When you see a crypto project promising social media rewards and 24-hour price jumps, it’s easy to get excited. But Social Send (SEND) isn’t what it claims to be. It’s a textbook example of a scam token with impossible numbers, zero real trading, and no functional platform. If you’re considering investing or even just checking it out, stop here. This isn’t a risky investment - it’s a warning sign you can’t afford to ignore.

How Social Send Claims to Work - And Why It Doesn’t

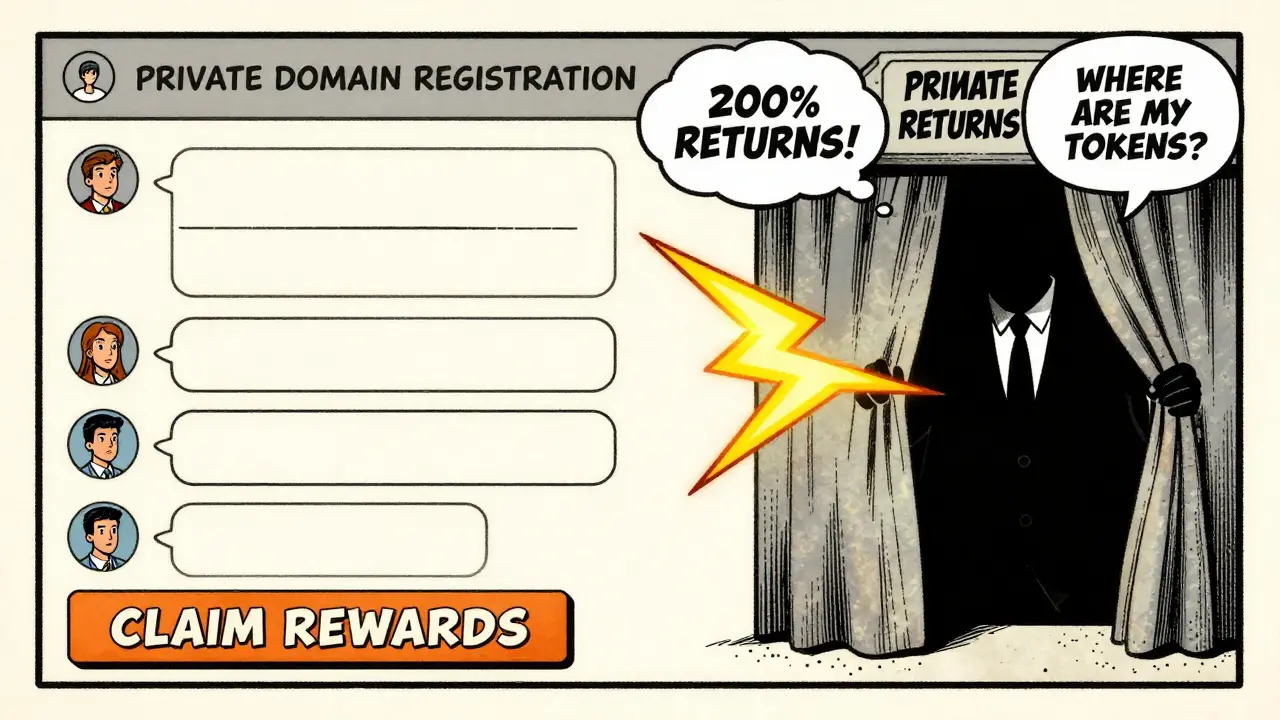

Social Send says it’s a blockchain-based social network where users earn SEND tokens for posting, sharing, and engaging. Sounds familiar? It’s trying to copy platforms like Minds.com or Peepeth, which actually let you own your content and get paid in real tokens. But Social Send skips the hard parts: no public smart contract, no blockchain explorer link, no wallet integration guide, and no developer documentation. Legitimate projects publish these details openly. Social Send doesn’t even try. Its website, socialsend.io, looks professional on the surface. But when you dig deeper, nothing works. No login. No reward system. No way to claim tokens. Even the “official” Twitter account @SocialSendOfficial only posts automated ads - no replies, no support, no real users. This isn’t a beta launch. It’s a ghost site.The Impossible Numbers: Zero Supply, Price Movement, and $0 Volume

