Fiat‑Pegged Stablecoins: How They Work and Why They Matter

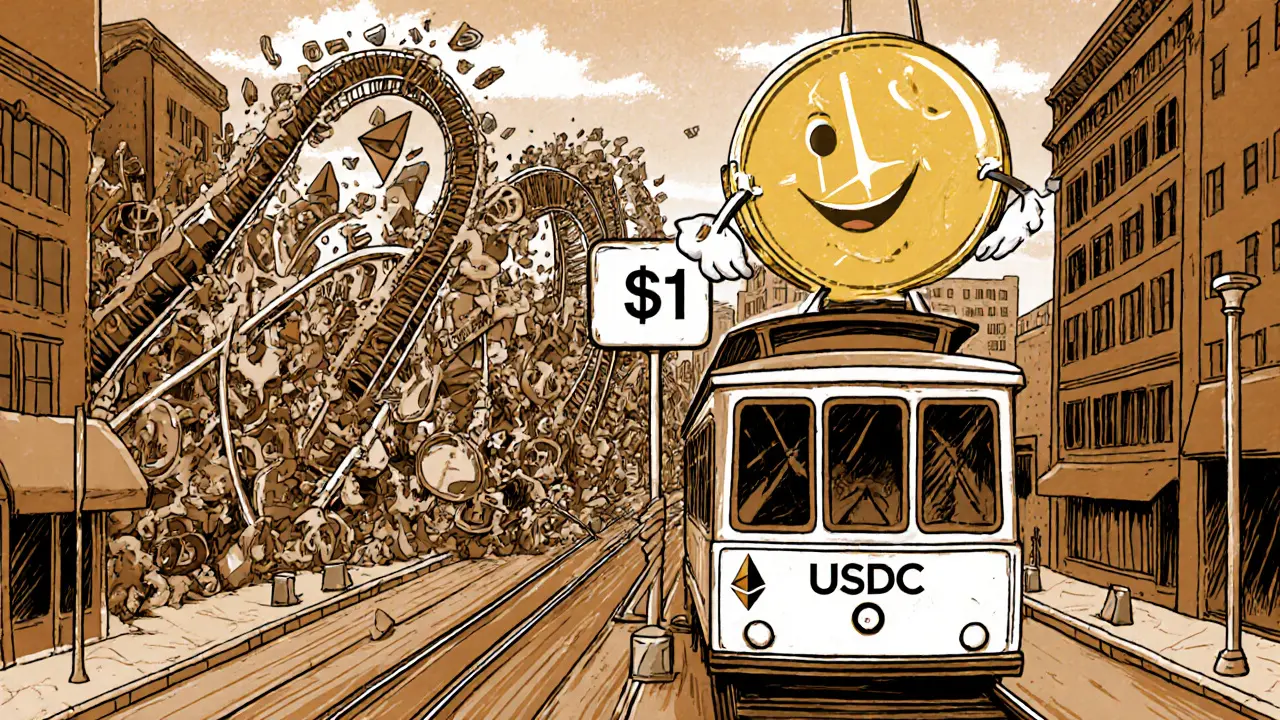

When working with fiat‑pegged stablecoins, digital tokens backed 1:1 by government currencies such as the US dollar or euro. Also known as stablecoins, they aim to combine crypto speed with fiat price stability. Stablecoins act as a bridge between traditional money and blockchain, letting you move value without the wild swings that most crypto faces.

Two of the most widely used examples are USDC, a regulated, fully audited dollar‑backed token issued by Circle and Coinbase and USDT, Tether’s dollar‑linked token that operates on dozens of blockchains. Both claim a 1:1 reserve ratio, but USDC leans on strict compliance while USDT has faced more controversy over its audits. Understanding their differences helps you pick the right coin for trading, saving, or earning yield.

Another key player is DAI, a decentralized token that maintains a dollar peg through crypto collateral and smart‑contract governance. Although DAI isn’t backed by fiat reserves, its algorithmic stability mechanisms showcase an alternative route to a stable price. Comparing DAI with USDC and USDT highlights how design choices—centralized custody versus decentralized collateral—shape risk profiles and user trust.

At the heart of any fiat‑pegged stablecoin is collateral management. Issuers must hold real‑world assets—bank deposits, Treasury bills, or cash equivalents—in a trusted reserve. This reserve acts as the backing that lets each token be redeemed for its underlying fiat on demand. When reserve transparency drops, confidence erodes, leading to price dips or even de‑pegging events. So, watch for regular attestations, third‑party audits, and clear redemption processes.

Tokenomics play a big role, too. Supply can be elastic (minted or burned based on demand) or fixed, affecting liquidity and market depth. Some stablecoins charge a minting fee, while others earn interest on their reserves and pass a share to holders. These economic layers influence how attractive a stablecoin is for everyday users versus institutional players looking for low‑cost, high‑volume settlement.

DeFi platforms have built entire ecosystems around stablecoins. Yield farms, lending protocols, and synthetic assets all need a price‑stable base to function. By providing a predictable unit of account, stablecoins let traders earn interest, borrow against positions, or hedge volatility without leaving the blockchain. In practice, you’ll see USDC powering Compound’s lending markets while USDT fuels high‑frequency trading on decentralized exchanges.

Cross‑chain bridges extend stablecoin reach even further. A token locked on Ethereum can be minted as an equivalent on Solana, Binance Smart Chain, or Polygon, enabling almost instant transfers with lower fees. These bridges rely on smart‑contract validators or custodial nodes to maintain the peg across networks. The ability to move a stablecoin across chains expands liquidity pools and opens new arbitrage opportunities for savvy users.

Below you’ll find a hand‑picked collection of articles that dive deeper into the world of stablecoins. From tokenomics breakdowns and risk‑management guides to real‑world use cases and bridge mechanics, the posts give you actionable insights you can apply right away. Explore the list to see how stablecoins intersect with airdrops, DeFi strategies, and the broader crypto market.

Stablecoins: Tackling Crypto Volatility in 2025

by Johnathan DeCovic Oct 12 2025 22 CryptocurrencyExplore how stablecoins tame crypto volatility, the mechanisms behind their peg, major players, benefits, risks, and 2025 market trends in clear, practical terms.

READ MORE