There’s no such thing as a legitimate crypto exchange called Colodax. Not in any meaningful, verifiable way. If you’ve seen ads, comparison charts, or review sites touting Colodax as a "highly reputable" platform with "cutting-edge security," you’re being misled. These aren’t real reviews-they’re SEO spam, copied word-for-word across low-quality websites, designed to trick people into clicking links that lead nowhere or worse, into handing over their crypto.

Colodax Doesn’t Exist as a Real Exchange

No one can find Colodax on any official crypto directory, regulatory database, or trusted review platform. It doesn’t appear on CoinMarketCap, CoinGecko, or CryptoCompare-the three main sources for tracking legitimate exchanges. No one has posted about it on Reddit’s r/CryptoCurrency or Bitcoin Talk. No user reviews exist on Trustpilot or Sitejabber. If a platform handles billions in trades like Binance or Coinbase, people talk about it. Colodax? Silence.The Marketing Lies Are Too Generic to Be Real

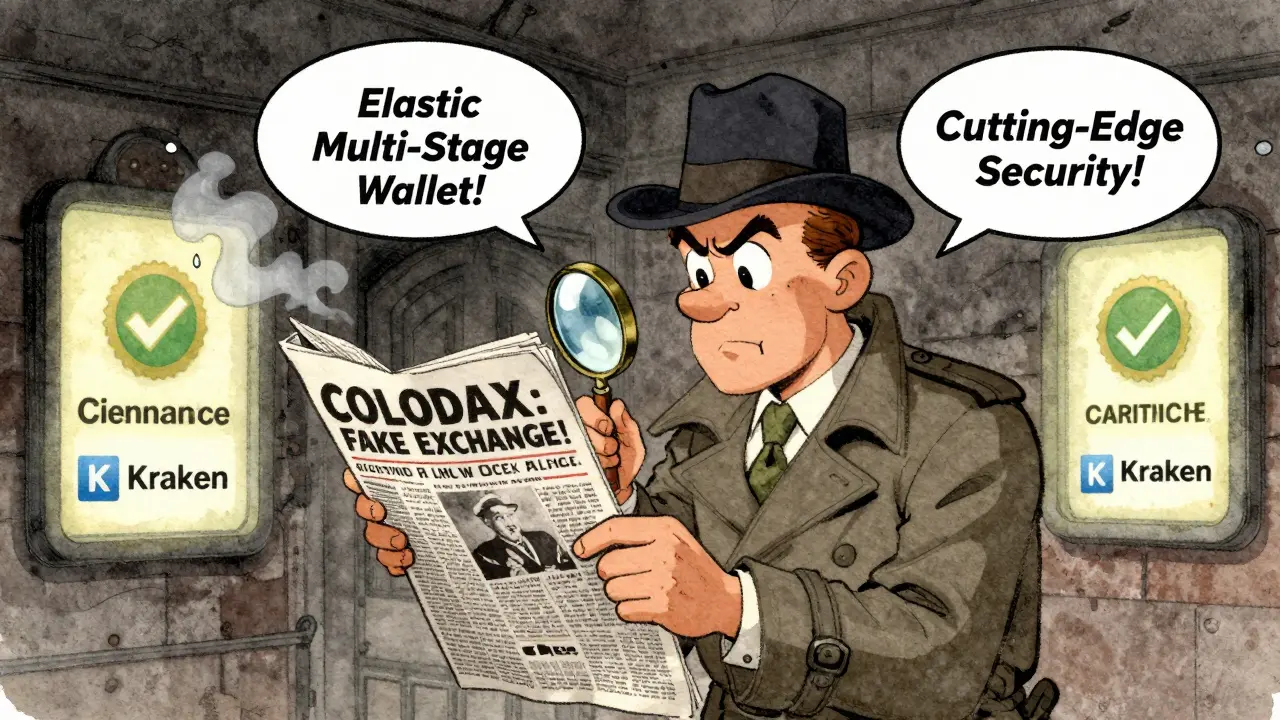

The same phrases keep popping up on shady comparison sites: "Colodax employs the most reliable, effective security technologies available," "elastic multi-stage wallet strategy," "two-factor authentication for all users." These sound impressive-but they’re empty buzzwords. Real exchanges don’t talk like this. They say: "We store 98% of funds in cold storage," "We’ve been audited by Kudelski Security," "Our withdrawal whitelist blocks unauthorized transfers." Colodax offers none of that. No audit reports. No technical specs. No proof of anything.Security Claims Are Just Words

