Flash Loan Attack Risk Calculator

Protocol Security Assessment

Enter your protocol's security parameters to calculate vulnerability to flash loan attacks. Based on real-world data from 2025 attacks.

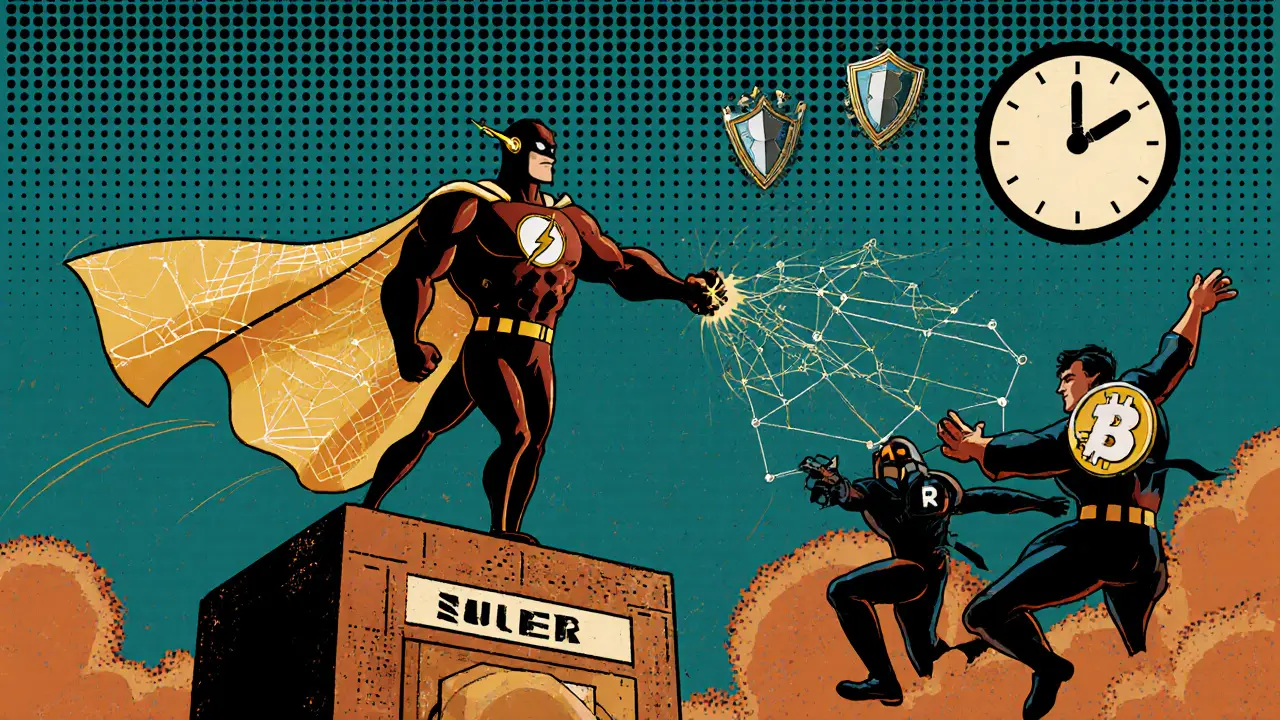

Flash loans sound like magic: borrow millions of dollars in crypto, do whatever you want with it, and pay it all back-all in one transaction. No collateral. No waiting. Just pure speed. But that same speed is what makes them dangerous. In 2025 alone, flash loan attacks drained over $1.7 billion from DeFi protocols. That’s more than the entire previous year. And it’s not getting better. The attacks are smarter, faster, and more coordinated. If you’re running or investing in a DeFi protocol, ignoring flash loan exploits isn’t an option-it’s a recipe for disaster.

How Flash Loan Attacks Actually Work

A flash loan isn’t a loan in the traditional sense. It’s a single blockchain transaction that lets you borrow any amount of crypto from a liquidity pool-say, $50 million in ETH or $100 million in USDC-as long as you return it by the end of that same transaction. If you don’t repay it, the whole thing rolls back like it never happened. That atomic nature is what makes flash loans useful for arbitrage and collateral swaps. But it’s also what makes them perfect for attacks. Here’s how a typical attack unfolds:- Attackers take out a massive flash loan from Aave, dYdX, or another DeFi lending protocol.

