Bitstamp Trading Fee Calculator

Calculate Your Bitstamp Trading Fee

Your estimated trading fee will be $0.00 (0.00%)

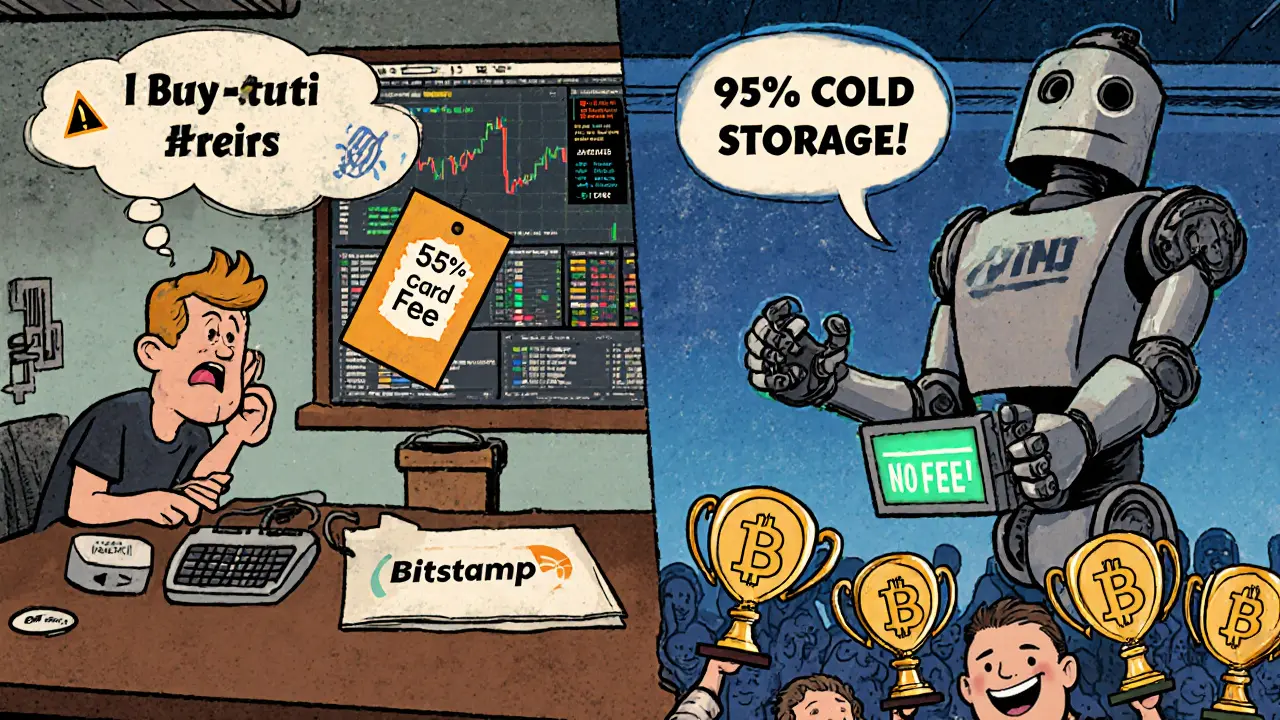

Note: Card purchases incur 5% + $0.50 fee, which is significantly higher than these calculated trading fees.

When you’re looking for a crypto exchange that doesn’t feel like a gamble, Bitstamp comes up often. It’s not the flashiest platform, and it doesn’t have the most coins. But if you care about safety, clear rules, and not getting hacked, Bitstamp has been around long enough to prove it can deliver.

One of the Oldest, Still Standing

Bitstamp started in 2011, back when Bitcoin was still under $100 and most people thought crypto was a weird internet experiment. Founded in Slovenia and later moved to Luxembourg for better regulation, it’s one of the few exchanges that survived the 2014 Mt. Gox collapse, the 2018 bear market, and the 2022 Terra crash. As of 2025, it serves over 4 million users globally, with 1.2 million of them based in Europe. That’s not just luck - it’s a track record.Regulation That Actually Matters

