Crypto Risk Calculator

Underground Crypto Use Risk Assessment

This calculator estimates the potential consequences of using cryptocurrency in Nepal despite the ban. Enter your estimated values below to see how they compare to typical outcomes.

Risk Assessment Results

Potential Legal Consequence

Typical Financial Benefit

Despite a strict cryptocurrency ban enforced by the Nepal Rastra Bank, many Nepalis are still finding ways to tap into digital assets for cross‑border money transfers and speculative trading. The underground ecosystem relies on a mix of tech tricks, foreign platforms, and personal networks that operate well beyond the reach of local law enforcement.

Key Takeaways

- Nepal’s ban covers trading, mining, payments and even personal holding of crypto.

- Penalties can reach up to three years in prison, heavy fines and confiscation of wallets.

- Remittances are the main driver-young workers use crypto to bypass costly formal channels.

- Common work‑arounds include VPNs, offshore exchanges, peer‑to‑peer trades and messenger‑based stablecoins.

- Risks are high: legal prosecution, fraud, loss of funds and no consumer protection.

Legal Landscape: Absolute Prohibition

In 2021 the Nepal Rastra Bank (NRB) issued a blanket prohibition on all crypto‑related activities under the Foreign Exchange Regulation Act (FERA) and reinforced it with the Electronic Transaction Act (ETA, 2063 B.S.). Anyone caught buying, selling, mining, or even holding crypto can face up to three years imprisonment, fines up to three times the transaction value, and seizure of digital wallets. High‑profile arrests in Kathmandu and provincial capitals show that enforcement is active, not merely symbolic.

Why Nepalis Still Turn to Crypto

Remittance flows account for roughly 25% of Nepal’s GDP. Traditional money‑transfer services charge high fees, impose strict documentation, and often delay funds for several days. For a country with over 8million workers abroad, especially in the Gulf and Malaysia, the lure of near‑instant, low‑cost cross‑border transfers is powerful.

Tech‑savvy youth, many of whom have studied abroad, view crypto as a way to retain the full value of earnings without the 10‑15% deductions imposed by formal channels. The anonymity and global reach of digital assets also appeal to those wanting to bypass capital controls.

Underground Methods: How the Work‑Around Happens

Because open discussion is risky, most Nepalis share tactics through private Telegram groups, Discord servers, and word‑of‑mouth networks.

- VPNs and Proxy Servers - Users mask their IP address to access foreign exchanges like Binance, Kraken or local Asian platforms that still accept Nepali customers.

- Offshore Exchanges - Accounts are opened on exchanges based in Singapore, Malta or the UAE, often using a foreign phone number and KYC documents of a relative abroad.

- Peer‑to‑Peer (P2P) Marketplaces - Platforms such as LocalBitcoins, Paxful or community‑run Facebook groups let sellers list crypto for cash. Payments are settled via Western Union, bank transfers to overseas accounts, or direct hand‑over in border towns.

- Messenger‑Based Stablecoins - Some groups use stablecoins (USDT, USDC) transferred via WhatsApp‑linked wallets that hide transaction details behind encrypted chats.

- Crypto ATMs in Neighboring India - Residents of border districts travel to Indian towns where Bitcoin ATMs dispense cash in exchange for crypto sent from a Nepali wallet.

These methods rely heavily on crypto wallets-software or hardware tools that store private keys. Because the government can seize devices, many users prefer mobile wallets with strong encryption and hidden app icons.

Real‑World Snapshot

In late 2024 a Kathmandu‑based collective was busted after a raid uncovered over 150 wallets holding a combined value of $2.3million. The group’s operation involved:

- Collecting Nepali workers’ earnings abroad via offshore exchanges.

- Converting the crypto to stablecoins.

- Distributing funds through P2P trades to families back home.

While the participants faced prison sentences and asset confiscation, the case highlighted a thriving informal network that continues to function despite the crackdown.

