Imagine spending $500 on a cryptocurrency, only to find out two hours later that the transaction never happened - because someone else spent the same coins first. This isn’t science fiction. It’s a 51% attack, and it’s happened more than 40 times since 2019 on smaller blockchains. The good news? Most of these attacks could have been stopped - and they’re becoming harder to pull off as networks get smarter.

What Exactly Is a 51% Attack?

A 51% attack happens when one person or group controls more than half of a blockchain’s computing power (in Proof-of-Work) or staked tokens (in Proof-of-Stake). That’s it. No magic. No hacking. Just brute force control. Once they have that majority, they can:- Stop new transactions from being confirmed

- Reverse their own transactions (double-spending)

- Prevent others from mining or validating blocks

Why Do These Attacks Happen on Some Blockchains and Not Others?

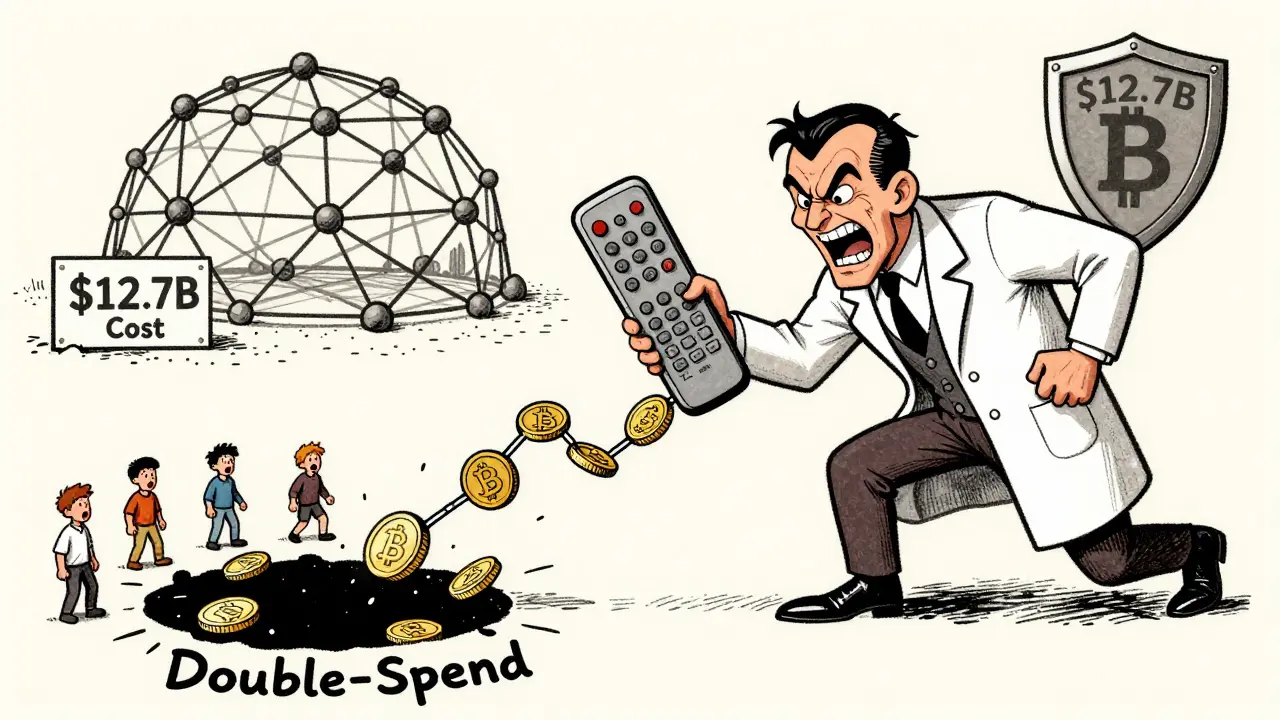

It’s not about the technology. It’s about scale. Bitcoin’s network has over 400 exahashes per second (EH/s) of computing power. To control 51% of that, you’d need $12.7 billion in mining hardware and $48 million per day in electricity. No one’s doing that - not even governments. But take Bitcoin Gold. It runs on a much smaller network - only 0.6 EH/s. Renting enough hash power to attack it costs less than a new laptop. That’s why 7 out of the 40+ documented 51% attacks happened on networks with market caps under $100 million. According to Chainalysis, 87% of all 51% attack victims had market caps below $50 million. Meanwhile, no successful attack has ever occurred on a blockchain with a market cap over $10 billion. The rule is simple: the bigger and more decentralized the network, the safer it is.How Proof-of-Work Networks Fight Back

Bitcoin and other Proof-of-Work (PoW) chains rely on mining power. To prevent 51% attacks, they use three main tools:- Hash rate monitoring - Bitcoin Core has tracked mining pool dominance since 2016. If any single pool hits 40% of the network’s hash rate, alerts go off. Miners are encouraged to switch pools.

