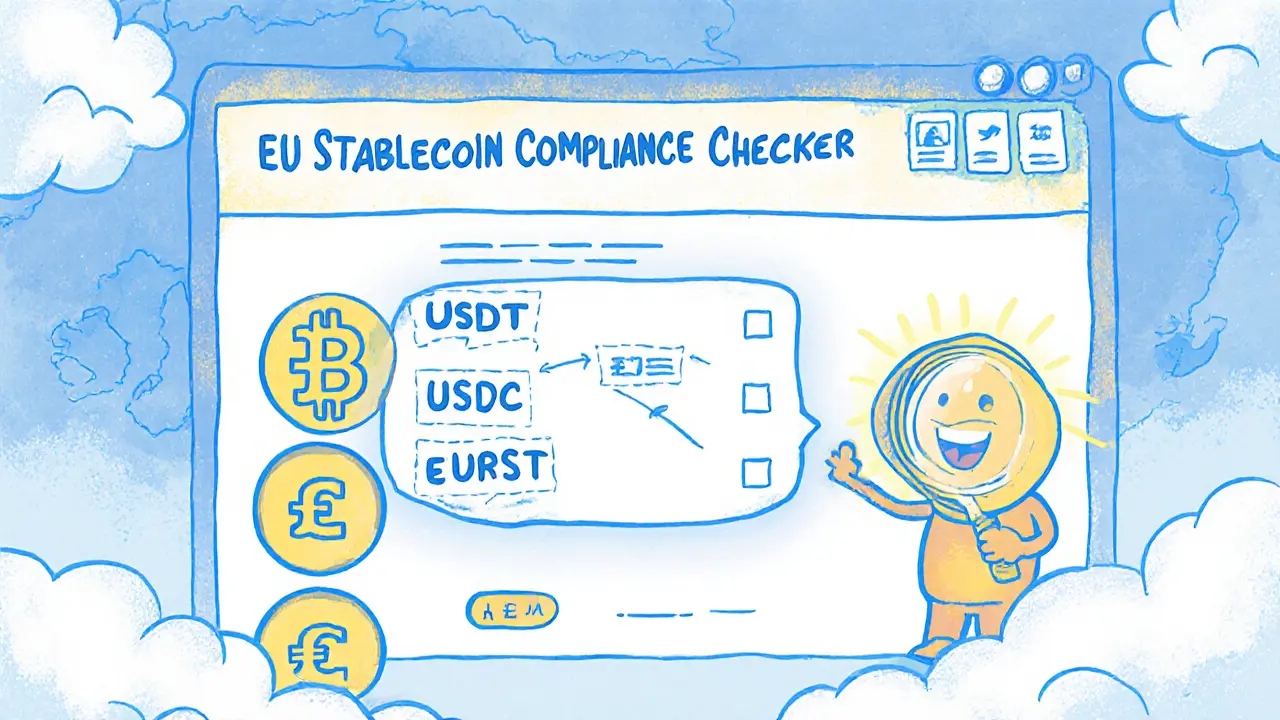

EU Stablecoin Compliance Checker

Compliance Status

Conversion Options

Regulatory Impact

EU stablecoin restrictions have turned the crypto landscape upside down for anyone holding or trading USDT and similar tokens. This guide breaks down what the Markets in Crypto‑Assets (MiCA) rules demand, how they affect USDT, and what you can do to stay on the right side of the law.

TL;DR

- MiCA classifies stablecoins as Asset‑Referenced Tokens (ARTs) or E‑Money Tokens (EMTs) and forces a 1‑for‑1 reserve backed by protected assets.

- USDT is currently considered non‑compliant; EU platforms must stop trading it by January2025 and fully enforce restrictions by Q12025.

- CASPs (crypto‑asset service providers) can only offer limited custody and must provide conversion options for USDT holders.

- Compliance requires a legal review, reserve‑monitoring systems, and ongoing reporting - expect 6‑12months of preparation.

- Europe is building its own euro‑stablecoin, slated for 2026, to compete with US‑dominated tokens.

What is MiCA and why does it matter?

MiCA regulation is the European Union’s comprehensive framework for crypto‑assets, officially titled Regulation (EU)2023/1114. Enforced across all 27 member states in 2025, MiCA aims to bring investor protection, market integrity, and financial stability to a space previously ruled by self‑regulation. The European Securities and Markets Authority (ESMA) oversees the rollout, setting tight deadlines for platforms to adapt.

