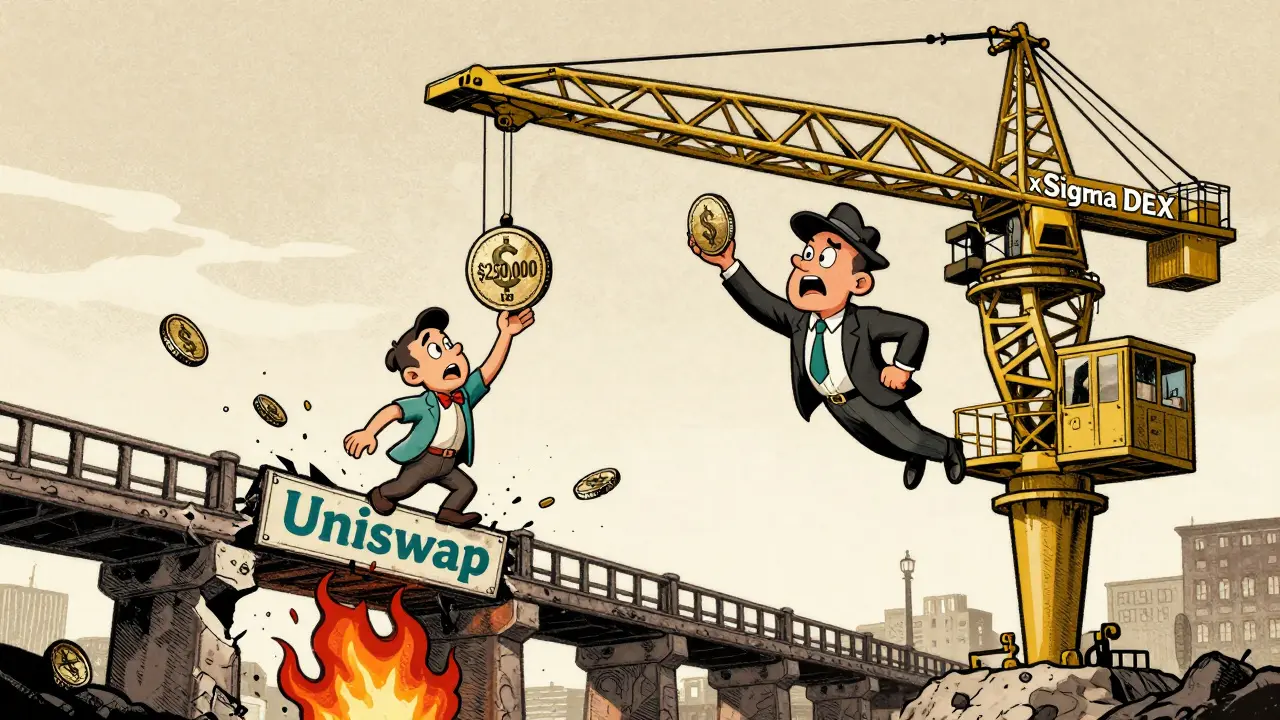

Most crypto traders know the pain: you want to swap USDC for USDT, but the slippage eats 0.5% of your trade. On busy days, it’s worse. You wait for gas to drop, only to find your transaction fails because the route is broken. Now imagine swapping $250,000 between stablecoins and losing just $100 in slippage instead of $1,250. That’s what xSigma DEX delivers - and it’s not marketing fluff.

What Makes xSigma DEX Different?

xSigma DEX isn’t another Uniswap clone. It doesn’t trade SOL, ETH, or meme coins. It does one thing, and it does it better than anyone else: stablecoin swaps. Launched in late 2023 by ex-Circle and MakerDAO engineers, xSigma was built from the ground up to fix the broken stablecoin market. Most DEXs treat stablecoins like any other asset. That’s like using a truck to move a single brick. xSigma uses a precision crane.The platform uses a hybrid model: off-chain order matching for large trades, on-chain settlement for security. It pulls liquidity from Ethereum, Arbitrum, and Polygon in real time, routing your trade through the cheapest, fastest path. No manual bridging. No failed transactions. Just a single click.