Here’s where Social Send breaks every rule of crypto. According to CoinMarketCap data from October 2025:- Total supply: 54,317,038.65394 SEND

- Circulating supply: 0 SEND

- Price: $0.00042401

- 24-hour change: +4.16%

- Trading volume: $0.00

How It Compares to Real Blockchain Social Platforms

Let’s look at real projects that actually work:| Feature | Social Send (SEND) | Minds.com | Peepeth | Indorse.io |

|---|---|---|---|---|

| Circulating Supply | 0 SEND | 127M MINDS | On-chain ETH-based posts | 18.5M IND |

| Daily Trading Volume | $0.00 | $42,000+ | $18,000+ | $25,000+ |

| Exchange Listings | 1 (non-functional) | 5 (including Binance) | 2 (Uniswap, SushiSwap) | 5 (Gate.io, Uniswap) |

| Smart Contract Address | Not published | Publicly verified | Publicly verified | Publicly verified |

| Active Users (Monthly) | 0 | 1.2M | 89,000+ | 12,350 |

| Developer Docs | None | 47-page guide | Open-source repo | Public API docs |

Why Experts and Regulators Say It’s a Scam

This isn’t just opinion. Experts and regulators have flagged Social Send repeatedly. The California Department of Financial Protection and Innovation (DFPI) listed it in their October 2025 Crypto Scam Tracker as one of 22 “high-risk tokens” with red flags including “inconsistent supply metrics” and “non-verifiable trading activity.” Their report showed 372 similar projects in Q3 2025 - 98.7% were confirmed exit scams. DataVisor’s September 2025 analysis identified “zero circulating supply with reported price activity” as the #3 indicator of a crypto scam. Social Send hits that exact marker. Chainalysis analyst Dr. Elena Rodriguez put it bluntly in a September 2025 CoinDesk interview: “Projects claiming price movement with zero volume violate basic market mechanics - this is either deliberate misinformation or complete operational failure, both disqualifying for legitimate investment.” TechForing’s October 2025 update placed Social Send among “high-risk tokens” meeting four of seven scam indicators: impossible metrics, no supply, no utility, no support. That’s not a borderline case. That’s a red alert.Community Feedback: Zero Trust, 100% Warnings

Look at what real users are saying. On Reddit’s r/CryptoScams, 17 users posted in September 2025 about being lured by Social Send through Telegram and WhatsApp groups promising “200% returns in 7 days.” One user, u/CryptoWatcher2025, confirmed: “Contacted CoinMarketCap about SEND - they confirmed it meets their Tier 3 listing criteria, which requires minimal verification. That’s why scam tokens appear.” Trustpilot has zero reviews for socialsend.io. ScamAdviser gives the domain a 12/100 risk score. Bitcointalk forums show 100% of SEND mentions in the last 90 days are scam warnings. CoinGecko’s sentiment analysis found 100% negative sentiment across 47 forum mentions. No one is using it. No one trusts it. And no one is making money from it - except whoever created it.What Happens If You Try to Use It?

Let’s say you’re curious. You buy SEND on the one exchange it’s listed on. What then? You can’t store it. No wallet supports it because there’s no verified contract address. You can’t claim rewards because the platform doesn’t work. You can’t sell it because no one else is trading. The “price” you see is meaningless - it’s a number pulled from thin air. Users on CryptoSlate forums reported trying to connect wallets to the site. All failed. Some reported being redirected to phishing pages after clicking “claim rewards.” That’s not a bug. That’s a trap. The DFPI reported 8 new scam complaints in October 2025, with average losses of $3,250 per victim. That’s not a gamble. That’s theft.

