On June 1, 2025, China made it illegal for its citizens to own, trade, or even hold any cryptocurrency. This wasn’t a warning. It wasn’t a slowdown. It was a full stop. The People’s Bank of China (PBOC) issued Circular No.237, shutting down every door - exchanges, mining, OTC brokers, even private wallet use. For the first time, owning Bitcoin or Ethereum became a criminal act under Chinese law.

What Exactly Is Banned?

The ban covers everything. No buying. No selling. No mining. No holding. No using USDT to send money abroad. No trading on Binance, OKX, or Coinbase - even if you use a VPN. Financial institutions like Bank of China, ICBC, and Alipay were ordered to cut off all payment channels linked to crypto. If your bank account shows a pattern of sending money to a known crypto exchange, it gets frozen. No warning. No appeal.Even indirect exposure is risky. Chinese companies can’t list crypto on their balance sheets. If you work for a firm that owns Bitcoin through a Hong Kong subsidiary, regulators can still come after you. The definition of illegal activity is broad: offering price data for crypto, acting as a middleman, or even running a Telegram group that shares exchange links can land you in trouble.

How Did We Get Here?

China didn’t wake up one day and decide to ban crypto. It was a 12-year march toward total control. Back in 2013, banks were told not to touch Bitcoin. In 2017, ICOs were shut down overnight - 24 platforms closed in a single day. By 2021, mining was outlawed because of energy use, and thousands of miners fled to Kazakhstan and the U.S. Then in September 2021, trading and transactions were banned, forcing exchanges like BTCC to shut down their mainland operations.The June 2025 ban was the final step. It didn’t just target businesses - it targeted individuals. Now, if you buy $500 worth of Bitcoin on a foreign exchange and store it in a wallet, you’re breaking the law. The government doesn’t care if you’re a student, a trader, or a developer. The rule is the same: no crypto.

How Are They Enforcing It?

China doesn’t rely on luck to catch people. They use tech. Banks now run automated systems that flag transactions matching crypto patterns - rapid transfers to offshore wallets, repeated small deposits to known OTC broker accounts, or even purchases of gift cards that later appear on crypto platforms. In July 2025, police raided 127 OTC broker offices across Guangdong and Sichuan, arresting 430 people for helping citizens convert yuan into USDT.Telecom providers are required to report users who access blocked crypto websites. If you use a VPN to reach Binance, your ISP might get a notice. You won’t be arrested just for browsing, but if you transfer money, you’re flagged. The government’s goal isn’t just to stop crypto - it’s to make it so risky and visible that no one tries.

Why Does China Care So Much?