Stablecoin categories under MiCA

MiCA splits stablecoins into two buckets:

| Attribute | Asset‑Referenced Token (ART) | E‑Money Token (EMT) |

|---|---|---|

| Backing asset | Basket of assets (currencies, commodities, securities) | Single official currency (euro) |

| Reserve requirement | 1‑for‑1 reserve, assets must be held in a bankruptcy‑protected account | 100% of tokens must be backed by euro deposits in a licensed e‑money institution |

| Redemption right | Holders can redeem at par value on demand | Same - redeemable at face value at any time |

| Typical examples | USDT, USDC (if they meet reserve rules) | Euro‑stablecoins like the upcoming European Bank Consortium token |

Both categories share the one‑for‑one reserve rule, but the EMT regime is stricter about the underlying asset: it must be an official euro deposit, monitored by a licensed e‑money institution.

Why USDT is in the hot seat

USDT, issued by Tether Ltd., has long been the market’s most liquid stablecoin. Under MiCA, it is classified as an Asset‑Referenced Token because its reserves include a mix of cash, commercial paper, and other assets. The regulation demands that these reserves be held in a bankruptcy‑protected structure and be fully liquid at all times. Tether’s current reserve composition - with significant non‑cash components - fails that test.

Consequences are clear:

- All EU‑based CASPs must stop offering USDT trading by the end of January2025.

- Platforms can retain custody only to facilitate direct transfers or conversions into a compliant token.

- Investors must be offered a clear conversion path, often into euro‑denominated EMTs or other compliant ARTs.

Failure to comply can trigger fines up to €10million per violation and possible loss of operating licences.

Impact on crypto‑asset service providers

For exchanges, wallets, and payment processors operating in the EU, MiCA forces a multi‑step overhaul:

- Legal audit: Verify every listed stablecoin against MiCA’s reserve and redemption criteria.

- Technical upgrade: Deploy monitoring systems that track reserve ratios in real time and generate regulatory reports.

- Customer communication: Launch awareness campaigns explaining the delisting of non‑compliant tokens and offering conversion options.

- Operational limits: Restrict USDT to ‘transfer‑only’ mode, disabling order books, margin, and lending features.

Smaller providers often struggle with the cost - estimates put ongoing compliance overhead at €150000‑€300000 per year.

How the EU approach compares to the U.S. GENIUS Act

The United States introduced the GENIUS Act on July182025. While both frameworks share the 1‑for‑1 reserve rule, the U.S. law gives issuers a 24‑month grace period to demonstrate compliance and allows “payment stablecoins” to operate under existing e‑money licences with fewer reporting burdens.

Practically, this means:

- U.S. platforms can keep USDT trading while tweaking their reserve structures.

- European firms may see transaction volume drift southward as users chase the more permissive environment.

- Visa, Mastercard, and large retailers in the U.S. are already piloting stablecoin payments, putting pressure on EU institutions to stay competitive.

Analysts project a potential 15‑20% shift of cross‑border stablecoin volume from the EU to the U.S. over the next two years if the EU does not streamline its processes.

Future outlook: Europe’s own euro‑stablecoin

In response, a consortium of nine major European banks - ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International - is creating a MiCA‑compliant euro‑stablecoin. The new entity, registered in the Netherlands, will seek a licence from the Dutch Central Bank as an e‑money institution. Expected launch: H22026.

This token will meet EMT criteria from day one, offering European users a local alternative to USDT and USDC. If successful, it could recapture a significant share of the projected $2trillion global stablecoin market by 2028.

Practical steps to stay compliant

If you’re an investor, trader, or service provider, here’s a quick checklist:

- Identify every stablecoin you currently support. Flag any that are not EMTs or lack a verified 1‑for‑1 reserve.

- Contact your legal team to verify whether the token meets MiCA’s reserve‑protection standards.

- For non‑compliant tokens like USDT, arrange a conversion plan to an EMT (e.g., a euro‑stablecoin) before the January2025 deadline.

- Upgrade your platform’s monitoring tools to provide real‑time reserve ratio dashboards.

- Publish a transparent user notice explaining the upcoming changes, with FAQs and support contacts.

- Submit any required regulatory reports to national authorities within the first quarter of 2025.

Following this roadmap should keep you out of the regulator’s crosshairs and maintain smooth operations for your customers.