Most exchanges talk about compliance. Bitstamp does it. It holds a BitLicense from New York’s financial regulators - a rare credential that only a handful of exchanges have. It’s also fully licensed across 32 European Economic Area countries. This isn’t just for show. It means they’re audited annually by Big 4 accounting firms, follow strict anti-money laundering rules, and keep customer funds separate from company money. In a market full of exchanges that vanish overnight, Bitstamp’s regulatory backbone is its biggest strength. According to a Deloitte survey of 2,000 European crypto users in Q3 2025, Bitstamp ranked as the 3rd most trusted exchange in the region - behind only Coinbase and Kraken.Security: Cold Storage and No Major Breaches Since 2015

In 2015, Bitstamp got hacked. 19,000 Bitcoin were stolen - about $5 million at the time. It was a major blow. But here’s what matters: they didn’t disappear. They rebuilt. Today, 95% of all customer funds are stored offline in cold wallets. The rest are kept in hot wallets with multi-signature access and real-time monitoring. They’re SOC2 Type 2 certified, which is the gold standard for data security in fintech. Compare that to exchanges that brag about “insurance” but never show proof. Bitstamp doesn’t just say they’re secure - they prove it with audits, certifications, and a decade-long clean record since the breach.Trading Options: Fewer Coins, But Clean Execution

Bitstamp offers 82 cryptocurrencies as of October 2025. That includes Bitcoin, Ethereum, Litecoin, and Bitcoin Cash - the big ones. But if you’re chasing Solana, Cardano, or Dogecoin, you’ll be disappointed. They’ve been slow to add new coins. In fact, one user on Trustpilot complained it took 18 months for Dogecoin to appear. That’s changing. In August 2025, Bitstamp announced plans to add 15 new tokens by Q1 2026, including Solana and Polygon. That’s a direct response to user demand. But for now, their selection is thin compared to Coinbase (250+ coins) or Binance (500+). For trading, you get two interfaces: the simple Bitstamp app for beginners, and Bitstamp Pro for advanced users. Pro offers real-time charts, limit orders, stop-losses, and API access - perfect for traders who need more control. The mobile apps are solid, rated 4.8/5 on iOS and 4.6/5 on Android with over 50,000 combined reviews.

Fees: Fair for Volume, High for Cards

Bitstamp’s fee structure is tiered based on your 30-day trading volume:- Under $10,000: 0.5% per trade

- $10,000-$50,000: 0.4%

- $50,000-$100,000: 0.3%

- $100,000-$1 million: 0.2%

- Over $15 million: 0%

No Staking, No Earnings - A Big Gap

Here’s where Bitstamp falls behind. You can’t earn interest. You can’t stake your Ethereum or Cardano. There’s no yield program. Not even for non-U.S. users - yet. Platforms like Crypto.com offer up to 14.5% APY on some coins. Coinbase lets you stake 20+ assets. Bitstamp? Nothing. That’s a serious drawback in 2025, when earning passive income from crypto is standard. The good news? Bitstamp is developing staking for five major coins, targeting a Q2 2026 launch - but only for non-U.S. customers. U.S. users will still be left out.Customer Support: Slow, But Available

Bitstamp doesn’t have live chat. That’s a problem. According to Trustpilot, 37% of negative reviews mention the lack of instant help. You get email and phone support - available 24/7 - but response times vary. During market spikes, Business Insider found email replies took an average of 14 hours. The good part? The KYC process is fast. Most users get verified in under 2.5 hours. One user reported being approved in just 2 hours with a government ID and a selfie. That’s faster than most exchanges.

The Robinhood Acquisition: What It Means

In June 2025, Robinhood bought Bitstamp for $200 million. This wasn’t just a cash grab - it’s a strategic move. Robinhood needed a regulated European platform to expand globally. Bitstamp needed funding to catch up on product features. Analysts think this is a win. Bitstamp now has access to Robinhood’s tech team, customer support infrastructure, and capital to build staking, DeFi integrations, and more coins. If they execute, this could be the turning point. If they don’t, they risk becoming a relic - a safe but outdated platform for Europeans who don’t care about innovation.Who Is Bitstamp For?

Bitstamp isn’t for everyone. If you want the most coins, the lowest fees, or passive income - look elsewhere. But if you’re:- Based in Europe or the U.S. and want a regulated exchange

- Worried about security and want a platform with a real track record

- Trading larger amounts and can handle the fees

- Not interested in staking or DeFi right now

What’s Next?

