Crypto Taxation in China: Interactive Timeline

Overview

China has implemented a complete ban on all cryptocurrency activities. This interactive timeline shows how China moved from initial prohibitions to a comprehensive ban that eliminates any possibility of crypto taxation.

- No capital gains tax - activities are illegal

- No income tax - mining/staking is prohibited

- No VAT - crypto-related services are illegal

- Illicit proceeds subject to confiscation, not taxation

Because crypto activities are illegal, there's no tax framework to apply.

| Jurisdiction | Legal Status | Tax Approach | Enforcement |

|---|---|---|---|

| China | Complete ban on ownership, trading, mining, ICOs | No tax - activities are illegal; confiscation instead | Criminal penalties, asset seizure, financial bans |

| Taiwan | Legal, regulated exchanges | 5% VAT on trading revenue; capital gains taxed per income brackets | AML/KYC compliance, fines for non-registration |

| United States | Legal, subject to SEC/FinCEN oversight | Capital gains tax, income tax on mining, reporting (Form 8949) | IRS audits, civil penalties, criminal fraud charges |

| European Union | Legal, licensed providers | Capital gains tax after one-year holding period; income tax on mining | MiCA compliance, AML/KYC, fines for breach |

China stands alone among major economies in completely eliminating the tax question by outlawing crypto.

- China’s stance is clear: no taxation due to complete prohibition

- Enforcement includes fines, imprisonment, and asset seizure

- Foreigners are equally bound by the regulations

- The digital yuan serves as the sole legal digital currency

- Future policy shifts remain uncertain but are likely to preserve central control

Final Insight

In China, cryptocurrency is illegal, so there is no tax on it. The government's strategy is to eliminate competition for the state-controlled digital yuan and prevent speculative bubbles.

Key Points

- China has banned all crypto activities, so traditional tax concepts simply don’t apply.

- The ban covers trading, mining, ICOs, and even personal ownership.

- Violations can lead to confiscation, heavy fines, or criminal charges.

- China promotes the state‑run digital yuan as the only legal digital currency.

- Some experts hint at a future softening, but no concrete policy change exists yet.

What the crypto taxation China landscape looks like today

When people talk about cryptocurrency a digital asset that uses cryptography to secure transactions, they usually assume there’s a tax rule somewhere-capital gains, income, or VAT. In China the world’s most populous nation, governed by the Communist Party, the story is different. The People’s Bank of China (PBOC the country’s central bank and primary financial regulator) issued a comprehensive ownership ban on June12025. The decree treats any crypto‑related activity as an illegal financial act, not a taxable event.