Security is the #1 thing you need from a crypto exchange. Colodax claims to have it-but gives zero details. Does it support TOTP (Google Authenticator) or SMS? SMS is weak and easily hacked. Does it use multi-party computation (MPC) for wallet security? Does it have insurance for user funds? No answers. Legitimate exchanges publish this stuff openly. Kraken releases monthly proof-of-reserves. Coinbase discloses its cold storage ratios. Colodax? Nothing. That’s not privacy-that’s evasion.No Regulatory Footprint, No Legal Protection

Legitimate exchanges register with financial authorities. Coinbase has a BitLicense in New York. Kraken is registered with FinCEN. Binance has licenses in multiple countries. Colodax? No registration. No compliance documents. No public legal entity. If a platform isn’t regulated, you have zero legal recourse if it vanishes. And yes-fake exchanges disappear all the time. They call themselves "Colodax," build a slick-looking website, collect deposits, then shut down overnight. That’s called an exit scam. And Colodax fits the profile perfectly.

Who’s Behind These Fake Reviews?

The same generic Colodax description appears on Slashdot, SourceForge, and a handful of other low-authority sites. All use identical language. All lack any real data. All link to the same mysterious website. This isn’t coincidence. This is a coordinated SEO scam. Someone created a fake exchange name, wrote a few buzzword-filled paragraphs, and dumped them across dozens of sites to rank for "Colodax review" and similar searches. The goal? Drive traffic to affiliate links or phishing pages. You think you’re reading a review. You’re actually clicking on an ad.What You Should Do Instead

If you’re looking for a safe place to trade crypto, stick to platforms with real track records:- Coinbase: Regulated in the U.S., insured custodial wallets, transparent audits

- Kraken: Public proof-of-reserves since 2021, strong security team, no history of breaches

- Binance: Highest trading volume globally, though complex regulatory status

- Bitstamp: One of the oldest exchanges, based in Europe, fully licensed

Red Flags That Colodax Is a Scam

Here’s a quick checklist. If Colodax (or any exchange) matches even one of these, walk away:- No verifiable company address or legal registration

- No third-party security audit reports

- No user reviews on Trustpilot, Reddit, or independent forums

- Generic marketing language with no specifics

- Only appears on comparison sites, not official crypto trackers

- Website looks too clean, too perfect-no typos, no real contact info

- Offers unusually high yields or "guaranteed" returns

Why This Matters

Crypto scams cost users over $3.5 billion in 2024 alone, according to Chainalysis. Fake exchanges like Colodax are among the most common. People lose life savings because they trusted a name they saw on a Google ad. No one wakes up thinking, "I’ll invest in a crypto exchange with zero public data." But they do it because the website looks professional, the language sounds smart, and the reviews seem real. Don’t let that happen to you.How to Spot a Fake Crypto Exchange

Always verify before you deposit:- Search the exchange name + "scam" or "review" on Google. Look for independent sources, not affiliate sites.

- Check CoinMarketCap or CoinGecko. If it’s not listed, it’s not legitimate.

- Look for regulatory licenses. Go to the official site of the regulator (like FinCEN or FCA) and search for the company name.

- Search for security audits. Type the exchange name + "Kudelski" or "CertiK" or "PeckShield"-if nothing comes up, skip it.

- Join a crypto subreddit. Ask if anyone has used it. Real users will warn you.

Final Warning

Colodax is not a crypto exchange. It’s a digital ghost. A marketing illusion. A trap disguised as an opportunity. If you’ve already sent crypto to Colodax, you’ve likely lost it. There’s no customer service to call. No refund process. No legal recourse. The only thing you can do now is learn from it.Never trust a platform that hides behind buzzwords. Always demand proof. Always verify. And if something sounds too good to be true-especially in crypto-it almost always is.

Is Colodax a real crypto exchange?

No, Colodax is not a real crypto exchange. There is no verifiable evidence it operates as a legitimate platform. It doesn’t appear on trusted crypto directories like CoinMarketCap or CoinGecko, has no regulatory registration, no security audit reports, and no user reviews on credible platforms. All references to Colodax come from SEO-generated content designed to mislead users.

Why do some websites say Colodax is reputable?

Those websites are part of an SEO scam. They copy the same fake description across multiple low-quality sites to rank higher in search results. The goal is to drive traffic to affiliate links or phishing pages. These aren’t real reviews-they’re paid promotions disguised as impartial advice. Legitimate exchanges don’t need to buy fake reviews.

Can I trust Colodax’s security claims?

No. Colodax claims to use "two-factor authentication" and an "elastic multi-stage wallet strategy," but provides zero technical details. Real exchanges specify which 2FA methods they support (TOTP, hardware tokens), publish cold storage ratios, and release third-party audit results. Colodax offers none of this. These are empty phrases designed to sound secure without actually being secure.