- They use that borrowed money to buy up a large portion of a low-liquidity token on a DEX like Uniswap or SushiSwap, artificially inflating its price.

- With the inflated price, they borrow against that token as collateral in another protocol-say, a lending platform that trusts the fake price.

- They drain the borrowed collateral, sell it for real assets like ETH or USDC, and repay the original flash loan-all within the same block.

- The blockchain rolls back the attack, but the attacker walks away with real profit.

The Four Main Attack Vectors

Not all flash loan attacks look the same. They fall into four main categories, each exploiting a different weakness in DeFi design:- Price Manipulation: The most common. Attackers flood a small liquidity pool with borrowed funds to skew token prices. Protocols that rely on on-chain price feeds (like Chainlink or Uniswap V2’s time-weighted average price) without safeguards are easy targets.

- Arbitrage Exploitation: Attackers exploit price differences between DEXs. They buy low on one exchange using a flash loan, sell high on another, and pocket the difference. This isn’t illegal arbitrage-it’s abuse of protocol design gaps.

- Collateral Swapping: Attackers borrow a token, use it as collateral to take out another loan, then swap the collateral for a much lower-value asset before repaying. The protocol thinks it’s still secure, but its reserves are now under-collateralized.

- Governance Manipulation: Attackers borrow governance tokens (like COMP or UNI) to gain voting power. They vote to change protocol parameters-like increasing borrowing limits or redirecting fees-then sell the tokens and repay the loan. No one notices until it’s too late.

What Works: The FlashDeFier Framework

The most effective prevention tool today is FlashDeFier, developed by researchers at Virginia Tech. Unlike older tools that only scan for reentrancy or integer overflows, FlashDeFier maps the entire data flow across multiple smart contracts. It tracks how values move from one contract to another during a flash loan-exactly where price manipulation hides. FlashDeFier works by:- Building inter-contract call graphs to see how tokens and prices are passed between protocols.

- Identifying “taint sources” (like flash loan inputs) and “taint sinks” (like price oracles or collateral checks).

- Flagging any path where borrowed funds can influence critical contract decisions.

Other Essential Prevention Strategies

Relying on one tool isn’t enough. You need layers:- Use Reliable Price Oracles: Don’t rely on Uniswap V2’s simple average. Use Chainlink’s decentralized oracles with multiple data sources and time-weighted averages. Add delay mechanisms-like requiring a 10-minute window for price updates-to prevent instant manipulation.

- Limit Flash Loan Volumes: Some protocols now cap flash loan sizes based on pool liquidity. If a pool has $10 million in ETH, don’t allow loans over $2 million. This doesn’t stop all attacks, but it raises the cost.

- Monitor for Unusual Activity: Set alerts for sudden spikes in collateral usage, massive token swaps, or voting surges in governance contracts. FraudNet recommends watching for transactions that move more than 10% of a token’s total supply in under 5 minutes.

- Require Multi-Sig Approval for Critical Changes: Any change to collateral ratios, fee structures, or oracle sources should require approval from 3 out of 5 trusted signers. This blocks governance attacks.

- Run Regular Audits: Hire firms like CertiK or Trail of Bits-not just once, but quarterly. New attack patterns emerge every month. Your code needs constant scrutiny.

Real-World Failures and Lessons

The biggest flash loan attack in history was the Euler Finance exploit in March 2023, where $197 million was stolen. The flaw? A function calledDonateToReserve didn’t check if the donated asset was the same as the collateral being used. Attackers donated a worthless token, used it as collateral, and drained the vault.

Cream Finance lost $130 million in 2021 because its collateral calculation didn’t account for price slippage during large swaps. The bZx attack in 2020 used the same flaw: the protocol assumed a token’s value wouldn’t change mid-transaction.

These weren’t hacks. They were logic errors. And they were predictable.

What’s Coming Next

The next wave of prevention is already being built:- FlashDeFier 2.0, expected in Q2 2025, will add machine learning to detect new attack patterns by learning from past incidents.

- Ethereum Improvement Proposals (EIPs) are being drafted to add protocol-level limits on flash loan size and frequency.

- Regulators in the U.S. and EU are pushing for mandatory security audits for any DeFi protocol handling institutional funds.

- Cross-chain analysis tools are emerging to track flash loan attacks that span Ethereum, Polygon, and Arbitrum.