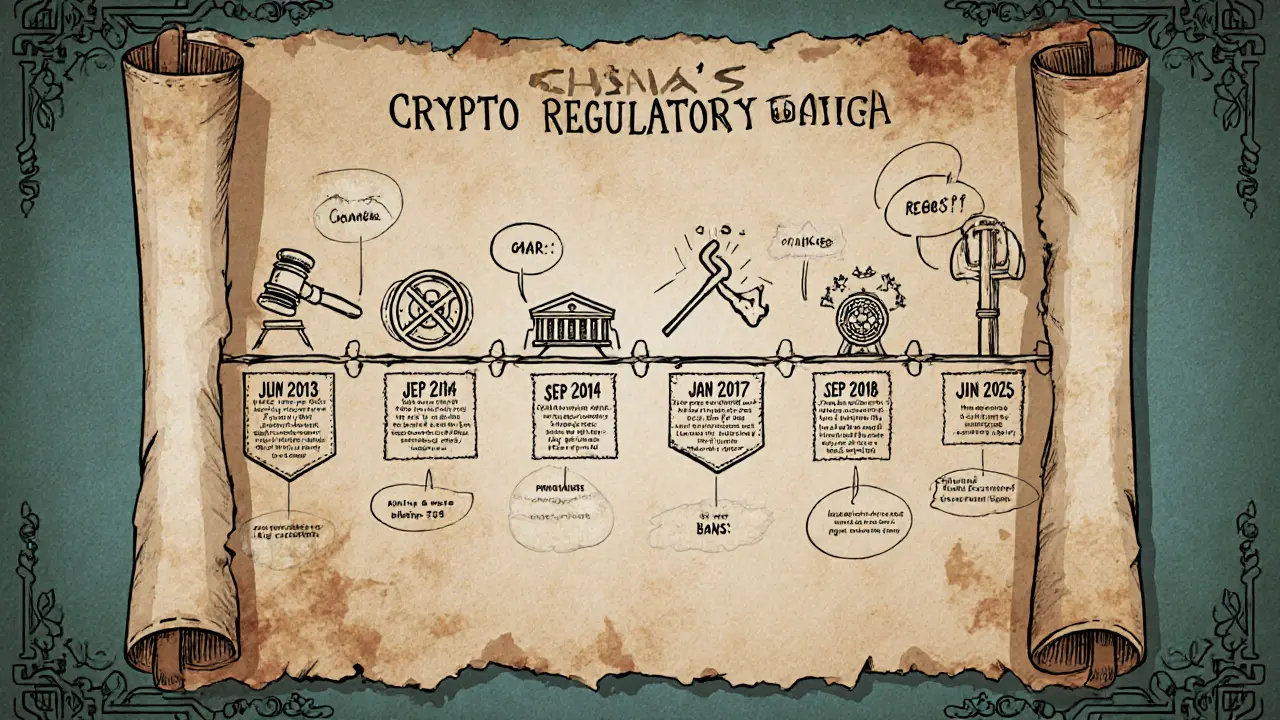

How China got here: a 16‑year regulatory march

- June2009 - Initial prohibition of virtual currencies to stop online payments with Bitcoin.

- December52013 - Banks and payment firms barred from handling crypto transactions.

- April12014 - PBOC orders closure of all Bitcoin trading accounts.

- September302017 - ICOs banned; exchanges forced to shut down.

- January2018 - Massive crackdown pushes mining rigs overseas.

- June2021 - Mining ban enacted over energy‑use concerns.

- September242021 - Comprehensive ban on trading, mining, and transactions.

- May302025 - Final ownership ban decree signed; effective June12025.

Each step tightened control, culminating in a zero‑tolerance policy that eliminates any legal basis for tax collection.

Legal framework: why there is no crypto tax

The 2025 ownership ban states that crypto transactions are “illegal financial activities.” Because they are illegal, the tax code never gets a chance to classify them as income, capital gains, or value‑added tax. In practice, this means:

- There is no capital gains tax a tax on profit from the sale of an asset on crypto sales.

- Mining rewards or staking income are not subject to income tax tax on earned earnings because the activity itself is prohibited.

- Businesses cannot charge or deduct VAT value‑added tax on the sale of goods or services on crypto‑related services.

Any gains derived from illegal crypto activity are considered illicit proceeds. The state may confiscate them under criminal asset‑seizure laws, but that is a penalty, not a tax.

Enforcement: what happens if you ignore the ban

The crackdown is heavily enforced. Violations can trigger:

- Administrative fines ranging from ¥10,000 to ¥500,000.

- Criminal charges for “illegal fundraising” or “financial fraud,” potentially resulting in up to three years in prison.

- Asset seizure-any crypto held in wallets identified by authorities can be frozen and confiscated.

- Blacklisting of individuals and companies, making it impossible to open bank accounts or obtain financing.

Even foreigners staying in China or transiting through Chinese airports are subject to the same rules. The law does not distinguish between citizens and non‑citizens when it comes to crypto prohibition.

China vs. the rest of the world: a quick comparison

| Jurisdiction | Legal status | Tax approach | Key enforcement tool |

|---|---|---|---|

| China | Complete ban on ownership, trading, mining, ICOs | No tax - activities are illegal; confiscation instead | Criminal penalties, asset seizure, financial bans |

| Taiwan | Legal, regulated exchanges | 5% VAT on trading revenue; capital gains taxed per income brackets | AML/KYC compliance, fines for non‑registration |

| United States | Legal, subject to SEC/FinCEN oversight | Capital gains tax, income tax on mining, reporting (Form 8949) | IRS audits, civil penalties, criminal fraud charges |

| European Union (e.g., Germany) | Legal, licensed providers | Capital gains tax after one‑year holding period; income tax on mining | MiCA compliance, AML/KYC, fines for breach |

The table shows that China is the only major economy that has erased the tax question by outlawing crypto entirely.

Why China chose prohibition over taxation

The ban aligns with two broader policy goals:

- Digital yuan China’s state‑issued Central Bank Digital Currency (CBDC) is positioned as the sole legal digital monetary instrument. Eliminating competing tokens reduces fragmentation and strengthens state control.

- Preventing speculative bubbles and illicit capital flows supports financial stability, a core concern of the Communist Party.

By classifying crypto activities as illegal, the government sidesteps the administrative headache of tracking millions of wallets and applying complex tax rules.

