When you lose your private key, your cryptocurrency doesn’t vanish from the blockchain. It just becomes impossible to touch. Forever.

The Hard Truth: No One Can Help You

There’s no customer service line to call. No password reset button. No bank manager who can verify your identity and restore access. If you lose your private key - the 64-character string or 12-to-24-word recovery phrase that unlocks your wallet - your coins are gone. Not locked. Not frozen. Not temporarily inaccessible. Permanently lost. This isn’t a glitch. It’s by design. Bitcoin’s creator, Satoshi Nakamoto, built the system so that no central authority could interfere. That’s the whole point. Control belongs to whoever holds the key. No exceptions. No backdoors. Not even the people who built the network can recover it for you. AnchorWatch put it bluntly in January 2025: “If you lose the private keys that control your Bitcoin, no one else can access it. And no one can help you recover it - not the exchange.” That’s not a warning. That’s the rule.How Much Is Lost? $248 Billion and Counting

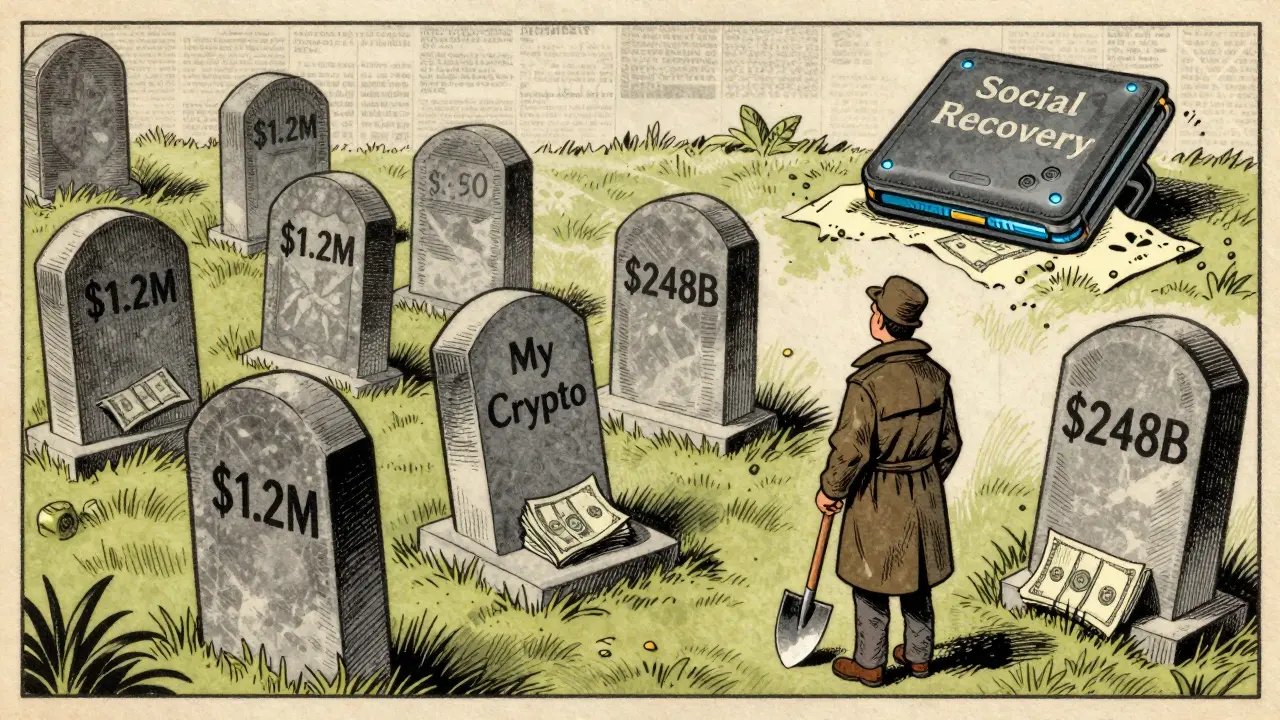

Chainalysis reported in 2024 that roughly 3.7 million BTC - worth about $248 billion as of January 2026 - is permanently locked away because someone lost the key. That’s more than the GDP of most countries. And it’s growing. These aren’t just speculative investors. They’re doctors, teachers, retirees, and entrepreneurs who trusted their savings to crypto without understanding how it works. Some deleted their wallet file by accident. Others wrote down their recovery phrase and lost the paper. A few forgot the password to their hardware wallet. One Reddit user, ‘CryptoWidow2024,’ lost $1.2 million after her husband died without telling her where the keys were stored. The money is still on the blockchain. You can see it. You can track every transaction. But without the key, it’s like having the combination to a safe that no one else knows - and you’ve forgotten it.Private Keys vs. Passwords: Why This Is Different

Think about your email or bank account. If you forget your password, you click “Forgot Password,” answer a security question, get an email, and you’re back in. That’s because those systems are centralized. Someone holds the keys - literally. Crypto is the opposite. There’s no central server. No middleman. Your wallet doesn’t “belong” to Coinbase, MetaMask, or Ledger. It belongs to the key. If you lose that key, the system treats you like a stranger. Even if you’re the original owner. And here’s the kicker: you can’t even prove you’re the owner. Blockchain doesn’t store your name, your ID, or your birthdate. It only records public addresses and signatures. If you can’t sign a transaction with the right private key, you’re not recognized as the owner. Period.What’s the Difference Between Lost and Stolen?