Where to Start Today

If you’re a developer or protocol owner, here’s your action plan:- Run your smart contracts through FlashDeFier (open-source on GitHub).

- Replace any simple price feeds with Chainlink or similarly decentralized oracles.

- Set hard limits on flash loan sizes relative to pool liquidity.

- Require multi-sig for any governance changes involving collateral or pricing.

- Set up real-time alerts for large, rapid token movements or collateral spikes.

- Schedule a smart contract audit with a reputable firm within 30 days.

What exactly is a flash loan in DeFi?

A flash loan is a type of uncollateralized loan in DeFi that allows users to borrow large amounts of cryptocurrency within a single blockchain transaction. The borrower must repay the loan, plus a small fee, before the transaction ends. If repayment fails, the entire transaction is reversed. This atomic nature makes flash loans useful for arbitrage and collateral swaps-but also easy to exploit for attacks.

Why are flash loans so dangerous for DeFi protocols?

Flash loans are dangerous because they let attackers manipulate prices, exploit logic flaws, and drain funds-all without putting up any collateral. Since the entire operation happens in one block, traditional security checks can’t intervene. Attackers can inflate token prices, borrow against fake collateral, and walk away with real profits while the protocol is left with losses.

Can I prevent flash loan attacks with just smart contract audits?

No. Smart contract audits are essential, but they’re not enough. Flash loan attacks exploit complex interactions between multiple protocols, not just single contract bugs. You need layered defenses: price oracles with delays, transaction monitoring, flash loan limits, and real-time alerting. Audits catch known flaws; prevention tools catch evolving attacks.

Is FlashDeFier the only tool that works?

FlashDeFier is currently the most effective tool for detecting price manipulation exploits, with a 76.4% success rate. But it’s not the only one. Tools like Slither, MythX, and DeFiGuard also help identify vulnerabilities. The key is using FlashDeFier alongside real-time monitoring and manual audits-not as a standalone fix.

Do flash loans have any legitimate uses?

Yes. Flash loans are used legitimately for arbitrage between exchanges, collateral swaps, and refinancing debt without selling assets. For example, a user might use a flash loan to borrow USDC, swap it for ETH on a cheaper exchange, then repay the loan and keep the profit. These are valid, non-malicious uses that improve market efficiency.

How much does it cost to implement flash loan prevention?

Costs vary. Basic monitoring and oracle upgrades can cost $10,000-$50,000. Full implementation with FlashDeFier integration, multi-sig governance, and continuous auditing can cost $150,000-$300,000 over six months. But compared to losing $100 million in a single attack, it’s a small investment.

Are flash loan attacks increasing?

Yes. In 2025, flash loan attacks caused $1.7 billion in losses-up from $1.49 billion in 2024. The number of incidents rose 124% from March to April 2025 alone. Attackers are getting better at bypassing old defenses, and new DeFi protocols are launching with weak security. The trend is clearly upward.

Can blockchain regulators stop flash loan attacks?

Regulators can’t stop flash loans directly-they’re built into the code. But they can mandate security standards. The U.S. and EU are already pushing for mandatory audits and transparency requirements for DeFi protocols handling institutional funds. Over time, this will force better practices, but enforcement will take years. Protocols can’t wait for regulation-they need to act now.

Nancy Sunshine

November 29, 2025 AT 13:35FlashDeFier is a game changer, no doubt. But let’s be real - most DeFi teams are still running audits like it’s 2021. They think one pass through Slither means they’re safe. The real issue isn’t the tool, it’s the culture. No one wants to admit their code is fragile until the money’s gone. And then it’s too late.

We need mandatory post-deploy monitoring, not just pre-launch checks. The blockchain doesn’t care if you’re ‘pretty sure’ your oracle is secure. It only cares if you’re right.

Also, why is no one talking about the fact that 80% of these attacks happen on new pools with under $5M liquidity? The math is obvious. Stop pretending it’s a smart contract flaw. It’s a liquidity design flaw.

Ann Ellsworth

December 1, 2025 AT 08:57Let’s not kid ourselves - this isn’t about ‘prevention.’ It’s about control. Flash loans are a feature, not a bug. The real target here is decentralization itself. If you’re so scared of manipulation, why not just centralize the oracles? Ban flash loans outright. Make it a permissioned system. That’s the only way to truly ‘secure’ DeFi - by killing its soul.