Possible softening: what the July2025 Shanghai debate hinted at

On July102025, the Shanghai State‑owned Assets Supervision and Administration Commission hosted a round‑table on digital assets. Speakers discussed stablecoins, cross‑border payments, and the “strategic response” to global crypto trends. While no policy shift was announced, a few take‑aways emerged:

- Officials acknowledge the rapid evolution of digital assets and the need for a flexible regulatory toolkit.

- There is interest in shaping a limited, state‑approved framework for certain “controlled” token use‑cases, possibly linked to the digital yuan.

- Any future changes will likely preserve the core principle of central financial control.

For now, the ban remains in effect, and the tax question stays moot.

Practical advice for individuals and businesses

If you are a Chinese citizen, expat, or a foreign company with ties to China, keep these points in mind:

- Don’t attempt to trade or mine crypto on mainland soil. Even a small transaction can trigger investigations.

- Store any crypto holdings outside Chinese jurisdiction and use offshore wallets that are not accessible from within China.

- Report any crypto‑related income to tax authorities in your home country-China won’t tax it, but other jurisdictions will.

- Monitor official PBOC announcements; a subtle regulatory tweak could create new compliance obligations.

Looking ahead: the digital yuan’s role

The CBDC a digital form of a nation’s sovereign currency issued by its central bank-the digital yuan-is being piloted in major cities, integrated into payment apps, and linked to government subsidies. Its rollout demonstrates that China prefers a state‑controlled digital money system over a decentralized one. Should the digital yuan achieve widespread adoption, it could further marginalize any illicit crypto activity, reinforcing the ban’s long‑term viability.

Frequently Asked Questions

Is owning Bitcoin illegal in China?

Private ownership sits in a legal gray area, but any attempt to trade, transfer, or use Bitcoin publicly is illegal. Authorities can confiscate holdings if they discover them.

Will I be taxed on crypto gains if I’m a foreigner visiting China?

No Chinese tax applies because the activity is prohibited. However, your home country may still require you to report any gains.

Can a Chinese company issue its own token?

No. Issuing a token would be classified as an ICO, which has been banned since 2017. The only legal digital token is the digital yuan.

What penalties can I face for crypto mining?

Mining is illegal nationwide. Penalties range from hefty fines to criminal prosecution, especially if the operation causes excessive energy consumption.

Is there any chance China will start taxing crypto instead of banning it?

Current policy signals a firm commitment to prohibition. While officials are discussing digital‑asset strategies, any shift would likely keep the focus on the digital yuan and maintain strict controls.

Chris Hayes

December 4, 2024 AT 22:17China's extreme stance on crypto basically forces anyone who cares about personal finance to look elsewhere. The government’s blanket ban sidesteps any real fiscal policy discussion, which is a missed opportunity for nuanced regulation. If they wanted to control capital flows, a tax regime could have done the trick without driving the whole sector underground.

Aditya Raj Gontia

December 8, 2024 AT 03:44From a compliance standpoint, the prohibition eliminates the need for AML/KYC frameworks, but it also kills any potential for a structured crypto‑tax ecosystem. The lack of reporting obligations basically renders the market non‑existent under Chinese jurisdiction.

mannu kumar rajpoot

December 11, 2024 AT 09:12What most people don’t see is that the ban is a front for a larger surveillance agenda. By criminalising every transaction they gain unfettered access to financial data, turning ordinary wallets into instruments of state control. The tax question becomes irrelevant because the state already confiscates anything it deems illegal.

Tilly Fluf

December 14, 2024 AT 14:39It is evident that the Chinese authorities prioritize monetary sovereignty over individual liberty. While the enforcement may appear harsh, the overarching goal of protecting the digital yuan aligns with their macro‑economic stability objectives.

Darren R.

December 17, 2024 AT 20:06We must ask ourselves: is it moral to punish ordinary citizens for simply holding a digital token?; The answer is a resounding no!!!; The state’s heavy‑handed approach reflects a deeper ideological battle against decentralisation!!!

Hardik Kanzariya

December 21, 2024 AT 01:33Look, the best way to stay safe is to keep crypto activities completely out of mainland China. If you’ve already got exposure, consider moving assets to a jurisdiction with clear tax guidance and robust legal protection.

Shanthan Jogavajjala

December 24, 2024 AT 07:01Honestly, the ban is just a buzzword shield for a lack of real policy. By labeling everything illegal they avoid the messy work of creating a tax code that actually tracks real‑world usage. It’s a classic case of regulatory avoidance masquerading as strict enforcement.

Jack Fans

December 27, 2024 AT 12:28Yep, the Chinese policy is a straight‑up ban; not a tax matter at all. If you’re looking for a place to trade, you’ll have to move offshore – just make sure you’re not tring to access it from within China lol.