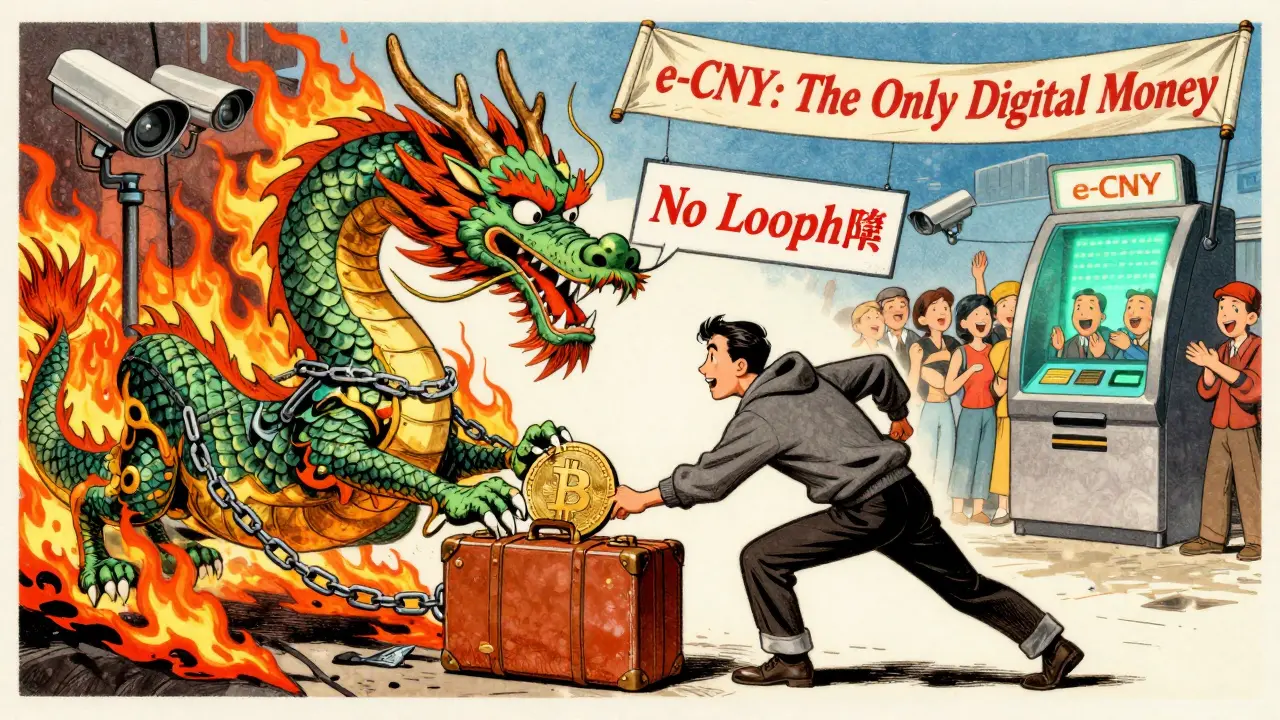

This isn’t about Bitcoin being “bad.” It’s about control. China’s economy runs on state oversight. The yuan is tightly managed. Capital outflows are monitored. Crypto threatens all of that. When people use Bitcoin or stablecoins to move money out of the country, it weakens the yuan. That’s why the crackdown on USDT was so aggressive - it’s the main tool for bypassing capital controls.At the same time, China is pushing its own digital currency: the digital yuan, or e-CNY. The PBOC has spent billions building this system. It’s not decentralized. It’s not anonymous. Every transaction is tracked by the state. The crypto ban clears the way for the digital yuan to become the only digital money Chinese citizens can legally use. There’s no room for competition.

What About Hong Kong?

Hong Kong is the exception. While mainland China bans crypto, Hong Kong has licensed exchanges, allowed ETFs, and even started tokenizing real estate. But here’s the catch: Hong Kong is part of China. If you’re a mainland resident, you can’t legally open a Hong Kong exchange account unless you have a Hong Kong ID. Most banks won’t let you fund it from a mainland account. Even if you manage to, using that account to trade crypto still violates mainland law.So while Hong Kong is open for business, it’s not a loophole for mainlanders. It’s a parallel system - and crossing between them is now a legal minefield.

What Happens If You Get Caught?

There’s no official punishment listed in the law, but cases are handled under existing financial crime statutes. Penalties range from fines to jail time, depending on how much money was involved. In 2025, a man in Shenzhen was sentenced to 18 months for using his family’s bank accounts to move $2.3 million into crypto. His assets were seized. His name was added to a financial blacklist - meaning he can’t get a loan, open a business, or even rent an apartment in some cities.For businesses, the consequences are worse. Companies found facilitating crypto transactions face license revocation, asset freezes, and criminal charges for executives. Even foreign companies that market crypto services to Chinese users - like a U.S.-based crypto newsletter - can be blocked, fined, or have their servers taken down by Chinese authorities.

Is There Any Way Around It?

Technically, yes. Some people still use peer-to-peer platforms, private wallets, or offshore accounts. But it’s not safe. Every method has risks:- Peer-to-peer (P2P) trading: Sellers often demand cash in person. Scams are common. If you’re caught, you’re treated as a participant in illegal financial activity.

- VPNs: Many are now blocked by China’s Great Firewall. Even if you get one, your traffic is monitored. Using it for crypto makes you a target.

- Hardware wallets: Owning one isn’t illegal - but if authorities find it during a raid, you’ll need to prove you didn’t use it. Good luck.

There’s no legal, safe, or reliable way to access crypto in China today. The government has spent years building systems to make it nearly impossible.

What’s Next for China and Crypto?

Don’t expect a reversal. The digital yuan is now in use across 200+ cities. Over 600 million people have active e-CNY wallets. The government is rolling out features like offline payments and automated tax deductions. Crypto isn’t just banned - it’s being replaced.Experts say China won’t lift the ban unless the digital yuan completely replaces cash and private digital money - and even then, it’s unlikely. The state sees crypto as a threat to its financial sovereignty. The ban isn’t temporary. It’s structural.

