ETHPad Token Burn Calculator

Understanding ETHPad Deflationary Mechanisms

ETHPad uses three automatic burn triggers to reduce its circulating supply:

1. Staking Burns

When users lock ETHPAD to secure the platform, a small percentage of the staked amount is burned each epoch.

2. IDO Participation Fees

Every time an investor buys a new project token on ETHPad, a fee is taken in ETHPAD and sent to a burn address.

3. Governance Actions

Proposals that pass on the platform require a token-commitment fee, part of which is burned to offset supply.

Key Benefit

Higher platform activity → more burns → lower circulating supply → potential price appreciation, assuming demand holds steady.

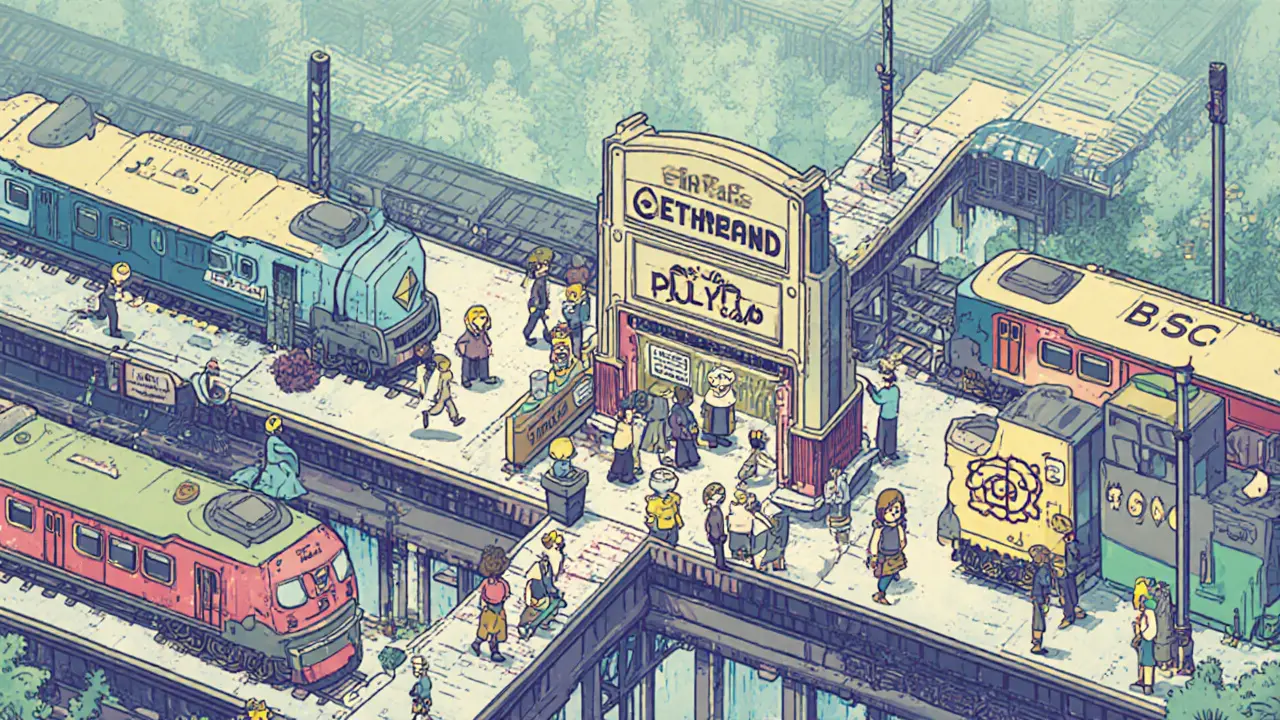

Cross-Chain Launchpad Features

ETHPad's cross-chain bridge allows projects to launch on multiple networks including:

- Ethereum

- Binance Smart Chain

- Polygon

- Avalanche

This provides access to a broader pool of investors and reduces reliance on single network congestion.