Risks and Consequences

Beyond legal penalties, underground crypto use carries financial dangers:

- No Regulatory Protection - If a platform disappears or a wallet is hacked, users have no recourse.

- Scams and Ponzi Schemes - Fraudsters exploit the lack of oversight, promising unrealistic returns.

- Cybercrime Exposure - Using VPNs and hidden apps can attract malware attacks aimed at stealing private keys.

- Asset Freezing - Law enforcement can request foreign exchanges to block accounts linked to Nepali IP addresses.

Future Outlook: CBDC vs. Crypto Demand

The Nepal Rastra Bank is developing a Central Bank Digital Currency (CBDC) slated for launch within the next two years. The CBDC aims to provide a state‑controlled digital payment method while maintaining strict oversight. However, the CBDC will likely remain fully regulated, requiring a bank account and identity verification-features that many currently bypass with crypto. Unless the government relaxes its stance or offers a low‑cost, border‑friendly digital channel, the underground crypto market is expected to persist.

Practical Guidance for Those Navigating the Ban

If you or someone you know is considering crypto for remittance, keep these points in mind:

- Understand the legal stakes-imprisonment and fines are real.

- Never store large sums on a single device; use hardware wallets with secure backups.

- Prefer peer‑to‑peer trades with trusted contacts rather than unknown strangers.

- Stay informed about any changes in NRB policy or CBDC rollout.

- Consider legal alternatives such as official remittance corridors that offer lower fees for bulk transfers.

The safest route is to wait for a regulated digital solution, but many will continue to use crypto as long as the cost‑gap remains.

