Key Takeaways

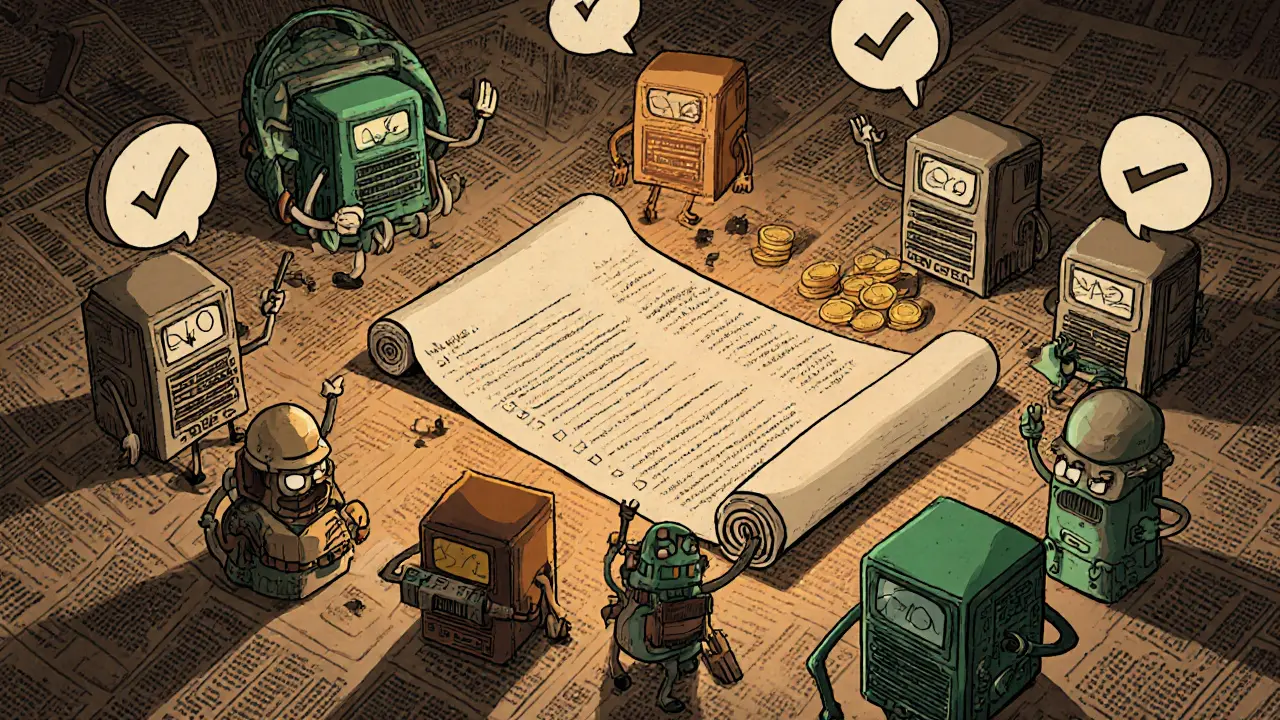

- Consensus mechanisms let distributed computers agree on the same data without a central boss.

- Proof of Work (PoW) trades energy for security; Proof of Stake (PoS) trades hardware for capital.

- Hybrid or delegated models boost speed but often give up some decentralization.

- Choosing the right mechanism depends on your priority: security, scalability, or decentralization.

- Regulations and energy costs are reshaping which mechanisms firms adopt.

Ever wondered how Bitcoin can keep track of every transaction without a bank? The answer lies in consensus mechanisms a set of rules that let a network of independent nodes agree on the state of a blockchain ledger. In plain English, they’re the game‑rules that make sure everyone sees the same “truth” on a distributed ledger. This guide walks through the most common mechanisms, why they matter, and how you can pick the right one for a project.

What Exactly Is a Consensus Mechanism?

At its core, a blockchain a tamper‑proof, append‑only ledger shared across many computers needs a way to decide which transactions are valid. Without a central authority, each node runs the same protocol and votes on the next block. When enough nodes agree, the block is added and the ledger moves forward.

Typical steps look like this:

- A node proposes a new block containing pending transactions.

- The block is broadcast to peers.

- Each peer validates the block against the network’s rules.

- Nodes cast a “vote” according to the specific consensus algorithm.