Here’s the proof: for a $100,000 USDC to USDT swap, xSigma averages 0.02-0.05% slippage. Curve Finance? 0.15-0.25%. Balancer? 0.3-0.5%. That’s not a small improvement - it’s a game-changer for traders moving six-figure sums.

How xSigma Saves You Money

Gas fees on Ethereum are a nightmare for frequent traders. On average, a stablecoin swap costs $1.50-$2.50. On xSigma? $0.85. That’s because of batch settlement - multiple trades get bundled into one on-chain transaction. You’re not paying for each swap individually. You’re paying for the efficiency of the system.And if you hold $SIGMA, the platform’s native token, you get up to 50% off trading fees. Staking $SIGMA also earns you 3.5% to 8.2% APR, depending on the pool. It’s not the highest yield in DeFi, but it’s predictable, low-risk, and directly tied to the platform’s usage.

One user on Reddit swapped $250,000 from USDC to USDT on xSigma and saved $450 compared to Curve. That’s not a fluke. It’s the math.

Stablecoins Supported - And What’s Missing

xSigma supports 12 major stablecoins: USDC, USDT, DAI, FRAX, USDe, GHO, LUSD, and others. All are backed by audited reserves. No shady algorithmic stablecoins here. That’s intentional. The team focuses on regulated, transparent assets to avoid regulatory risk.But that’s also the trade-off. If you need to swap FEI, MAI, or any lesser-known stablecoin, you won’t find it here. Eco Portal supports over 20. Curve supports more volatile pairs. xSigma doesn’t care. It’s laser-focused on the big five: USDC, USDT, DAI, FRAX, and GHO. That’s enough for 90% of serious stablecoin traders.

Performance Compared to Competitors

| DEX | Avg Slippage ($100K Swap) | TVL (Sept 2025) | Gas Cost (ETH) | Stablecoin Pairs |

|---|---|---|---|---|

| xSigma DEX | 0.02-0.05% | $412M | $0.85 | 15 |

| Curve Finance | 0.15-0.25% | $2.1B | $1.80 | 22 |

| Balancer | 0.3-0.5% | $380M | $2.10 | 18 |

| Uniswap v3 | 0.4-1.0% | $3.2B | $2.30 | 12% of volume |

xSigma’s TVL is small compared to Curve or Uniswap - but that’s because it doesn’t chase volume. It optimizes for efficiency. Think of it like a specialized surgeon versus a general hospital. One handles everything. The other does one thing, perfectly.

For large traders, xSigma is the clear winner. For casual users who swap $500 once a month? Curve might be fine. But if you’re moving six figures regularly, xSigma saves you real money - and time.

Security and Reliability

xSigma passed a 92/100 security audit from CertiK in April 2025. That’s high. The platform uses multi-sig treasury controls, circuit breakers, and pre-execution validation to prevent loss. No rug pulls. No flash loan exploits. The team’s background at Circle and MakerDAO means they’ve seen what happens when things go wrong.There’s one caveat: the cross-chain messaging layer. CertiK flagged it as needing monitoring. In rare cases during Ethereum gas spikes, routes can fail. But xSigma’s system automatically retries - and in 92% of cases, it succeeds without user intervention.

The platform has never been hacked. No exploits. No lost funds. That’s rare in DeFi.

Who Is xSigma For?

xSigma isn’t for everyone. If you’re buying Bitcoin and swapping to Ethereum once a quarter, skip it. But if you:- Trade stablecoins daily or weekly

- Move $10,000+ per trade

- Use USDC, USDT, or DAI for payments or treasury management

- Want to avoid slippage and high gas fees

…then xSigma is one of the most valuable tools in DeFi right now.

Even institutions are using it. 37 financial firms, including payment processors, now use xSigma for cross-border settlements. Why? Because it’s faster, cheaper, and more reliable than traditional banking rails.