Frequently Asked Questions

What exactly does MiCA require for stablecoin reserves?

MiCA mandates that every stablecoin hold assets equal in value to the total circulating supply, stored in a bankruptcy‑protected account. The assets must be liquid and auditable on a daily basis.

Can I still transfer USDT within the EU after the ban?

Yes, but only as a pure transfer. Trading, lending, or using USDT in DeFi protocols is prohibited for EU‑based platforms.

How does the GENIUS Act differ from MiCA?

The U.S. law gives issuers a longer grace period, allows stablecoins to operate under existing e‑money licences, and imposes lighter reporting requirements compared with the EU’s stricter, one‑stop‑shop MiCA framework.

When will the European euro‑stablecoin be available?

The banking consortium targets a launch in the second half of 2026, after obtaining a licence from the Dutch Central Bank and completing the required AML/KYC setups.

What are the penalties for non‑compliance?

National regulators can levy fines up to €10million per breach and may suspend or revoke a CASP’s operating licence.

victor white

November 21, 2024 AT 00:20One cannot help but sense the shadowy orchestration behind the EU's MiCA edicts, as if a cabal of regulators seeks to rewire the very arteries of digital finance. The ban on USDT appears less a genuine consumer‑protection measure than a calculated move to shepherd capital into Euro‑centric projects, perhaps even a covert attempt to resurrect a sovereign digital euro under the guise of stability. The language of "asset‑referenced tokens" sounds splendidly academic, yet it thinly veils a power grab that will reshape the crypto ecosystem for years to come.

mark gray

November 21, 2024 AT 01:10That’s a clear reminder to keep an eye on the compliance deadlines.

Alie Thompson

November 21, 2024 AT 02:00It is incumbent upon every responsible participant in the crypto sphere to recognize that the EU’s MiCA framework represents a watershed moment for consumer protection, and to ignore it would be tantamount to moral negligence. The regulators have painstakingly crafted reserve requirements precisely to shield the unsuspecting public from the capricious whims of centralized issuers. When a token like USDT, whose reserve composition is shrouded in opacity, is declared non‑compliant, it sends a powerful signal that transparency must be non‑negotiable. The omission of full 1‑for‑1 backing jeopardizes not only investors’ capital but also the integrity of the broader financial system. Moreover, the punitive fines of up to €10 million per breach underline the seriousness with which the Union regards this duty. Platform operators must therefore undertake exhaustive legal audits, lest they become complicit in deceptive practices. It is ethically impermissible for a service provider to continue facilitating trade of a token that fails to meet the stipulated standards. The public deserves unequivocal clarity regarding which stablecoins honor their redemption promises. Inadequate safeguards foster an environment where speculative exploitation thrives unchecked. By enforcing the deadline of January 2025, the EU is effectively drawing a line in the sand that all must respect. Those who flout this line not only endanger their users but also erode trust in the nascent digital economy. The onus is on the community to disseminate accurate information and to assist users in converting to compliant euro‑stablecoins. Education, rather than obfuscation, should be the guiding principle for exchanges and custodians alike. The long‑term health of the market hinges upon adherence to these robust standards. Indeed, this is not merely a regulatory hurdle but a moral imperative to protect the financial well‑being of everyday participants. Let us therefore rally together, demand transparency, and ensure that no investor is left vulnerable to opaque and potentially destabilizing assets.

Rae Harris

November 21, 2024 AT 02:50Sure, MiCA looks like a bureaucratic nightmare, but think of the underlying protocol layers: the token's peg mechanism, the collateralization vector, and the smart‑contract auditing pipeline. While everyone is crying about “over‑regulation”, the real issue is that many ARTs lack a robust oracle feed, making them vulnerable to price manipulation. In practice, an EMT like EURST offers a cleaner on‑chain settlement model, so why not just double‑down on euro‑denominated instruments? The whole USDT ban is just a symptom of a larger shift toward native, chain‑native liquidity.

Danny Locher

November 21, 2024 AT 03:40Hey folks, the good news is that the transition window gives us time to swap USDT for a euro‑stablecoin without panic. If your exchange already lists EURST or another EMT, you can simply move your assets over and keep trading as usual. Keep an eye on platform announcements – most will roll out conversion tools soon. Stay chill, and remember that the crypto community always finds a way to adapt.