- If the required threshold is met, the block is sealed and becomes part of the permanent chain.

This process happened for the first time in Bitcoin’s whitepaper back in 2008, where Satoshi Nakamoto introduced Proof of Work a puzzle‑solving approach that requires miners to expend computational effort. Since then, dozens of new models have tried to improve on Bitcoin’s trade‑offs.

Proof of Work (PoW)

Proof of Work requires participants, called miners, to solve a cryptographic puzzle that costs electricity and hardware is the oldest and most battle‑tested. Bitcoin targets a 10‑minute block interval and, as of October 2023, the network churns through roughly 7.8 exahashes per second. That’s enough electricity to power a small country - Cambridge’s 2023 study puts Bitcoin’s annual draw at 121.49TWh, comparable to Greece.

Why do people still use PoW?

- Security: Attacking the network means buying enough hardware to out‑compute honest miners - an astronomically expensive proposition.

- Transparency: Every miner’s work is publicly verifiable.

- Permissionless entry: Anyone can start mining with the right equipment.

Downsides are obvious. Energy use is high, and transaction throughput stays low - roughly 7TPS (transactions per second). Miners also need specialized ASIC hardware that can cost up to $15,000 per unit.

Proof of Stake (PoS)

Proof of Stake chooses validators based on the amount of cryptocurrency they lock up as a security deposit flips the script: instead of expending electricity, participants lock capital. Ethereum’s switch to PoS on September152022 (the “Merge”) required a validator to stake 32ETH, roughly $51,200 at October2023 prices.

PoS shines in these areas:

- Energy efficiency: The Ethereum Foundation estimates a 99.95% drop in energy usage after the Merge.

- Higher throughput: Ethereum now processes around 1million daily transactions, far above Bitcoin.

- Lower barrier to entry for hobbyists: Staking pools let users participate with fractions of a full stake.

The trade‑off is that wealth can translate into influence. If a single entity gathers a huge stake, it could, in theory, dominate validation.

Delegated Proof of Stake (DPoS)

Delegated Proof of Stake lets token holders vote for a limited set of trusted delegates who produce blocks aims to combine speed with some degree of decentralization. Networks like EOS and TRON can hit 500‑1,000TPS, a huge jump from PoW’s single‑digit rates.

The catch? Only a handful of elected delegates produce blocks, so the system leans toward centralization. If delegates collude, the network could be compromised.

Other Notable Mechanisms

Beyond the big three, several niche models serve specific use cases.

- Ripple Consensus relies on a Unique Node List and needs an 80% super‑majority for validation. It settles 1,500TPS with 3‑5second finality but only works with permissioned validators.

- Stellar Consensus Protocol uses quorum slices and federated Byzantine agreement to achieve 1,000‑5,000TPS. Trust is built through business relationships rather than pure math.

- Practical Byzantine Fault Tolerance (PBFT) can tolerate up to one‑third malicious nodes while guaranteeing finality. Hyperledger Fabric adopts PBFT for enterprise settings.

These specialized protocols often sacrifice open‑access participation for speed, regulatory compliance, or predictable finality.

Comparing the Major Mechanisms

| Mechanism | Typical TPS | Energy Use | Decentralization | Typical Use‑Case |

|---|---|---|---|---|

| Proof of Work | ~7 | High (≈121TWh/yr for Bitcoin) | Very high | Value storage (e.g., Bitcoin) |

| Proof of Stake | ~30‑100 (layer‑2 can boost higher) | Low (≈0.05% of PoW) | High | Smart‑contract platforms (e.g., Ethereum) |

| Delegated PoS | 500‑1,000 | Low | Medium‑Low | High‑throughput dApps (e.g., EOS) |

| Ripple Consensus | 1,500 | Very low | Low (permissioned) | Cross‑border payments |

| Stellar SCP | 1,000‑5,000 | Very low | Low‑Medium (federated) | Asset tokenization |

| PBFT (e.g., Hyperledger) | ~10,000 (private networks) | Low | Low (permissioned) | Enterprise supply‑chain |

Notice how every mechanism leans toward two of the three blockchain trilemma pillars (security, decentralization, scalability) while compromising the third. That’s the core lesson from Vitalik Buterin’s trilemma framework.