Bitstamp’s future hinges on two things: adding more coins and launching staking. If they deliver on their 2026 roadmap, they’ll move from “reliable but limited” to “reliable and competitive.” If they delay or underdeliver, they’ll stay stuck in a niche - loved by cautious investors, ignored by the rest. For now, it’s a solid, no-nonsense exchange. Not the best, but one of the most trustworthy.Is Bitstamp safe to use in 2025?

Yes. Bitstamp is one of the safest crypto exchanges in the world. It stores 95% of user funds in cold storage, undergoes annual audits by Big 4 accounting firms, holds SOC2 Type 2 certification, and is licensed in New York and across 32 European countries. It hasn’t had a major security breach since 2015, and its regulatory compliance is among the strongest in the industry.

Does Bitstamp support staking or earn interest on crypto?

Not yet - but it’s coming. As of October 2025, Bitstamp does not offer staking or yield programs for any users. However, the platform announced in August 2025 that it plans to launch staking for five major cryptocurrencies (like Ethereum and Solana) in Q2 2026, though only for non-U.S. customers. U.S. users will still not have access to earning features.

What cryptocurrencies can I trade on Bitstamp?

As of October 2025, Bitstamp supports 82 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and Ripple (XRP). It does not currently support Solana, Cardano, Dogecoin, or many newer altcoins - though 15 new tokens are planned for addition by Q1 2026.

How much are Bitstamp’s trading fees?

Bitstamp uses a volume-based fee structure: 0.5% for trades under $10,000, dropping to 0% for users trading over $15 million per month. Card purchases cost 5% plus $0.50 per transaction. Bank withdrawals are free, and U.S. users get instant ACH deposits. Compared to Kraken or Coinbase, Bitstamp’s fees are higher for small traders but competitive for high-volume users.

Can I use Bitstamp if I live in the U.S.?

Yes. Bitstamp is one of the few crypto exchanges legally allowed to operate in New York thanks to its BitLicense. U.S. users can deposit via ACH, withdraw up to $50,000 per transaction, and trade the same 82 cryptocurrencies as international users. However, U.S. users won’t get access to upcoming staking features, and some services may be limited compared to European accounts.

How long does account verification take on Bitstamp?

Bitstamp’s verification process is fast. According to its September 2025 transparency report, 98.7% of accounts are verified within 24 hours, with an average time of just 2.3 hours. You’ll need a government-issued photo ID and proof of address. Many users report approval in under two hours.

Does Bitstamp have live chat support?

No. Bitstamp does not offer live chat support. You can reach customer service via email or phone, 24/7. However, response times can be slow - Business Insider’s 2025 test found email replies took an average of 14 hours during periods of high market volatility. The lack of live chat is a common complaint among users.

Is Bitstamp better than Coinbase?

It depends. Bitstamp is more regulated and has better security transparency, but Coinbase offers more coins (250+), staking, and better customer support with live chat. If you prioritize safety and compliance, Bitstamp wins. If you want more coins, earning options, and faster support, Coinbase is better. For European users, Bitstamp often has lower fees and smoother Euro deposits.

Kirsten McCallum

October 29, 2025 AT 20:37Safe? Sure. Boring? Absolutely.

Will Barnwell

October 31, 2025 AT 10:07They still don't have staking? In 2025? That's not safe, that's just lazy. If you're not earning yield, you're losing to inflation. This place is a museum with a trading interface.

Lawrence rajini

November 1, 2025 AT 21:01Bitstamp is the grandma of crypto exchanges 😅 Safe, reliable, and still wears socks with sandals. But hey, if you want to sleep at night? This is your guy. Just don't expect fireworks.

Cory Munoz

November 2, 2025 AT 04:20I’ve used Bitstamp since 2017. It’s not flashy, but I’ve never lost sleep over my funds. The lack of live chat sucks, but their email support eventually answers. And after everything that’s happened in crypto? That’s worth something.

Jasmine Neo

November 4, 2025 AT 00:27U.S. users get locked out of staking again? Classic. Robinhood bought them to kill innovation, not enable it. This isn't a crypto exchange-it's a compliance zoo with a UI. And 5% card fees? That's robbery with a European passport.

Ron Murphy

November 5, 2025 AT 19:48Regulatory depth is their real asset. Most platforms pretend to be compliant. Bitstamp actually is. That’s why I use them for EUR deposits-no delays, no surprises. The coin list is weak, but I don’t need 500 tokens to trade BTC and ETH.