Has Colodax ever been audited by a security firm?

There is no public record of Colodax undergoing any security audit by reputable firms like Kudelski Security, CertiK, or PeckShield. Legitimate exchanges proudly display audit reports. Colodax doesn’t. This absence is a major red flag. Without audits, there’s no way to verify their security claims-or protect your funds.

What should I do if I already sent crypto to Colodax?

If you’ve sent crypto to Colodax, assume it’s gone. There is no customer support, no refund policy, and no legal recourse. Crypto transactions are irreversible. The best action now is to report the site to your local financial regulator and warn others. Never send funds to any platform without verifying its legitimacy first.

What are safer alternatives to Colodax?

Stick to well-established exchanges with transparent operations: Coinbase, Kraken, Bitstamp, and Binance (depending on your region). These platforms are regulated, publish security audits, offer insurance on custodial funds, and have years of user history. Always verify an exchange is listed on CoinMarketCap or CoinGecko before depositing any funds.

Are there any official Colodax apps or websites?

There is no official Colodax website or app. Any site claiming to be Colodax is fake. These sites often use domain names that look similar to real ones (e.g., colodax.io, colodax.exchange) to trick users. Always double-check the URL and avoid clicking on ads or search results that promise "top-rated" or "best" exchanges without proof.

Jerry Ogah

January 28, 2026 AT 17:01Colodax is a total scam and anyone who falls for it deserves to lose their crypto. I’ve seen these fake review farms pop up every few months-same template, same buzzwords, same phishing links. People just don’t check anything anymore. It’s embarrassing.

Stop trusting Google ads. Stop trusting ‘top-rated’ labels. Start doing your own homework. It’s not hard.

And if you’re reading this and you already sent funds? You’re not alone. But you’re also not getting it back. Welcome to crypto.

Now go delete that bookmark.

Andrea Demontis

January 29, 2026 AT 14:40What’s fascinating about Colodax isn’t just that it’s fake-it’s how perfectly it mirrors the psychological architecture of modern digital deception. The language is engineered to trigger cognitive ease: long, polysyllabic phrases like ‘elastic multi-stage wallet strategy’ sound authoritative because they mimic the cadence of technical jargon without substance. We’ve been conditioned to equate complexity with credibility.

Real security is transparent, granular, and humble. It says ‘we use cold storage’ not ‘we employ cutting-edge technologies.’ The absence of specifics is the specificity. The silence is the signal.

This isn’t just a scam. It’s a cultural symptom. We live in an attention economy where trust is commodified, and the most dangerous lies are the ones that sound like truth wrapped in a professional font.

And yet-we still click. We still trust the polish. We still ignore the void behind the UI. That’s the real tragedy here.

Joseph Pietrasik

January 29, 2026 AT 17:33Raju Bhagat

January 31, 2026 AT 10:56Bro seriously this is so sad to see. I’ve had friends lose everything to these fake exchanges. One guy sent 5 BTC to a site that looked exactly like Binance-same logo, same colors, even the same ‘2FA’ button. He thought he was safe.

Now he’s working double shifts just to get back on his feet. I told him ‘trust the process, not the pretty website’ but he didn’t listen.

People need to wake up. Crypto isn’t magic. It’s math. And math doesn’t lie. But people? Oh they lie like crazy.

Stay safe fam. Always verify. Always double check. And if you’re new? Stick to Coinbase. Period.

laurence watson

February 1, 2026 AT 21:27I just want to say thank you for writing this. I’ve been trying to explain this to my cousin for weeks-he kept saying ‘but the website looks so legit!’ and I didn’t know how to make him see it.

This breakdown is perfect. I’m sharing it with him right now. No jargon, no condescension, just facts. That’s what people need.

Also, the checklist at the end? Print that out. Tape it to your monitor. I wish I had when I started.

You’re doing good work here.

Elizabeth Jones

February 2, 2026 AT 02:02The structural failure here is not merely technical-it’s epistemological. We have outsourced our verification mechanisms to algorithms, search engines, and aesthetic cues, assuming that surface-level professionalism implies legitimacy. Colodax exploits this cognitive shortcut with surgical precision.

Legitimate exchanges do not need to manufacture credibility; they earn it through transparency, accountability, and time. The absence of these markers is not an oversight-it is a diagnostic feature.

Furthermore, the replication of identical content across low-authority domains is not coincidental but algorithmically orchestrated. This is not spam-it is a coordinated disinformation campaign targeting financial illiteracy.

Our collective failure is not in being deceived, but in failing to teach others how to recognize deception before it’s too late.

Pamela Mainama

February 3, 2026 AT 06:13