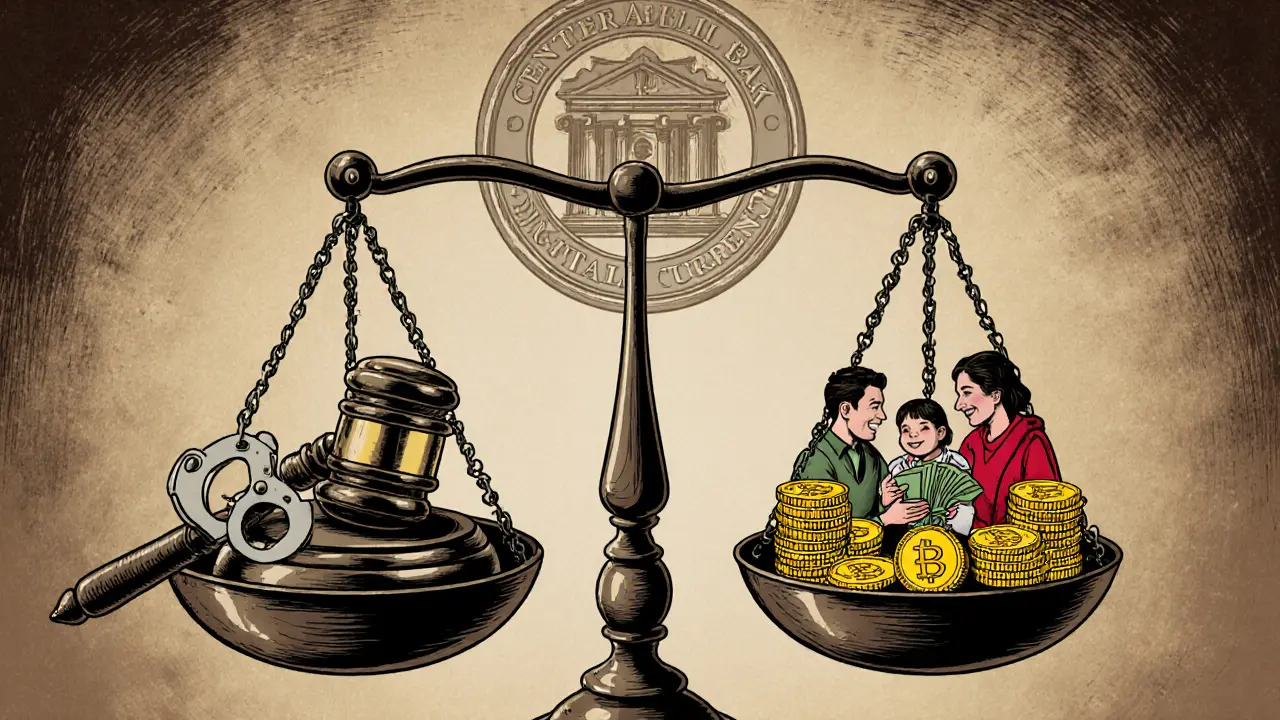

Comparison: Legal Penalties vs. Potential Gains

| Aspect | Legal Consequence | Typical Financial Benefit |

|---|---|---|

| Holding crypto wallets | Seizure of device, up to 3‑year jail | Save 10‑15% on remittance fees |

| Peer‑to‑peer trading | Fine up to 3× transaction value | Immediate cash delivery, no bank delay |

| Using offshore exchanges | Possible imprisonment, asset freeze | Access to wider crypto markets, liquidity |

| Crypto ATM withdrawals (India) | Cross‑border enforcement risk | Physical cash without bank visit |

Frequently Asked Questions

Is it illegal for Nepalis to own a small amount of Bitcoin for personal use?

Yes. The ban covers all ownership, regardless of amount. Possessing even a fraction of a Bitcoin can lead to fines and possible imprisonment under the Electronic Transaction Act.

How do Nepalis typically move crypto across the border?

Most use peer‑to‑peer platforms or messenger‑based stablecoins. Some travel to Indian towns with crypto ATMs, while others rely on offshore exchanges accessed via VPNs.

What are the most common penalties if caught?

Penalties range from up to three years in prison, fines up to three times the transaction amount, and confiscation of wallets and related assets.

Will the upcoming CBDC replace the need for crypto?

The CBDC will be fully regulated and linked to bank accounts, so it may not satisfy those seeking low‑cost, border‑free transfers. Until the CBDC offers comparable speed and fees, crypto demand is likely to continue.

How can users protect themselves from scams?

Only trade with known contacts, verify wallet addresses twice, use hardware wallets for storage, and stay updated on NRB enforcement notices. Remember there’s no legal recourse if a scam occurs.

Kevin Fellows

July 26, 2025 AT 19:44Crypto's a wild ride, but people find ways.

meredith farmer

July 31, 2025 AT 00:32The moment you think the state can’t see you, it’s already watching the next transaction. You’re basically a puppet on a string tied to a surveillance balloon. Every whisper about "underground" feels like a theater of the absurd. Still, we keep dancing under the spotlight.

Robert Eliason

August 4, 2025 AT 05:20I gotta say, the whole "crypto is a revolution" hype is just another hype train. People get all excited about decentralization, but they forget the real world still has police. Even if you hide behind a VPN, the govt can still track your IP if you slip up. And don’t get me started on the exchanges that are basically front doors for money laundering – they’re just as shady. The risk of getting your wallet seized is real, especially when the law says it’s illegal. I mean, why even bother with a "safe" wallet when the whole thing could be wiped out tomorrow? The fear of a 3‑year jail sentence is not a joke, yet many act like it’s a game. The financial gains are often overstated, you’re trading $500 for a chance at $5,000, but the odds? Not great. Many think it’s an escape from the banking system, but it’s just another layer of complexity. And the whole offshore exchange thing? That’s a red flag bigger than a neon sign. The moment you try to move large sums, the system will flag you. People act like they’re rebels, but the reality is just a high‑risk gamble with a government that doesn’t care. So before you jump in, think about the “what‑ifs”. It’s not just about profit; it’s about freedom, privacy, and the looming threat of a police raid. Yeah, there’s a chance you’ll profit, but the price might be your freedom. Think twice before you click “confirm”.

Cody Harrington

August 8, 2025 AT 10:08Nice breakdown, the risk‑reward matrix really helps visualize the stakes.