Losing your key is not the same as having your crypto stolen. If someone hacks your wallet and transfers your funds, blockchain analysts can often trace the movement. Firms like Elliptic have a 92.7% success rate tracking stolen crypto, according to their 2025 report. Exchanges can freeze those addresses. Law enforcement can sometimes recover funds if they’re moved to a known exchange. But if you lose your key? There’s no trail. No transaction to reverse. No address to flag. The coins just sit there - untouched, unmovable, and invisible to everyone except the person who still has the key. Andreas Antonopoulos, a leading crypto educator, put it simply: “There is no such thing as a lost bitcoin, only lost private keys.” The bitcoin is still there. You’re just not the one who can use it anymore.

How Do People Actually Lose Their Keys?

Most people don’t get hacked. They just mess up. According to OSL Academy’s 2025 report:- 68.7% lost access by forgetting their recovery phrase or password

- 22.4% lost access due to hardware wallet failure - a broken device, water damage, or dead battery

- 8.9% lost access because they didn’t back up anything at all

What About Recovery Tools or Services?

There are companies that claim they can recover lost keys. They’ll ask for your wallet address, your transaction history, maybe even your device. They’ll charge you thousands of dollars. Then they disappear. These are scams. No tool, software, or service can brute-force a 256-bit private key. The number of possible combinations - 1.1579209 × 10^77 - is more than the number of atoms in the observable universe. Even if every computer on Earth worked together, it would take longer than the age of the universe to guess it. Some services promise “social recovery” - letting trusted friends or family help you regain access. That’s not magic. It’s just a smarter backup system. Wallets like Argent and Coinbase’s pilot program let you name 3-5 people who can help you reset your key, but only if you set it up before you lose access. If you didn’t plan for this, no service can fix it.How to Never Lose Your Key - The 3-2-1 Rule

The only way to avoid losing your crypto is to prepare. Here’s what works:- Three copies of your recovery phrase

- Two different media types - paper, metal, encrypted USB, encrypted cloud

- One stored offsite - safety deposit box, trusted friend’s house, buried in concrete

What If You’re the Only One Who Knows the Key?