- ChainLocks - Developed by the MIT Digital Currency Initiative and open-sourced in 2021, this protocol requires 60% of miners to sign off on each block. Even if you control 51% of hash power, you still need to control 60% of signing keys - which is nearly impossible without insider access.

- Community pressure - When Ravencoin had a false alarm in January 2023 that triggered a network halt, the community pushed back. Developers learned: too many false positives scare users away. Now, alerts are tuned to only trigger when attack patterns are statistically certain.

How Proof-of-Stake Networks Are Even Stronger

Ethereum switched from Proof-of-Work to Proof-of-Stake (PoS) in September 2022. That change didn’t just cut energy use by 99.95%. It made 51% attacks economically suicidal. In PoS, validators lock up real money - 32 ETH (about $51,200 in late 2023) per node. If a validator tries to cheat, they lose all or part of their stake. Ethereum’s system uses something called the quadratic leak: the more validators you control, the faster your stake melts away. Control 35%? You lose 5% of your stake per day. Control 51%? You’re bankrupt in days. Ethereum’s Beacon Chain survived three coordinated attacks in late 2022 where bad actors controlled up to 35% of validators. None succeeded. The slashing mechanism punished them before they could even try to reverse transactions. Other PoS chains like Cardano and Solana use similar economic penalties. But they also add governance:- Cardano’s Voltaire phase lets token holders vote to remove malicious validators.

- Solana’s 21 block producers are elected by the community and can be replaced within minutes if they act dishonestly.

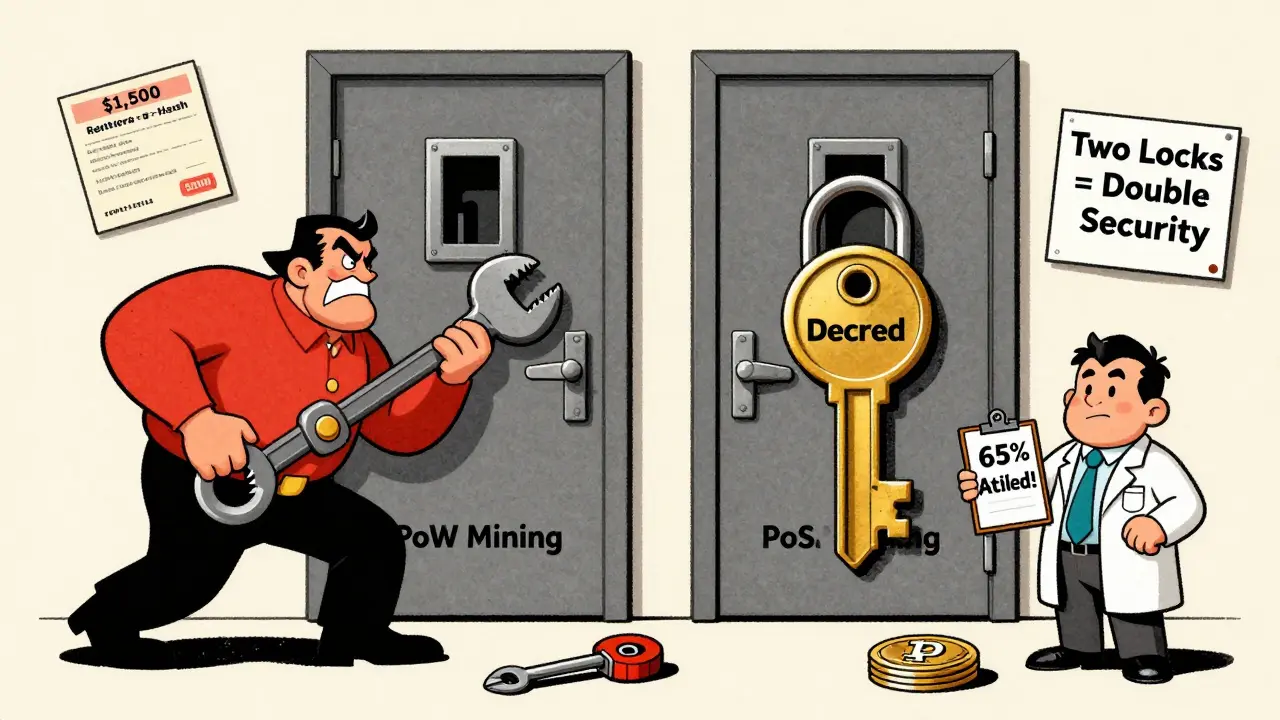

Hybrid Models: The Best of Both Worlds?

