the transaction to be confirmed, and then publishing a conflicting transaction on their private fork that moves the same coins elsewhere. Once the private fork becomes the longest chain, the merchant’s transaction disappears, and the attacker keeps the goods and the coins.

If you’re wondering whether a 51% attack could hit your favorite chain, keep reading. Real‑world incidents show it’s not just theory. In 2019, Ethereum Classic suffered a 51% attack that erased over $1 million in transactions. Bitcoin Gold faced a similar breach in 2020, leading to a temporary drop in price and a flood of disputed transactions. Both cases illustrate how quickly trust can erode when a majority of hashing power flips sides.

Why do some blockchains become easy targets? Smaller networks often have fewer miners, lower overall hash rates, and less diversified staking pools. That makes the cost of buying or renting enough hardware relatively cheap. Conversely, large chains like Bitcoin and Ethereum (post‑merge) benefit from massive, globally distributed miner and validator sets, raising the economic barrier for an attacker.

Mitigation strategies fall into three buckets: technical safeguards, economic incentives, and community vigilance. On the technical side, many projects adopt hybrid consensus models—for example, combining proof of work with proof of stake or using checkpointing to lock in blocks at regular intervals. Economically, a well‑designed tokenomics model makes a successful attack more costly than the potential gain. Some networks impose “bonding” requirements for validators, meaning they must lock up a significant amount of capital that can be slashed if they act maliciously. Community vigilance involves monitoring hash‑rate spikes, unusual block re‑orgs, and reporting suspicious activity to development teams.

From a user perspective, there are practical steps you can take to reduce exposure. Stick to exchanges and wallets that run full nodes or rely on reputable third‑party services with strong security track records. Diversify where you hold assets; don’t keep large sums on a single, low‑security network. Follow on‑chain analytics tools that highlight hash‑rate distribution changes—sharp increases may signal an impending attack.

Our collection below dives deeper into these topics. You’ll find exchange reviews that assess security measures, guides that break down consensus mechanisms, and risk‑management tips that help you stay ahead of potential 51% threats. Explore the posts to arm yourself with the knowledge you need to navigate the crypto landscape safely.

How to Prevent 51% Attacks on Blockchains: Real-World Strategies for Network Security

by Johnathan DeCovic Jan 20 2026 16 CryptocurrencyLearn how 51% attacks work, which blockchains are most at risk, and how Proof-of-Stake, hybrid models, and economic penalties are making these attacks harder to pull off. Real-world data and expert insights on blockchain security.

READ MOREProof of Stake vs Proof of Work: Which Is More Resistant to 51% Attacks?

by Johnathan DeCovic Oct 18 2025 22 CryptocurrencyExplore how Proof of Stake and Proof of Work differ in resisting 51% attacks, the economics behind each, real-world examples, and future challenges.

READ MORE