How to Choose the Right Mechanism

If you’re building a new blockchain or picking a platform for a project, ask yourself these three questions:

- Do I need the highest possible security (e.g., storing billions of dollars)? If yes, PoW or a well‑audited PoS is safest.

- Is transaction speed the main value proposition (e.g., gaming, micro‑payments)? Then look at DPoS, Ripple, or Stellar.

- Do regulators or partners require permissioned access? PBFT‑based private ledgers might be the answer.

In practice, many enterprises adopt a hybrid model-using PoS for the public layer and PBFT for a private sidechain. Gartner predicts 70% of blockchain deployments will be hybrid by 2025.

Real‑World Experiences

Reddit user u/CryptoAnalyst89 reported cutting staking costs from $1,200 to $150 a month after Ethereum’s Merge, highlighting PoS’s economic upside. Contrast that with MinerDave on Bitcoin Talk, who shut down 60% of his ASIC fleet when Ontario’s electricity rates jumped 22% YoY. These anecdotes underline how energy prices can dictate which consensus model makes financial sense.

Enterprise surveys back this up: a 2022 Deloitte study found 55% of execs consider consensus choice a make‑or‑break factor. Meanwhile, the European Union’s MiCA regulation now forces PoS validators to register, adding compliance overhead that some firms prefer to avoid by using permissioned PBFT networks.

Future Trends

Research is moving fast. Stanford’s 2023 “Merge Consensus” paper showed a prototype that blends PoW’s security with PoS’s efficiency, achieving 99.99% fault tolerance with 90% less energy. On the performance side, Solana’s new Firedancer client aims for a million TPS, though recent outages remind us that pushing speed can hurt reliability.

Ethereum’s upcoming Dencun upgrade (expected Q12024) will add proto‑Danksharding, potentially multiplying data availability for rollups by ten‑fold. If rollups become the norm, PoS‑based chains could dominate the high‑throughput segment without sacrificing decentralization.

Bottom line: consensus mechanisms are evolving, but the core idea-getting many computers to agree without a boss-remains unchanged.

Quick Decision Checklist

- Prioritize security? → Proof of Work or audited Proof of Stake.

- Need thousands of TPS? → Delegated PoS, Ripple, Stellar, or a permissioned PBFT setup.

- Regulatory constraints? → Look at permissioned models and validator‑registration requirements.

- Budget for hardware vs. capital? → PoW = hardware spend; PoS = crypto stake.

- Long‑term sustainability goals? → PoS cuts energy use dramatically.

Frequently Asked Questions

What is the main difference between Proof of Work and Proof of Stake?

Proof of Work requires miners to solve computational puzzles, consuming a lot of electricity. Proof of Stake picks validators based on the amount of crypto they lock up, so the cost is mainly the capital you stake, not energy.

Can I run a validator on a laptop?

For most PoS networks you need a stable internet connection and enough RAM, but the hardware itself can be modest. Ethereum requires 32ETH, not a high‑end CPU.

Why do some blockchains use a permissioned consensus model?

Permissioned models like PBFT let enterprises guarantee transaction finality and meet compliance rules because only known participants can validate blocks.

Is a hybrid consensus model better than a pure one?

Hybrid designs try to get the best of both worlds - the security of PoW and the efficiency of PoS - but they add complexity. Whether they’re “better” depends on the project’s risk tolerance and technical expertise.

How does energy consumption affect my choice of consensus?

If you care about sustainability or operate in a high‑cost electricity region, PoS or other low‑energy models make financial sense. PoW can become unprofitable when electricity prices rise sharply.

Millsaps Crista

October 14, 2025 AT 08:19Great rundown! I love how you broke down the trade‑offs between security, speed, and decentralisation. It really helps newcomers see why you’d pick PoW for a store of value but PoS for a smart‑contract platform. Keep the practical examples coming, they make the theory feel tangible.

Matthew Homewood

October 18, 2025 AT 09:33The philosophical angle is spot on – consensus is essentially a social contract among nodes. When you view each validator as a citizen, the choice of mechanism mirrors the political system you prefer.

Shane Lunan

October 22, 2025 AT 10:46Nice.

Russel Sayson

October 26, 2025 AT 10:59Alright, let’s dig deep. First, any consensus protocol is a game of incentives; you align participants’ profit motives with the health of the network. In Proof of Work, the incentive is the block reward plus transaction fees, paid to whoever solves the hash puzzle first. That puzzle is deliberately hard – it forces miners to burn electricity, which translates into security because an attacker would need to out‑spend the entire honest mining community. The downside is obvious: massive energy consumption and low throughput, typically under ten transactions per second.