Adetoyese Oluyomi-Deji Olugunna

December 30, 2024 AT 17:55One could argue that the Chinese approach epitomises a hegemonic overreach, a kind of techno‑imperialism that silences dissenting financial narratives under the guise of national security.

Krithika Natarajan

January 2, 2025 AT 23:23The timeline is clear.

Ayaz Mudarris

January 6, 2025 AT 04:50From a macro‑economic perspective, the absolute prohibition eliminates the need for a tax apparatus, thereby simplifying fiscal administration. However, this simplification is achieved at the expense of aligning with global financial standards, potentially isolating China from future digital‑asset innovations.

Irene Tien MD MSc

January 9, 2025 AT 10:17It’s almost comical how the Chinese government pretends that banning crypto entirely solves any tax‑related conundrum, as if the mere act of outlawing automatically absolves them of any fiscal responsibility. The reality is that by criminalising the activity they have sidestepped the complex task of integrating a nascent asset class into existing tax frameworks, which, let’s be honest, would have required a modicum of bureaucratic competence. Instead of grappling with the nuances of capital‑gains calculations, they opted for a blunt instrument, crushing any hope of legitimate market development. One could argue this is a masterstroke of authoritarian efficiency, but it also reveals a profound lack of strategic foresight. The ban eliminates the tax base, sure, but it also erodes potential revenue streams from a sector poised for explosive growth. Moreover, the enforcement machinery now bears the burden of surveillance, asset seizure, and prosecution, which are far more costly than a well‑designed tax regime would have been. In other words, they’ve swapped a manageable tax code for an endless cat‑and‑mouse game with underground operators. The digital yuan, touted as the nation’s sole legal digital currency, may thrive in a vacuum, yet its legitimacy on the world stage could be compromised by the perception of forced exclusivity. All this drama unfolds while the rest of the world refines its crypto‑tax policies, turning a blind eye to the irony that China’s ‘no‑tax’ proclamation is, in fact, a costly policy gamble. Ultimately, the ban serves as a stark reminder that governance without nuance often produces more problems than it solves.

kishan kumar

January 12, 2025 AT 15:44In the grand tapestry of fiscal philosophy, one might view China's outright ban as a radical, yet perhaps necessary, stroke. The state’s pursuit of monetary homogeneity could be justified, though it invites scrutiny regarding civil liberties. 🙂

Linda Welch

January 15, 2025 AT 21:12Oh sure, because banning everything is the hallmark of a thriving economy. The ‘no‑tax’ gimmick just masks a massive power grab, and anyone who thinks otherwise is clearly ignoring the bigger geopolitical picture.

meredith farmer

January 19, 2025 AT 02:39The drama surrounding this ban is almost theatrical. It’s as if the authorities staged an epic showdown between the digital yuan and any rogue crypto, playing on fear to cement their dominance.

Peter Johansson

January 22, 2025 AT 08:06For anyone still contemplating crypto in China, the safest path is to respect the regulations and focus on compliant financial avenues. Keep learning, stay adaptable, and remember that the global landscape offers many alternatives.

Cindy Hernandez

January 25, 2025 AT 13:33The key takeaway is that the Chinese ban removes any tax considerations outright, but it also limits financial freedom. Readers should evaluate the trade‑off between state control and individual autonomy when looking at digital assets.

Karl Livingston

January 28, 2025 AT 19:01It’s fascinating how a single policy can reshape an entire ecosystem. The ban’s ripple effects are felt far beyond borders, prompting other nations to reassess their own crypto strategies.

Kyle Hidding

February 1, 2025 AT 00:28The analysis here is shallow; the ban merely shifts risk to a black market where oversight is non‑existent, creating a breeding ground for fraud and money‑laundering. From a risk‑assessment perspective, China has swapped a manageable tax problem for an uncontrolled illicit economy.

Andrea Tan

February 4, 2025 AT 05:55Just a heads up: if you’re traveling through China, keep any crypto activity off the grid. It’s not worth the hassle.

Gaurav Gautam

February 7, 2025 AT 11:22Let’s try to keep the conversation constructive. While the ban is strict, it’s possible to find collaborative solutions in other jurisdictions that balance innovation with regulation.

Robert Eliason

February 10, 2025 AT 16:50Honestly, i dont see why anyone would care about a ban when the rest of world is movin on. Its just another pice of arse

Cody Harrington

February 13, 2025 AT 22:17Overall, the Chinese approach illustrates a stark contrast to the tax‑friendly models emerging elsewhere.