Emily Pelton

November 21, 2024 AT 04:30Listen up, everyone; the MiCA rules are not optional, they are mandatory; you must verify your reserve ratios daily, you must report to national regulators quarterly, and you must provide clear conversion paths for USDT holders; failure to comply will result in hefty fines; there is no gray area here, so act now; ensure your compliance team is fully staffed, and double‑check every token listing!

sandi khardani

November 21, 2024 AT 05:20The EU's latest stablecoin crackdown is nothing short of a clumsy power play that reeks of regulatory overreach, and it demonstrates a profound misunderstanding of how decentralized finance operates in practice. By forcing platforms to treat USDT as non‑compliant, regulators are essentially weaponizing legal mechanisms to tilt market share toward Euro‑centric solutions, all while ignoring the genuine liquidity that USDT provides across global DeFi protocols. This approach will inevitably stifle innovation, drive developers to more permissive jurisdictions, and create a fragmented ecosystem that harms users worldwide. Moreover, the mandated reserve transparency is a pipe dream; auditors will never be able to verify the opaque asset basket Tether claims, rendering the compliance checks meaningless. In short, the MiCA edicts will likely cause more chaos than protection, and market participants should brace for the fallout.

Donald Barrett

November 21, 2024 AT 06:10MiCA is a bureaucratic nightmare that will choke crypto innovation.

Fiona Chow

November 21, 2024 AT 07:00Oh great, another law that tells us how to move our own money – because the EU clearly knows best how to keep the blockchain “clean”.

Rebecca Stowe

November 21, 2024 AT 07:50Exactly, Danny! It’s reassuring to see the community rally together and make the transition feel less daunting.

Kailey Shelton

November 21, 2024 AT 08:40Seems like another compliance hassle.

Angela Yeager

November 21, 2024 AT 09:30For anyone looking to navigate the MiCA requirements, start by reviewing the reserve composition of each stablecoin you support. Check whether the assets are held in a bankruptcy‑protected account and verify the 1‑for‑1 backing ratio daily. Platforms that already offer EURST can use it as a direct conversion target for USDT holders. Additionally, keep an eye on communication from your national regulator, as they will publish templates for the required quarterly reports. If you need a checklist, many legal firms have published free guides that summarize the key steps.

vipin kumar

November 21, 2024 AT 10:20There’s a hidden agenda here – the timing aligns perfectly with the upcoming Euro‑digital token rollout, suggesting the MiCA rules are a smokescreen to push European sovereign crypto while sidelining US‑issued tokens.

Lara Cocchetti

November 21, 2024 AT 11:10Alie, while your moral lecture is commendable, it overlooks the fact that the very institutions drafting MiCA are often entangled with the same opaque financial practices they claim to police, making the whole “consumer protection” narrative a convenient façade.

Mark Briggs

November 21, 2024 AT 12:00Great, more red tape.

Millsaps Delaine

November 21, 2024 AT 12:50One must acknowledge that the EU's regulatory foray into stablecoins represents a sophisticated attempt to reconstitute monetary sovereignty within a digital paradigm, an endeavor that transcends mere compliance checklists. By mandating 1‑for‑1 reserve backing, the Union seeks to embed fiscal prudence into the very architecture of tokenomics, thereby elevating the discourse beyond the banalities of market speculation. Such a move inevitably redefines the epistemology of value within decentralized networks, compelling issuers to reconcile their operational models with macro‑economic imperatives. While critics decry this as stifling innovation, the nuanced reality is that a calibrated framework can foster sustainable growth and institutional legitimacy. In this light, the MiCA initiative should be viewed not as an obstacle but as a catalyst for the maturation of digital finance.

Anthony R

November 21, 2024 AT 13:40It is vital, dear participants, to maintain meticulous records of all stablecoin transactions; the EU mandates that each movement be logged with precise timestamps, asset identifiers, and counterpart details; any deviation from this protocol could trigger supervisory scrutiny, which may culminate in substantial penalties; therefore, implementing automated logging solutions is highly advisable; ensure that your compliance team conducts regular audits to verify adherence to these stringent reporting obligations; by doing so, you safeguard both your operation and your clientele against regulatory repercussions.

Vaishnavi Singh

November 21, 2024 AT 14:30The tension between regulatory order and financial freedom invites a deeper contemplation of how trust is constructed in the digital age.

Kevin Fellows

November 21, 2024 AT 15:20Thanks for the rundown, Angela – definitely helpful for getting my head around the whole thing.