Proof of Stake flips the model. Instead of expending electricity, validators lock up capital as a bond. The chance of proposing a new block is proportional to the stake, so honest behaviour is financially rewarded and dishonest behaviour is slashed. This dramatically cuts energy use – Ethereum’s Merge claimed a 99.95 % reduction – while raising the barrier that wealth equals influence.

Delegated Proof of Stake adds a political layer: token holders elect a handful of delegates to produce blocks. This boosts TPS into the hundreds, but centralises power among a few entities. If those delegates collude, the network’s integrity suffers.

Permissioned models like PBFT or Ripple’s consensus operate on a known set of validators. They achieve finality in seconds and can process thousands of TPS, but they sacrifice the permissionless ethos of early blockchains. Enterprises love this trade‑off because regulatory compliance and predictable performance trump pure decentralisation.

When you compare mechanisms, the trilemma resurfaces: you can optimise for two of security, decentralisation, and scalability, but you’ll always compromise the third. That’s why hybrid solutions are emerging – a PoW‑anchored base layer for security, topped with a PoS or PBFT side‑chain for speed.

Overall, the right choice hinges on your use‑case: value storage → PoW or audited PoS; high‑frequency dApps → DPoS, Stellar, or Solana‑style chains; regulated finance → permissioned PBFT. The landscape is evolving fast, so keep an eye on upcoming upgrades like Ethereum’s Dencun, which promises massive data availability for rollups, effectively marrying PoS security with near‑Bitcoin scalability.

Isabelle Graf

October 30, 2025 AT 12:13Honestly, the whole "energy‑hungry PoW" narrative feels like moral grandstanding. If you care about the planet, just move to PoS – it’s not a philosophical discussion, it’s common sense.

Maria Rita

November 3, 2025 AT 13:26Super helpful guide! As someone just starting a DAO, I was lost in the jargon. This breaks it down into bite‑size pieces, and the checklist at the end is pure gold for decision‑making.

Jordann Vierii

November 7, 2025 AT 14:39From a cultural perspective, the shift toward PoS mirrors broader societal moves toward sustainability. It’s exciting to see tech aligning with global values.

Lesley DeBow

November 11, 2025 AT 15:53Deep dive, love the mix of technical detail and big‑picture view. Shows how philosophy and engineering intersect in blockchain design.

Scott G

November 15, 2025 AT 17:06Thank you for the thorough analysis. The distinction between permissioned and permissionless models is crucial for enterprises evaluating compliance requirements.

VEL MURUGAN

November 19, 2025 AT 18:19While the article is comprehensive, it glosses over the potential centralisation risk of large staking pools. Ignoring that could mislead newcomers.

Mitch Graci

November 23, 2025 AT 19:33Wow, another "green" hype piece-still, PoS is just a way for the rich to cement power!!! 🙄

DeAnna Greenhaw

November 27, 2025 AT 20:46One must acknowledge that the author’s exposition, whilst meticulous, occasionally lapses into pedantic elaboration. Nevertheless, the synthesis of comparative metrics is commendable.

Luke L

December 1, 2025 AT 21:59Reading this felt like a lecture on why we should all just trust the biggest validators. Not persuasive.

Cynthia Chiang

December 5, 2025 AT 23:13Great info! I think the key takeaway is: pick the tool that fits your project, not the hype.

Hari Chamlagai

December 10, 2025 AT 00:26Honestly, anyone who doesn’t see the obvious superiority of PoS over PoW after the Merge is living in the past. The numbers speak for themselves.

Ben Johnson

December 14, 2025 AT 01:39Interesting read-though I’d add that hybrid models are still experimental and can introduce unexpected attack vectors.

Della Amalya

December 18, 2025 AT 02:53This article captures the essence of blockchain consensus beautifully. It’s rare to find such a balanced perspective that respects both technical depth and accessibility.

Teagan Beck

December 22, 2025 AT 04:06Cool guide, helped me figure out which chain to use for my side project.

Kim Evans

December 26, 2025 AT 05:19Thanks for the detailed breakdown! 👍 The checklist at the end really ties everything together and makes the decision process feel manageable.