Current Market Data

Price (CoinMarketCap): $0.00126

Price (CoinCodex): $0.00885

50-Day SMA: $0.00808

200-Day SMA: $0.00499

RSI (14-day): 53.2

Volatility (30-day): 8.9%

Fear & Greed Index: 73 (Greed)

Price Forecast

Bullish Projection:

$0.1244 (8,000% growth)

Conservative Estimate:

$0.00818 (7% decline)

Risk Factors

Liquidity Fragmentation

Only listed on a few DEXs can cause dramatic price swings.

Minimal Community Data

Low public engagement makes sentiment difficult to assess.

Regulatory Uncertainty

IDO regulations are still evolving globally.

Calculate Potential Token Burns

Total Tokens Burned:

How to Buy ETHPAD Safely

- Choose a wallet. Supported options include Trust Wallet, MetaMask, or Binance Chain Wallet.

- Fund the wallet. Transfer ETH (for Ethereum) or BNB (for Binance Smart Chain) to cover swap fees.

- Connect to a DEX. On Ethereum, use Uniswap V2; on BSC, use PancakeSwap V2.

- Locate ETHPAD. Paste the contract address (0x... placeholder) into the DEX’s "Import Token" field.

- Execute the swap. Choose the amount of ETH or BNB you want to trade, confirm the transaction, and wait for the blockchain to settle.

- Secure your tokens. Transfer the newly minted ETHPAD to your personal wallet and consider adding it to the wallet’s watchlist.

When you hear the name ETHPad (ETHPAD) is a deflationary crypto token that also serves as a cross‑chain IDO launchpad built on Ethereum’s EIP‑1559 fee model. In plain terms, it’s a digital coin that not only powers a platform for new projects to raise funds, but also burns a portion of its supply every time the platform is used. That double‑dip - launchpad utility plus built‑in supply‑reduction - is the core idea you’ll see repeated throughout this guide.

- Understand what ETHPad is and why it leans on EIP‑1559.

- Learn how the token’s deflationary mechanics work.

- See the cross‑chain launchpad features that set it apart.

- Follow step‑by‑step instructions to buy ETHPAD safely.

- Get a snapshot of market data, price forecasts, and key risks.

What is ETHPad?

ETHPad is a decentralized platform that lets blockchain projects launch Initial DEX Offerings (IDOs) without relying on a single chain. The platform’s architecture is inspired by Ethereum (EIP‑1559), which introduced a base‑fee burn mechanism to make transaction fees more predictable. ETHPad mirrors that idea by burning a slice of its own token whenever users stake, participate in an IDO, or receive governance rewards. The result is a token that gradually becomes scarcer as the ecosystem grows.

How the Token Works - Deflationary Mechanics

The ETHPAD token follows the ERC‑20 standard, meaning it can be stored in any Ethereum‑compatible wallet. Its tokenomics include three automatic burn triggers:

- Staking Burns: When users lock ETHPAD to secure the platform, a small percentage of the staked amount is burned each epoch.

- IDO Participation Fees: Every time an investor buys a new project token on ETHPad, a fee is taken in ETHPAD and sent to a burn address.

- Governance Actions: Proposals that pass on the platform require a token‑commitment fee, part of which is burned to offset supply.

These mechanisms create a feedback loop: higher platform activity → more burns → lower circulating supply → potential price appreciation, assuming demand holds steady.

Cross‑Chain Launchpad Features

Unlike launchpads that operate solely on Ethereum, ETHPad’s cross‑chain bridge lets projects launch on multiple networks (e.g., Binance Smart Chain, Polygon). The bridge is guarded by a staking‑based anti‑bot system originally built by BlueZilla, the same team behind BSCPad and TRONPAD. By requiring participants to stake ETHPAD before they can trade in an IDO, the platform filters out automated bots that could otherwise front‑run retail investors.

Key cross‑chain benefits include:

- Access to a broader pool of investors across different ecosystems.

- Reduced reliance on a single network’s congestion or fee spikes.

- Enhanced security through audited bridge contracts.

How to Acquire ETHPAD

Buying ETHPAD is a multi‑step process that assumes you have some DeFi basics. Here’s a practical walkthrough:

- Choose a wallet. Supported options include Trust Wallet, MetaMask, or Binance Chain Wallet.