Nick Cooney

November 7, 2025 AT 11:56They added Dogecoin after 18 months? That’s not slow-that’s a statement. Like, ‘we don’t care about memes, we care about audits.’ Respect. But also… kinda sad.

Clarice Coelho Marlière Arruda

November 8, 2025 AT 02:33bitstamp is the only exchange i've ever used where i didn't feel like i was playing russian roulette with my crypto 😅 verified in 2 hours, no drama. fees are high for small buys but who cares if your money's safe?

Brian Collett

November 8, 2025 AT 05:43Anyone else think Robinhood’s acquisition is the best thing that could’ve happened? They’ve got the cash to fix the staking gap and add coins. Bitstamp’s like a vintage car-needs a tune-up, not a replacement.

Allison Andrews

November 9, 2025 AT 16:39There’s a philosophical tension here: safety versus participation. Bitstamp chooses safety, which means excluding the speculative, the innovative, the speculative. Is that wisdom-or stagnation? I’m not sure anymore.

Wayne Overton

November 10, 2025 AT 16:06Why are you still using this? Just move to Kraken. Fees are lower, staking is live, and you won’t feel like you’re using a 2015 app.

Alisa Rosner

November 11, 2025 AT 09:02BITSTAMP IS MY SAFE SPACE 🥺 I don't care if it's slow or boring-I've had coins stolen before. This place feels like my bank. Also, their app is so clean, it gives me peace. 10/10 for anxiety-free trading!

MICHELLE SANTOYO

November 13, 2025 AT 03:27They’re not dead-they’re in witness protection. Robinhood bought them to bury the truth: that regulation kills innovation. Now they’ll ‘launch staking’ in 2026… just like they said in 2023. Classic.

Lena Novikova

November 14, 2025 AT 06:2995% cold storage? Cool. But if you're not earning yield you're just holding cash in digital form. And 5% card fees? That's not a fee that's a punishment. Stop using cards if you can't afford it.

Olav Hans-Ols

November 14, 2025 AT 20:20Look, I get it-Bitstamp’s not sexy. But in crypto, being boring is a superpower. I’ve watched 10 exchanges vanish. Bitstamp? Still here. Still audited. Still not trying to be the next FTX. That’s worth a little extra fee.

Kevin Johnston

November 16, 2025 AT 15:00Bitstamp = crypto’s reliable best friend 🤝 No drama, no hype, just keeps the lights on. Staking coming soon? Good. But even without it? I’d still choose them over 90% of the rest.

jummy santh

November 17, 2025 AT 03:00As a Nigerian user, I appreciate Bitstamp’s regulatory clarity. In Africa, where crypto is often viewed with suspicion, having a platform audited by Big Four firms and licensed across 32 EEA countries is not just comforting-it is a lifeline. The fees are steep, yes, but when your transaction could vanish overnight due to unregulated platforms, safety is not a luxury-it is survival. I await staking with cautious optimism, hoping the U.S. exclusion is not a permanent wound.

Prateek Kumar Mondal

November 17, 2025 AT 23:07Bitstamp is not for the young and greedy. It is for the patient and wise. I have held BTC here since 2019. No drama. No hacks. No panic. The future is not about speed. It is about staying. And Bitstamp stays.

Henry Gómez Lascarro

November 18, 2025 AT 06:45Let’s be real-Bitstamp survived because it was too slow to die. They didn’t innovate, they just didn’t get hacked. And now Robinhood’s buying them to turn them into a regulatory puppet? This isn’t progress-it’s institutional capture. The whole crypto ecosystem is being strangled by compliance theater. If you’re not building DeFi, staking, or on-chain identity, you’re not part of the future. You’re just a glorified bank teller with a blockchain logo. And don’t get me started on the card fees-5% is a tax on stupidity. If you’re using a credit card to buy crypto, you shouldn’t be allowed to touch a wallet. This isn’t finance-it’s financial childcare.

Henry Gómez Lascarro

November 19, 2025 AT 15:58And let’s not pretend the ‘2026 staking launch’ means anything. They said they’d add Solana in 2024. Still not there. Robinhood’s tech team is busy optimizing their meme coin feed, not building secure staking contracts. This is just PR noise to make cautious investors feel better. Meanwhile, the real innovation is happening on decentralized protocols that don’t need a license to operate. Bitstamp isn’t the future. It’s the last breath of centralized crypto.