Decred is a hybrid chain - 60% PoW, 40% PoS. In 2021, researchers tried to control 65% of its resources. They failed. Why? Because you’d need to control both the mining power and the staked tokens. That’s two separate systems to hack at once. This model isn’t common - but it’s one of the most secure designs ever tested. It’s like having two locks on a door. Break one? Still locked.What Enterprises Are Doing Differently

Big companies don’t use public blockchains like Bitcoin or Ethereum for sensitive data. They use permissioned chains like Hyperledger Fabric or R3 Corda. These networks don’t rely on mining or staking. They use Practical Byzantine Fault Tolerance (PBFT), where 66% of trusted nodes must agree on every transaction. Even if 33% go rogue, the network keeps running. Gartner rated these enterprise blockchains 92/100 on security. Public chains? Only 78/100 - mostly because of 51% attack risks on small networks. That’s why 72% of Fortune 500 companies use permissioned blockchains. They don’t care about decentralization. They care about control.What You Can Do to Stay Safe

If you’re a user:- Avoid trading or holding small-cap coins with market caps under $100 million.

- Wait for at least 6 confirmations before accepting a transaction - especially on lesser-known chains.

- Use exchanges that pause deposits after suspicious reorganizations (like Binance did after the Ethereum Classic attack).

- Use ChainLocks or similar block-signing protocols.

- Require at least 1,024 validators on PoS chains, spread across 6+ continents.

- Implement slashing penalties that scale with attack size - not flat fees.

- Start with a hybrid model if you can.

- Don’t launch with fewer than 100 independent validators or miners.

- Make sure no single entity controls more than 5% of the total stake or hash rate.

The Future: Can 51% Attacks Be Eliminated?

No. Not completely. In a permissionless system, someone could always theoretically rent enough power or buy enough tokens to attack. But the economics are shifting. The cost to attack Bitcoin is now over $12 billion. The cost to attack a $50 million coin? $1,500. That gap is widening. Ethereum’s Dencun upgrade in early 2024 will separate block proposers from builders - reducing the risk of miners colluding to manipulate transaction order. MIT’s new AI-powered monitor, released in late 2023, can predict attacks 89% of the time by spotting unusual hash rate patterns before they happen. By 2027, experts predict successful 51% attacks on networks with market caps above $1 billion will drop to less than 0.5 per year - down from 2.3 today. The message is clear: security scales with size, diversity, and economic cost.FAQ

Can a 51% attack steal my cryptocurrency?

No. A 51% attack can’t steal coins from your wallet. It can only reverse transactions that were already confirmed - meaning the attacker can double-spend coins they already own. Your private keys remain safe. The real danger is losing trust in the network and seeing your deposits frozen while exchanges investigate.

Why don’t big networks like Bitcoin get 51% attacked?

Because it’s too expensive. Bitcoin’s network requires 400 EH/s of computing power. To control 51% of that, you’d need $12.7 billion in mining hardware and $48 million per day in electricity. No one has that kind of capital - and even if they did, the market would crash the moment the attack started, making it financially ruinous.

Is Proof-of-Stake completely safe from 51% attacks?

No system is 100% safe. But PoS makes attacks economically self-defeating. To control 51% of Ethereum’s staked ETH, you’d need over $100 billion worth of tokens. And if you tried to attack, the network would slash your stake - potentially wiping out your entire investment. That’s why no PoS chain has ever suffered a successful 51% attack.

How can I tell if a blockchain is at risk?

Check its market cap and hash rate or staked supply. If the market cap is under $100 million, it’s vulnerable. Look up its hashrate on sites like Blockchain.com or CoinGecko. If a single mining pool controls over 40% of hash rate, or one staking pool holds over 30% of stake, it’s a red flag. Avoid trading or holding coins on those networks.

Are exchanges responsible for preventing 51% attacks?

Exchanges aren’t responsible for the blockchain’s security - but they are responsible for protecting their users. Good exchanges pause deposits and withdrawals after a chain reorganization, wait for 10+ confirmations on small chains, and blacklist wallets involved in double-spends. If an exchange doesn’t do this, don’t trust it with your funds.

Matthew Kelly

January 21, 2026 AT 11:31Linda Prehn

January 22, 2026 AT 06:11Adam Lewkovitz

January 22, 2026 AT 12:38Clark Dilworth

January 24, 2026 AT 07:19Mark Estareja

January 24, 2026 AT 17:54David Zinger

January 25, 2026 AT 10:44Athena Mantle

January 25, 2026 AT 14:35carol johnson

January 25, 2026 AT 20:34Chidimma Catherine

January 26, 2026 AT 19:32Nathan Drake

January 28, 2026 AT 19:04tim ang

January 30, 2026 AT 02:39Bonnie Sands

January 30, 2026 AT 04:56Abdulahi Oluwasegun Fagbayi

January 30, 2026 AT 05:50Anna Topping

January 31, 2026 AT 11:51Jeffrey Dufoe

February 1, 2026 AT 14:01Adam Lewkovitz

February 1, 2026 AT 16:39