Lara Cocchetti

August 12, 2025 AT 14:56Even if you think you’re helping yourself financially, you’re indirectly supporting a system that hurts the vulnerable. The moral cost of evading regulation outweighs any personal gain.

Mark Briggs

August 16, 2025 AT 19:44Wow, another crypto‑enthusiast pretending they’re clever.

Millsaps Delaine

August 21, 2025 AT 00:32One must acknowledge the nuanced interplay between regulatory frameworks and emergent financial technologies, yet I remain steadfast in the belief that the sheer audacity of circumventing sovereign monetary policy reflects an intellectual daring that transcends mere profit‑seeking; indeed, the very act of participation becomes a philosophical statement about autonomy, even if it teeters on the brink of legal peril.

Adetoyese Oluyomi-Deji Olugunna

August 25, 2025 AT 05:20Honestly the whole underground scene is just a hype circus. The risks are real and the payoff is often overstateed.

Krithika Natarajan

August 29, 2025 AT 10:08Thanks for the balanced view. It's good to see both sides laid out clearly.

Ayaz Mudarris

September 2, 2025 AT 14:56It is incumbent upon us to scrutinize the efficacy of clandestine financial operations within jurisdictions where explicit prohibitions exist. An analytical lens reveals that while monetary benefit may be realized, the concomitant legal exposure is non‑trivial. One must weigh the potential imposition of punitive measures against the allure of reduced transaction costs. This deliberation should be guided by a rigorous risk‑assessment methodology, such as the calculator presented herein.

Irene Tien MD MSc

September 6, 2025 AT 19:44Sure, the government wants to crush crypto, but have you ever considered that maybe they’re just scared of losing control? The whole “ban” is like a toddler throwing a tantrum when a new toy arrives. And don’t even get me started on the way the media paints us as “dangerous hackers” – it’s pure theater. While they’re busy writing laws, we’re out there swapping sats over a cup of chai. The truth? We’re just trying to stay ahead of the curve, not start a revolution.

kishan kumar

September 11, 2025 AT 00:32From a philosophical standpoint, the act of evading state monetary control can be interpreted as a subtle form of existential protest. Yet, it is essential to maintain decorum and acknowledge that the legality remains clear. 🙂

Anthony R

September 15, 2025 AT 05:20Indeed, the juxtaposition of regulatory rigidity, versus the adaptive ingenuity exhibited by participants, underscores a complex, multilayered dynamic, one that warrants meticulous scrutiny.

Vaishnavi Singh

September 19, 2025 AT 10:08Contemplating the ethics of silver‑lining financial rebellion can be a quiet meditation on modern autonomy.

Linda Welch

September 23, 2025 AT 14:56Oh great, another patriotic rant about protecting the motherland while sipping crypto profits. Sure, the “nation first” mantra works best when you’re hiding cash in a foreign exchange. The irony is delicious.

Peter Johansson

September 27, 2025 AT 19:44Hey folks, keep your heads up! 🚀 Even in tricky places, a little community support can make the journey smoother. If you’re learning the ropes, ask for tips – we’ve got each other’s backs.

Cindy Hernandez

October 2, 2025 AT 00:32For anyone looking to navigate this space safely, consider using hardware wallets and two‑factor authentication. Also, stay updated on local legal developments to avoid unexpected pitfalls.

Karl Livingston

October 6, 2025 AT 05:20It’s fascinating how the underground crypto scene mirrors a secret handshake culture. The blend of risk and innovation can be both thrilling and exhausting.

Kyle Hidding

October 10, 2025 AT 10:08Let’s cut the nonsense: the crypto hype is a data‑driven bubble. Most users are just feeding the rumor mill while regulators tighten the net. The jargon won’t save you from a seizure.

Andrea Tan

October 14, 2025 AT 14:56Nice insights, everyone. It’s good to see a balanced discussion.

Gaurav Gautam

October 18, 2025 AT 19:44Stay positive, stay informed, and remember we’re all in this together. Small steps and shared knowledge can make a big difference.