- Fund the wallet. Transfer ETH (for Ethereum) or BNB (for Binance Smart Chain) to cover swap fees.

- Connect to a DEX. On Ethereum, use Uniswap V2; on BSC, use PancakeSwap V2.

- Locate ETHPAD. Paste the contract address (0x… placeholder) into the DEX’s “Import Token” field.

- Execute the swap. Choose the amount of ETH or BNB you want to trade, confirm the transaction, and wait for the blockchain to settle.

- Secure your tokens. Transfer the newly minted ETHPAD to your personal wallet and consider adding it to the wallet’s watchlist.

Because the token is only listed on decentralized exchanges, liquidity can be thin, which may lead to price slippage. Always double‑check the swap settings before confirming.

Market Snapshot & Price Outlook

As of October32025, price feeds differ: CoinMarketCap lists ETHPAD at about $0.00126 with virtually no 24‑hour volume, while CoinCodex reports roughly $0.00885. The 50‑day simple moving average (SMA) sits near $0.00808, and the 200‑day SMA at $0.00499, indicating a short‑term tilt above longer‑term trends.

Technical indicators paint a neutral picture. The 14‑day Relative Strength Index (RSI) is 53.2, suggesting the token isn’t overbought or oversold. Over the last 30days, volatility has hovered around 8.9%, and half of the days closed green.

Price forecasts vary wildly. CoinLore’s bullish model predicts a December2025 price of $0.1244 (over 8,000% growth), while more conservative estimates from CoinCodex anticipate a modest 7% dip to $0.00818 in early 2024. The Fear & Greed Index currently reads 73 (Greed), hinting that sentiment may be overly optimistic.

Bottom line: the token’s fundamentals - deflationary burns and cross‑chain launch capabilities - give it a narrative edge, but the lack of consistent liquidity and mixed price signals mean investors should tread carefully.

How ETHPad Stacks Up Against BlueZilla’s Other Launchpads

| Feature | ETHPad | BSCPad | TRONPAD |

|---|---|---|---|

| Primary Chain | Ethereum (EIP‑1559) + cross‑chain bridge | Binance Smart Chain | TRON |

| Deflationary Burns | Staking, IDO fee, governance burns | Burn on token sales only | No native burn mechanism |

| Anti‑Bot Staking Requirement | Yes - mandatory for IDO entry | Optional | Optional |

| Cross‑Chain Support | Ethereum, BSC, Polygon, Avalanche (via bridge) | Limited to BSC | Limited to TRON |

| Launch History (as of 2025) | Launched 2021, limited updates | Multiple successful IDOs, active community | Active but smaller scale |

From the table you can see ETHPad’s unique selling point is the combination of EIP‑1559‑style burns and genuine cross‑chain flexibility. However, its community footprint trails behind BSCPad, which benefits from a longer track record on BSC.

Risks, Challenges & Things to Watch

Before you dip your toe in, consider the following red flags:

- Liquidity fragmentation: With the token listed only on a handful of DEXs, large trades can move the market dramatically.

- Sparse community data: Public forums, Discord activity, and developer updates are minimal, making it hard to gauge user sentiment.

- Regulatory uncertainty: Global regulators are still defining rules for IDO platforms, which could impact future listings or token sales.

- Technical complexity: Cross‑chain bridges add smart‑contract risk; any bug could freeze assets.

- Speculative price forecasts: Extreme bullish projections often ignore liquidity constraints and market cycles.

Mitigation strategies include staying on reputable DEXs, using hardware wallets for storage, and monitoring the BlueZilla team’s official channels for any roadmap announcements.

Frequently Asked Questions

What blockchain does ETHPad run on?

The core smart contracts live on Ethereum and use the EIP‑1559 fee model, but the platform also supports cross‑chain launches via a bridge that connects to BSC, Polygon, Avalanche and others.

How are ETHPAD tokens burned?

Tokens are automatically burned when users stake ETHPAD, when they pay IDO participation fees, and when they submit governance proposals that require a token‑commitment fee.