This is the nightmare scenario: you die, or become incapacitated, and no one else knows your recovery phrase. There’s no legal process to force a blockchain to give you access. Courts can’t order Bitcoin to be unlocked. The Northwestern Journal of Technology and Intellectual Property (2023) calls this a “legal black hole.” People have tried to claim lost keys in inheritance cases. Courts often dismiss them - because there’s no way to prove the key ever existed. Professor Aaron Wright from Cardozo Law School suggests creating legal registries for crypto assets, similar to how car titles are tracked. But until that happens, your heirs have zero legal recourse. If you’re serious about leaving crypto to someone, write down the recovery phrase. Put it in a sealed envelope. Give it to your lawyer. Tell your family where to find it. Don’t rely on a password manager they don’t know about. Don’t hide it behind a puzzle. Be clear. Be direct.What’s Changing? And What Isn’t

New tools are coming. Social recovery wallets. Multi-party computation (MPC) wallets. Time-locked multi-sig setups. These make it easier to recover access - but only if you set them up ahead of time. Coinbase’s Key Recovery Service, launched in late 2025, helps institutional clients recover keys using a 3-of-5 signature system. But it’s not available to regular users. And even then, it’s not magic. It’s just better planning. Ethereum’s Vitalik Buterin pushed for social recovery in EIP-86 (2025). It’s a step forward. But it doesn’t change the core rule: if you don’t control the key, you don’t control the asset. Gartner predicts that by 2030, 95% of consumer wallets will have some kind of recovery feature. But the blockchain itself? It won’t change. It won’t add a “Forgot Key?” button. The system was built to be unbreakable. That includes unbreakable by the user, too.Final Warning: This Is Not a Game

Crypto isn’t like stocks or savings accounts. You can’t call your broker and say, “I think I lost my password.” There’s no safety net. No FDIC insurance. No customer support team with a 1-800 number. Losing your private key isn’t a mistake. It’s a catastrophe. And it’s permanent. If you’re holding crypto, you’re not just investing in a technology. You’re taking on the responsibility of being your own bank. And if you don’t treat your private key like your life’s most important document, you’re gambling with money that can never be recovered. The good news? You can avoid this. The bad news? Most people won’t. They’ll wait until it’s too late. And then they’ll ask, “Why didn’t anyone tell me?” Someone told you now.Can I recover my crypto if I lose my private key?

No. Once your private key is lost, there is no technical, legal, or human way to recover your cryptocurrency. The blockchain has no mechanism for password resets or account recovery. The funds remain on the network but are permanently inaccessible without the exact key or recovery phrase.

Is there any service that can help me recover a lost private key?

No legitimate service can recover a lost private key. Any company claiming to do so is running a scam. Private keys are protected by 256-bit encryption with over 10^77 possible combinations - more than the number of atoms in the observable universe. Brute-forcing is impossible, even with supercomputers. Avoid any service asking for payment, access to your wallet, or personal data - they will take your money and vanish.

What’s the difference between losing a private key and having crypto stolen?

If your crypto is stolen, the transaction can often be traced using blockchain analysis tools. Authorities or exchanges may freeze the funds if they’re moved to a known address. But if you lose your private key, there’s no transaction trail to follow - the funds are simply locked forever. No one can access them, not even you. Theft has a chance of recovery. Lost keys do not.

How do I properly back up my private key?

Follow the 3-2-1 rule: create three copies of your 12- to 24-word recovery phrase. Store them on two different physical media - like paper and metal - and keep one copy offsite, such as in a safety deposit box or with a trusted family member. Never store your recovery phrase digitally on your phone, computer, or cloud. Write it by hand. Engrave it. Protect it like your life depends on it - because in crypto, it does.

What happens to my crypto if I die without telling anyone my private key?

Your crypto becomes permanently inaccessible. There is no legal process to force a blockchain to release funds without the private key. Courts cannot compel access. Heirs have no recourse unless you’ve left clear, written instructions with the recovery phrase. Many people have lost millions this way. If you hold crypto, document your keys and tell someone you trust where to find them - in writing, not just verbally.