Is There Any Chance This Becomes Legit?

No. Projects that are real build slowly. They launch testnets. They publish code. They get audits. They grow users organically. Social Send has been active since 2023. Its domain was last updated in March 2024 with privacy protection enabled - a common tactic used by scam operations to hide ownership. No GitHub commits. No team members listed. No roadmap updates. No community calls. No transparency. Just a price chart with zero volume and a website that doesn’t do anything. Chainalysis’ October 2025 study of 1,247 similar tokens found a 99.3% failure rate. Social Send isn’t an outlier - it’s the rule. It’s not a project waiting to take off. It’s already dead.What You Should Do Instead

If you want to get into blockchain social media, go with platforms that are real:- Minds.com - Built since 2011, 1.2M users, $2.3M annual revenue, fully transparent tokenomics.

- Peepeth - Posts stored on Ethereum, open-source, no middlemen.

- Indorse.io - Verified on 5 exchanges, active users, real trading volume.

Final Verdict: Don’t Touch Social Send

Social Send isn’t a crypto exchange. It’s not a social network. It’s not even a failed startup. It’s a scam designed to trick people into believing a token exists when it doesn’t. The numbers don’t lie. The experts don’t lie. The users don’t lie. This isn’t about risk. It’s about avoiding fraud. If you’re looking to invest in crypto, find projects with real activity, real users, and real transparency. Social Send has none of those. Walk away. Save your money. And warn others before they fall for the same trap.Is Social Send (SEND) a legitimate cryptocurrency?

No, Social Send is not legitimate. It has a circulating supply of 0 SEND, yet claims a market price and 24-hour price changes - which is mathematically impossible. No smart contract, no wallet support, no trading volume, and no verifiable team or platform exist. Regulators and blockchain analysts have flagged it as a high-risk scam.

Why does CoinMarketCap list Social Send if it’s a scam?

CoinMarketCap lists tokens based on minimal verification criteria, not legitimacy. Their Tier 3 listing requires only basic data submission - no proof of trading, no contract audit, no team verification. This allows scam tokens like Social Send to appear, misleading new investors. Always cross-check with independent sources like Chainalysis, DFPI, or CoinGecko’s sentiment data.

Can I buy Social Send tokens safely on any exchange?

No. Social Send is listed on only one exchange, and that listing has $0 trading volume - meaning no one is actually buying or selling it. Even if you purchase SEND, you won’t be able to store it in a wallet, use it, or sell it later. The token has no utility, and the platform doesn’t function. Any purchase is a total loss.

What are the signs of a crypto scam like Social Send?

Key signs include: zero circulating supply with reported price changes, $0 trading volume, no public smart contract, no developer documentation, no active community, and promotion through Telegram or WhatsApp with promises of quick returns. If you can’t verify the code, the team, or the trading activity, it’s a scam.

Has anyone lost money from Social Send?

Yes. The California DFPI documented 8 new scam complaints in October 2025, with average losses of $3,250 per victim. Users were lured by fake promises of high returns through WhatsApp and Telegram groups. These are not hypothetical risks - people have already been defrauded.

Should I avoid all social media crypto projects?

No. Projects like Minds.com, Peepeth, and Indorse.io are legitimate and transparent. The difference is in the details: public code, verifiable users, real trading volume, and active development. Avoid any project that hides its contract, has zero volume, or relies on hype instead of proof.

Robert Mills

January 26, 2026 AT 08:05Sunil Srivastva

January 26, 2026 AT 15:35Devyn Ranere-Carleton

January 28, 2026 AT 10:03Kevin Thomas

January 30, 2026 AT 03:02Tressie Trezza

January 31, 2026 AT 02:10Calvin Tucker

February 1, 2026 AT 03:33Jerry Ogah

February 2, 2026 AT 12:23Gustavo Gonzalez

February 3, 2026 AT 05:52