Can I trade ETHPAD on centralized exchanges?

As of October2025, ETHPAD is only listed on decentralized exchanges like Uniswap V2 (Ethereum) and PancakeSwap V2 (BSC). No major CEX has added the pair yet.

Is staking mandatory to join an IDO?

Yes. The platform requires participants to lock a minimum amount of ETHPAD before they can submit a purchase order. This staking step also triggers the built‑in burn function.

What are the biggest competitors to ETHPad?

Key rivals include BSCPad, TRONPAD, Polkastarter, and Launchpad services on Coinbase or Binance. Many of these offer similar IDO features but differ in chain focus and deflationary token designs.

Aditya Raj Gontia

August 19, 2025 AT 16:17The ETHPad tokenomics read like a textbook on deflationary mechanics, but the real utility remains nebulous. The three burn triggers sound impressive on paper, yet without strong liquidity they may just be a marketing gimmick. Staking burns, IDO fees, and governance burns all compress supply, but demand is the missing variable. If the platform can't attract sustained project pipelines, the burn mechanism alone won't drive price appreciation.

vipin kumar

August 19, 2025 AT 21:50Look beyond the glossy brochure – every new launchpad is a front for data harvesting. ETHPad's cross‑chain bridge allegedly expands access, but it also opens a vector for hidden back‑doors. The mandatory staking requirement could be a covert way to lock up capital while the team siphons fees. Their burn model is touted as a value driver, yet the actual burned volume is minuscule compared to the circulating supply. The platform's ecosystem is still a black box, and regulators are unlikely to look kindly on these opaque operations.

Lara Cocchetti

August 20, 2025 AT 03:24From a moral standpoint, the idea of a token that self‑destructs to benefit holders is tempting, but it raises ethical red flags. If the community is being misled about the real impact of burns, that's a breach of trust. Transparency is essential, especially when regulatory scrutiny is tightening around IDO platforms. Investors deserve clear, auditable data on burn rates and actual supply changes. Anything less feels like a veil over speculative hype.

Mark Briggs

August 20, 2025 AT 08:57Nice gimmick, nothing else.

mannu kumar rajpoot

August 20, 2025 AT 14:30While the paranoid narrative has its merits, the reality is that the cross‑chain bridge is a double‑edged sword. It offers broader exposure, but also multiplies attack surfaces. The mandatory staking could act as a filter, yet it may also concentrate power in the hands of early whales. If the governance model isn’t genuinely decentralized, the platform could devolve into a cartel of insiders. Users need to stay vigilant and demand real‑time audit trails for every burn event.

Tilly Fluf

August 20, 2025 AT 20:04Dear community,

I would like to extend my heartfelt appreciation for the diligent efforts many of you have invested in dissecting ETHPad’s intricacies. It is evident that the token’s deflationary architecture, comprising staking burns, IDO participation fees, and governance‑related token reductions, is designed with an aspirational vision of scarcity-driven value appreciation.

However, I must underscore that scarcity alone does not guarantee sustainable growth. The token’s utility must be anchored in genuine demand generated by a vibrant ecosystem of projects and participants. To this end, the cross‑chain bridge presents a commendable opportunity to diversify market exposure, yet it simultaneously introduces additional layers of technical risk that warrant meticulous scrutiny.

In light of the current market data-namely the divergent price feeds, modest trading volumes, and a relatively neutral RSI-it would be prudent for prospective investors to adopt a measured approach. Diversification, thorough due‑diligence, and an awareness of the platform’s liquidity fragmentation are essential safeguards.

Should you choose to engage with ETHPad, I recommend the following best practices: utilize reputable decentralized exchanges, secure your holdings in hardware wallets, and remain vigilant for any official communications from the development team regarding roadmap updates or security audits.

Collectively, by fostering transparent dialogue and adhering to disciplined investment principles, we can contribute to a healthier, more resilient crypto landscape.

Sincerely,

- A Concerned Community Member

Darren R.