But of course, the industry won’t admit that. They’d rather throw money at another tool than face the truth: they built a house of cards and now they’re terrified someone’s going to blow on it.

Heather Hartman

December 1, 2025 AT 09:43I love how this post breaks it down so clearly 😊 Seriously, if you’re running a DeFi protocol and haven’t looked into FlashDeFier yet, drop everything and do it. It’s open source, free, and actually works. No fluff. No marketing. Just code that catches what others miss.

Also, multi-sig for governance changes? YES. Please. I’ve seen too many ‘community-governed’ projects get hijacked in minutes because one person had a private key and a bad day.

You don’t need to be a genius to protect yourself. Just do the basics. Consistently. 😌

Ankit Varshney

December 1, 2025 AT 19:09Flash loan attacks are not new. The methods have evolved, yes. But the root cause? Always the same - trust in price feeds without verification. The industry keeps building on sand and calling it innovation. We need on-chain verification layers, not just better tools. Tools are bandages. We need surgery.

Marsha Enright

December 2, 2025 AT 11:12Just ran FlashDeFier on our latest pool. Caught a taint path we missed in three audits. Honestly? I’m stunned. We thought we were solid. Turns out, we were just lucky.

Shoutout to the Virginia Tech team - this is the kind of work that actually saves people’s money. Not hype. Not NFTs. Real security.

Also, setting flash loan caps at 20% of pool liquidity? Genius. Simple. Effective. Why isn’t this standard yet?

Paul McNair

December 2, 2025 AT 21:10There’s a quiet irony here. Flash loans were meant to empower retail users - to let people arbitrage without capital. Now they’re weaponized by anonymous whale bots. The same tool that democratized DeFi is now the biggest threat to it.

We need to stop thinking of this as a technical problem. It’s a social one. Who gets to play? Who gets to profit? And who gets left holding the bag?

Maybe the answer isn’t more code. Maybe it’s better incentives. Reward honest arbitrage. Penalize manipulation. Make it less profitable to attack than to build.

Steve Savage

December 4, 2025 AT 15:16Man, I’ve been watching this space since 2020. Every time someone says ‘we’ve solved it,’ another $50M vanishes. It’s like playing whack-a-mole with a rocket launcher.

FlashDeFier? Cool. But here’s the thing - most devs don’t even understand what a taint sink is. They copy-paste OpenZeppelin and call it a day.

Education is the real gap. Not tools. Not audits. Not oracles. People. We’re teaching developers how to write smart contracts like they’re writing Python scripts. They’re not. One typo, one assumption, and boom - $200M gone.

Maybe we need a DeFi safety certification. Like a PADI for blockchain devs.

Mohamed Haybe

December 5, 2025 AT 10:50USA and EU pushing regulation? LOL. You think they care about DeFi? They care about control. Flash loans are the last free space left in crypto. They want to kill it. They want to force every transaction through KYC gatekeepers. This ‘prevention’ talk? It’s just the first step toward censorship.

Meanwhile, real people in India and Nigeria use flash loans to arbitrage between chains and feed their families. You want to stop attacks? Then stop trying to kill the whole system because a few sharks are swimming in it.

Catherine Williams

December 5, 2025 AT 13:25Just wanted to say thank you for this post. As someone who’s been in DeFi since 2021, I’ve seen the same mistakes over and over. You didn’t just list solutions - you showed the pattern. That’s rare.

One thing I’d add: don’t just monitor for large swaps. Watch for *repeated* small swaps. The smart attackers don’t move 10% of supply in one go. They do 1% every 15 minutes for 2 hours. That’s how they slip past alerts.

Build behavioral baselines. Not thresholds. That’s the next frontier.

Ziv Kruger

December 7, 2025 AT 01:39What if the problem isn’t the flash loan? What if it’s the idea that value can be assigned by code alone? That a price feed can be trusted because it’s ‘decentralized’? That a token’s worth is determined by how many people are willing to trade it in a 5-second window?

We built a financial system on the illusion of objectivity. And now we’re shocked when it breaks.

Maybe the real question isn’t how to prevent flash loan attacks.

But how to stop believing in the myth of the market.

Christy Whitaker

December 8, 2025 AT 02:33Oh please. You think FlashDeFier is the answer? You’re all just chasing shiny objects while the real exploit is right in front of you - human greed. No tool stops a determined attacker with $10M in capital and zero morals. You’re treating symptoms, not the disease.