Meanwhile, global crypto markets have moved on. Trading volumes from China have dropped to near zero. The days when Bitcoin prices spiked on rumors from Beijing are over. China’s role in crypto is no longer as a market leader - it’s as a warning.

What This Means for the Rest of the World

China’s move is the strictest crypto ban in history. No other country has gone this far. The U.S. regulates. The EU monitors. Singapore licenses. China outlawed.This shows how far a government will go to control digital finance. It also proves that centralized systems can outmaneuver decentralized ones - not through technology, but through power. If you think crypto is unstoppable, look at China. The state won.

Can Chinese citizens still buy Bitcoin using a VPN?

No. While a VPN might let you access a foreign exchange website, buying Bitcoin is still illegal under Chinese law. Financial institutions are required to block payments linked to crypto. Even if you manage to fund an account, transferring money out of China for crypto purposes violates capital control rules. Authorities monitor these transactions closely, and getting caught can lead to fines, asset seizure, or criminal charges.

Is holding crypto in a hardware wallet legal in China?

Owning a hardware wallet isn’t explicitly illegal, but possessing one can be used as evidence in a criminal case. If authorities seize your wallet and find cryptocurrency inside, you must prove you didn’t acquire it through illegal means - which is nearly impossible. The June 2025 ban makes all private crypto ownership illegal, regardless of how it’s stored.

Can Chinese companies invest in crypto through offshore subsidiaries?

No. While companies might try to hold crypto through Hong Kong or offshore entities, the PBOC has made it clear that any indirect exposure is still a violation. Regulators can trace funds back to the parent company in China. Executives risk personal liability, and the company can face heavy fines, license revocation, or criminal investigation.

Why did China ban crypto mining?

China banned crypto mining in 2021 primarily due to its massive energy consumption, which conflicted with national carbon neutrality goals. But the deeper reason was financial control. Mining requires access to foreign exchanges and crypto payments, which undermines capital controls. By shutting down mining, China removed one of the largest channels for yuan-to-crypto conversion.

Is the digital yuan the same as cryptocurrency?

No. The digital yuan (e-CNY) is a central bank digital currency issued and fully controlled by the People’s Bank of China. Unlike Bitcoin or Ethereum, it’s not decentralized. Every transaction is tracked, and the government can freeze funds, limit spending, or deny access. It’s designed to replace cash and strengthen state control - the opposite of what cryptocurrencies aim to do.

Can I use crypto to send money to family overseas from China?

No. Sending crypto overseas from China is illegal under the June 2025 ban. Even if you use USDT or another stablecoin, it’s classified as an illegal cross-border financial transfer. Authorities actively monitor these transactions, especially those linked to OTC brokers. Violators face asset freezes, fines, and possible imprisonment.

Are there any legal crypto exchanges in China?

No. All domestic crypto exchanges were shut down by 2021. The 2025 ban made it illegal for any entity - domestic or foreign - to offer crypto services to Chinese residents. Even platforms that claim to be “for international users” are blocked if they market to or accept Chinese customers. There are no legal crypto exchanges operating in China.

nayan keshari

January 1, 2026 AT 02:05dayna prest

January 1, 2026 AT 10:24Jordan Fowles

January 2, 2026 AT 21:50Andy Reynolds

January 3, 2026 AT 21:59Bianca Martins

January 4, 2026 AT 13:27Rajappa Manohar

January 6, 2026 AT 12:34Mike Reynolds

January 8, 2026 AT 04:27Michelle Slayden

January 8, 2026 AT 13:42alvin mislang

January 9, 2026 AT 06:57Phil McGinnis

January 10, 2026 AT 14:10Ian Koerich Maciel

January 12, 2026 AT 14:00rachael deal

January 13, 2026 AT 02:54Bruce Morrison

January 13, 2026 AT 04:17Alexandra Wright

January 14, 2026 AT 00:21Adam Hull

January 14, 2026 AT 10:33Steve Williams

January 14, 2026 AT 19:03Ryan Husain

January 15, 2026 AT 12:56Brooklyn Servin

January 16, 2026 AT 13:43Josh Seeto

January 16, 2026 AT 18:55Abhisekh Chakraborty

January 18, 2026 AT 09:06Andrew Prince

January 18, 2026 AT 12:23Johnny Delirious

January 18, 2026 AT 22:26