August 21, 2025 AT 01:37Behold! The mighty ETHPad, a beacon of tokenomics brilliance, or perhaps a mirage in the desert of DeFi. One must ask: is the burn truly a phoenix rising, or merely ash that vanishes unnoticed? The cross‑chain aspirations are romantic, yet reality oft‑times resembles a tangled web of bridges waiting to collapse. Investors, take heed, lest the hype swallows your capital.

Hardik Kanzariya

August 21, 2025 AT 07:10Great points, everyone. If you’re considering buying, make sure to double‑check the contract address and use a hardware wallet for safety. Small steps can prevent big losses.

Shanthan Jogavajjala

August 21, 2025 AT 12:44The technical jargon surrounding the bridge suggests a sophisticated architecture, yet the underlying code audits remain opaque. A cautious stance is advisable until independent security reviews are published.

Millsaps Delaine

August 21, 2025 AT 18:17Allow me to expound at length on the existential quandary that ETHPad presents to the discerning investor. On one hand, we observe a token that purports to self‑regulate through systematic burns, an elegant archetype of deflationary economics that, in theory, should engender a perpetual appreciation of value. On the other hand, the practical manifestation of such mechanisms is contingent upon sustained transactional throughput, robust community engagement, and an unwavering commitment to transparency.

The platform’s cross‑chain capabilities, while ostensibly broadening its market reach, simultaneously dilute focus and amplify the vectors through which vulnerabilities may arise. Moreover, the scarcity narrative is predicated upon the assumption that demand will remain elastic in the face of diminishing supply-a premise that deserves rigorous scrutiny.

In summation, ETHPad dwells at the nexus of ambition and uncertainty, inviting both optimism and caution in equal measure.

Jack Fans

August 21, 2025 AT 23:50Interesting perspective! I’d add that the community’s role is pivotal-active participation can drive demand, whereas apathy leads to stagnation. Keeping an eye on upcoming project launches might give clues about future volume.

Adetoyese Oluyomi-Deji Olugunna

August 22, 2025 AT 05:24Looks like a copy‑paste job.

Krithika Natarajan

August 22, 2025 AT 10:57Thank you for the thorough analysis. I appreciate the balanced view and will proceed with caution.

Ayaz Mudarris

August 22, 2025 AT 16:30It is advisable to verify the token’s contract on Etherscan, ensure that the burn transactions are indeed recorded, and consider the health of the liquidity pools before allocating capital. Proper risk management is essential.

Irene Tien MD MSc

August 22, 2025 AT 22:04Oh dear, the grand theatrical performance continues! ETHPad heralds itself as the savior of deflationary tokenomics, yet the plot thickens with each new bridge that promises universal adoption. One cannot help but wonder whether the perpetual burn is a genuine economic catalyst or merely a smoke‑screen to distract from the shallow depth of actual utility. The token’s market data oscillates like a pendulum, and the fervent optimism seems to mask a profound lack of substantive community engagement. In a world where every new platform claims to be the next big thing, skepticism becomes a necessary virtue.

kishan kumar

August 23, 2025 AT 03:37Indeed, the spectacle is enthralling 😏. While the narrative dazzles, a measured investor will seek verifiable metrics before succumbing to the allure of perpetual burns.

Anthony R

August 23, 2025 AT 09:10Appreciate the insights; will monitor the platform closely.

Vaishnavi Singh

August 23, 2025 AT 14:44The philosophical underpinnings of scarcity are intriguing, yet practical implementation often diverges from theory. A balanced approach is warranted.

Linda Welch

August 23, 2025 AT 20:17Honestly, the whole thing smells like a nationalist agenda to push a local token into the global market without real substance. The lazy burn mechanism is just a PR stunt, and the community hype is manufactured. If you’re not skeptical, you’re being duped. Stop falling for the slick marketing and look at the actual on‑chain data before you throw money at this.

Kevin Fellows

August 24, 2025 AT 01:50Hey folks, staying positive! Even if it’s risky, a small test‑run might be fun.

meredith farmer

August 24, 2025 AT 07:24Amidst the drama of hype and speculation, one must remember that every token launch is a theatrical performance. The curtain may rise today, but the final act remains unwritten.