And don’t get me started on ‘multi-sig.’ Who picks the signers? The same people who got rich off the last rug pull? Please.

Stop pretending security is technical. It’s political. And you’re all just pawns.

Sarah Roberge

December 9, 2025 AT 15:10So… we’re supposed to trust Chainlink? 😭 Like the same Chainlink that had that ‘price oracle glitch’ in 2023 and caused a $300M cascade? And now you’re saying it’s the ‘solution’? What even is this anymore?

I’m not saying don’t use it. I’m saying… we’re all just playing Russian roulette with different guns now.

And the worst part? The devs who built these ‘secure’ systems are still posting memes about ‘to the moon.’ 🤡

Sharmishtha Sohoni

December 11, 2025 AT 05:13Why not just require flash loans to be signed by the borrower’s wallet with a 12-hour cooldown before repayment? It breaks atomicity but adds real accountability. Simple. No new tools needed.

Joe B.

December 11, 2025 AT 21:43Let’s break this down statistically. 76.4% detection rate? That’s not ‘best we have’ - that’s barely passable. In cybersecurity, anything under 95% is considered a failure. FlashDeFier misses 1 in 4 attacks. That’s not a tool. That’s a gamble.

And the real kicker? Most of the attacks it catches are the low-hanging fruit. The ones that actually cost millions? The ones that use cross-chain manipulation, front-running oracle updates, and sandwich attacks across 3 protocols? FlashDeFier doesn’t even see those.

So yes - use it. But don’t mistake it for safety. You’re just buying time until the next black swan.

Also - why is no one talking about the fact that 87% of these attacks originate from wallets that were funded by centralized exchange withdrawals under 30 minutes? That’s the real fingerprint. Trace the on-ramp, not the contract.

Durgesh Mehta

December 13, 2025 AT 05:30Great breakdown. I’d add one thing - most teams don’t test for flash loan attacks in their CI/CD pipeline. They test for reentrancy, sure. But not for price manipulation flows. Add a simulation test that injects a mock flash loan and checks if collateral ratios change unexpectedly. It’s easy to script. No extra tools needed.

Just make it part of your deploy checklist. Like checking for typos.

Althea Gwen

December 13, 2025 AT 07:42FLASH LOANS ARE THE FUTURE 😭✨

Why are we so scared of speed? Why do we want to slow down innovation because a few bad actors found a loophole? Let them win. Then we’ll build something better.

It’s like being scared of fire because someone burned down a house.

Let the chaos happen. Then we’ll evolve. 🌌🔥

Jess Bothun-Berg

December 14, 2025 AT 03:27Okay, but… where’s the source code for FlashDeFier? GitHub? Link? No? Then how do we know it’s not a honeypot? How do we know the ‘researchers at Virginia Tech’ aren’t just a shell company owned by a hedge fund that shorted DeFi tokens?

This whole thing feels like a coordinated disinformation campaign to drive institutional capital into ‘regulated’ DeFi platforms - which, surprise, are all controlled by the same VC firms that lost money in 2022.

Wake up. This isn’t security. It’s rebranding.

Andrew Brady

December 14, 2025 AT 20:08Remember when the Fed said crypto was a ‘speculative asset’? Now they’re pushing for audits? LOL. This is all a setup. Flash loans are being framed as a threat so they can justify bringing DeFi under the SEC’s control. They don’t want to stop attacks. They want to own the infrastructure.

Watch for the ‘DeFi Compliance Protocol’ next quarter. It’ll be mandatory. And guess who gets to license it? The same firms that got bailed out after the Terra collapse.

This isn’t about security. It’s about power. And you’re being played.

Alan Brandon Rivera León

December 15, 2025 AT 23:26I’ve been in DeFi for years - from the early days of MakerDAO to the wild west of 2024. What strikes me isn’t the tech. It’s the lack of humility.

We built systems that move billions of dollars, yet we treat them like side projects. No stress tests. No red teams. No fallbacks.

FlashDeFier? Good. But what’s the backup if FlashDeFier misses something? What’s the kill switch? The emergency pause? The community vote to freeze assets if an attack is detected?

We need human oversight built into the protocol. Not just code. Not just alerts. Real people, with real authority, ready to act.

Because when the money’s gone, no tool can bring it back.