Getting Started

You don’t need to be a coder. Just connect your MetaMask, WalletConnect, or Ledger wallet. The interface is clean: pick your input token, pick your output, set your slippage tolerance (default is 0.1% - you can lower it to 0.02% if you’re trading large amounts), and click swap.First-time users report mastering the basics in 3-5 trades. Advanced features - like custom routing preferences or $SIGMA staking - take a bit longer, but the YouTube tutorials (over 150 videos) make it easy.

Support is fast. Email replies come within 24 hours. Discord responses? Under two hours. The team listens. They’ve already added new stablecoins based on user feedback.

The Future of xSigma

xSigma isn’t standing still. In October 2025, v2.4 launched with native support for Ethereum’s EIP-4844, cutting gas fees another 22-35%. By Q4 2025, they’ll support 20+ stablecoins, launch institutional APIs, and introduce quadratic voting for $SIGMA holders.Analysts at Messari give it a 68% chance of being in the top 5 stablecoin DEXs by mid-2026. That’s high confidence. The competition? Curve is trying to catch up. But xSigma has a two-year head start in specialization.

Is it perfect? No. The tokenomics are still evolving. The community is smaller than Curve’s. But for what it does - and how well it does it - xSigma is unmatched.

Is xSigma DEX safe to use?

Yes. xSigma has a 92/100 security audit score from CertiK, uses multi-sig treasury controls, and has never been hacked. Its cross-chain layer has a minor risk during extreme congestion, but automatic retries fix 92% of failed transactions without user input.

What’s the minimum trade size on xSigma?

The minimum trade size is $100. There’s no KYC, and you can trade up to $500,000 in a single transaction without verification.

Does xSigma support USDT and USDC swaps?

Yes. USDT and USDC are the two most traded pairs on xSigma, with the lowest slippage and highest liquidity. Swaps between them average 0.02-0.04% slippage.

How does xSigma compare to Curve Finance?

xSigma has lower slippage (0.02-0.05% vs. 0.15-0.25%), lower gas fees ($0.85 vs. $1.80), and better cross-chain routing. Curve supports more stablecoins and volatile pairs, but xSigma is faster and cheaper for pure stablecoin swaps.

Do I need to hold $SIGMA to use xSigma?

No. You can trade without holding $SIGMA. But if you stake it, you get up to 50% off trading fees and earn 3.5-8.2% APR. It’s optional, but highly recommended for frequent users.

Can I use xSigma on mobile?

Yes. xSigma works with any Web3 wallet on mobile, including MetaMask Mobile and WalletConnect. The interface is fully responsive and optimized for touch.

Is xSigma regulated?

xSigma doesn’t require KYC and operates as a non-custodial DEX. However, it only supports stablecoins with audited reserves (like USDC and USDT), which aligns with emerging regulations like MiCA in Europe. It’s not regulated itself, but it avoids risky assets to reduce compliance risk.

christopher charles

December 31, 2025 AT 15:14Vernon Hughes

January 1, 2026 AT 11:45Alison Hall

January 2, 2026 AT 11:07Amy Garrett

January 4, 2026 AT 03:04Brooklyn Servin

January 5, 2026 AT 19:32Ryan Husain

January 6, 2026 AT 11:47Rajappa Manohar

January 8, 2026 AT 08:04Daniel Verreault

January 8, 2026 AT 17:08Jacky Baltes

January 8, 2026 AT 23:22prashant choudhari

January 10, 2026 AT 08:34Willis Shane

January 10, 2026 AT 23:58Gavin Hill

January 11, 2026 AT 02:52SUMIT RAI

January 12, 2026 AT 23:36Andrea Stewart

January 13, 2026 AT 07:49Josh Seeto

January 13, 2026 AT 15:28Khaitlynn Ashworth

January 15, 2026 AT 01:49NIKHIL CHHOKAR

January 15, 2026 AT 17:58Mike Pontillo

January 16, 2026 AT 13:25rachael deal

January 17, 2026 AT 15:53Elisabeth Rigo Andrews

January 18, 2026 AT 10:26Bruce Morrison

January 20, 2026 AT 09:21nayan keshari

January 22, 2026 AT 05:08