Anna Topping

January 21, 2026 AT 18:16So basically, crypto is like a vault you build yourself… and then forget the combination. And now the whole world can see your money sitting there, taunting you. I’m not even mad, just… impressed by how brutally elegant the failure mode is. 🤷♀️

Jeffrey Dufoe

January 22, 2026 AT 02:56I lost my keys once. Thought I had a backup. Didn’t. Now I just stick to exchanges. Less stress. More sleep. Not as cool, but I’m alive.

katie gibson

January 23, 2026 AT 22:29OMG. I just realized… I’m basically the main character of a tragic Netflix documentary right now. My crypto is out there. Watching me. Waiting. Like a ghost in the machine. I haven’t slept since I read this. My therapist is gonna kill me. 😭

Margaret Roberts

January 25, 2026 AT 13:38This is all a lie. The government already has backdoors. They just don’t want you to know. Why do you think they push this 'no recovery' nonsense? So you’ll keep buying more crypto and they can track you. Also, the blockchain is a CIA project. I know people who know people. They’re watching us right now. 😏

Tselane Sebatane

January 26, 2026 AT 18:21Let me tell you something, my friend. In my village in South Africa, we don’t have banks. We have elders. We have community. We have memory. You think crypto is the future? No. The future is knowing who to trust. Write your key on a stone. Give one copy to your sister. Bury one under the fig tree. Tell your children. That’s how you survive. Not tech. Not apps. People. 💪

Jonny Lindva

January 27, 2026 AT 06:54Hey, if you’re reading this and you’ve got crypto - stop scrolling. Go check your backups right now. Seriously. Open that drawer. Look at that envelope. Call your cousin. Don’t wait till it’s too late. You’ve got this. And if you need help setting up a 3-2-1 backup? I’ll walk you through it. No judgment. Just real talk.

Adam Lewkovitz

January 27, 2026 AT 16:26Americans think they can outsmart the universe with a USB stick. Meanwhile, real people in other countries still bury their gold. You lose your key? You deserve to lose your money. This isn’t a tech problem. It’s a lazy problem. Get a metal plate. Or don’t. I don’t care. But don’t cry when it’s gone.

Paru Somashekar

January 28, 2026 AT 08:03Dear All,

It is with profound respect for the cryptographic principles underlying blockchain that I must emphasize the absolute necessity of immutable key management. The 3-2-1 rule is not merely a recommendation-it is a non-negotiable standard of operational security. Please consider this a formal advisory from a practitioner of over a decade. Thank you.

With warm regards,

Paru Somashekar

Heather Crane

January 29, 2026 AT 10:47Okay, I’m crying. Not because I lost mine… but because I know someone who did. $1.2 million. Just… gone. And now I’m telling everyone I know. I’m posting this on Facebook. I’m texting my uncle. I’m screaming into the void. Please, please, please - if you have crypto, write it down. Don’t be cool. Don’t be ‘tech bro.’ Be safe. Be responsible. Your future self will thank you. ❤️

Chidimma Catherine

January 30, 2026 AT 12:28Melissa Contreras López

January 30, 2026 AT 12:50Okay, I’ve got a secret: I keep my recovery phrase on a metal plate… inside a waterproof case… inside a fake rock… in my garden. And I’ve told my dog. (He’s a good listener.)

But seriously - if you’re reading this and you haven’t backed up your keys yet… I believe in you. You’ve got the power to fix this. One step. One metal plate. One conversation with someone you love. You’re not alone.

Arielle Hernandez

January 31, 2026 AT 21:07The philosophical underpinnings of private key ownership reflect a radical epistemological shift in property theory: the transition from institutional custodianship to individual sovereignty. The blockchain, as a decentralized ledger, enforces ontological certainty - yet simultaneously renders the user’s epistemic failure irrevocable. Consequently, the loss of a private key constitutes not merely a technical mishap, but a metaphysical rupture in the social contract of digital ownership. This is not a bug; it is the feature.

Mathew Finch

January 31, 2026 AT 22:13Everyone’s acting like this is new. Newsflash: This is capitalism. You think the bank gives a damn about you? Nah. They’ll take your money, charge you fees, then laugh when you get scammed. Crypto just tells you the truth: you’re on your own. So stop whining. Get a metal key. Stop using your phone. And if you can’t handle that? Go back to your 401(k). We don’t need you here.