Bagels Finance (BAGEL) Airdrop Calculator

Airdrop Eligibility Checker

Calculate your potential BAGEL token allocation based on your participation in the Bagels Finance airdrop program.

Your Estimated Allocation

Based on your eligibility status, you qualify for:

- Total BAGEL Pool: 103,594 BAGEL

- Your Estimated Share: BAGEL

- Percentage of Pool: 0%

Airdrop Summary

| Total BAGEL Allocated | 103,594 BAGEL |

| Eligibility Criteria | Twitter follow, Telegram join, wallet interaction before July 2024 |

| Airdrop End Date | April 11, 2025 |

| Distribution Window | ~2 weeks post-end |

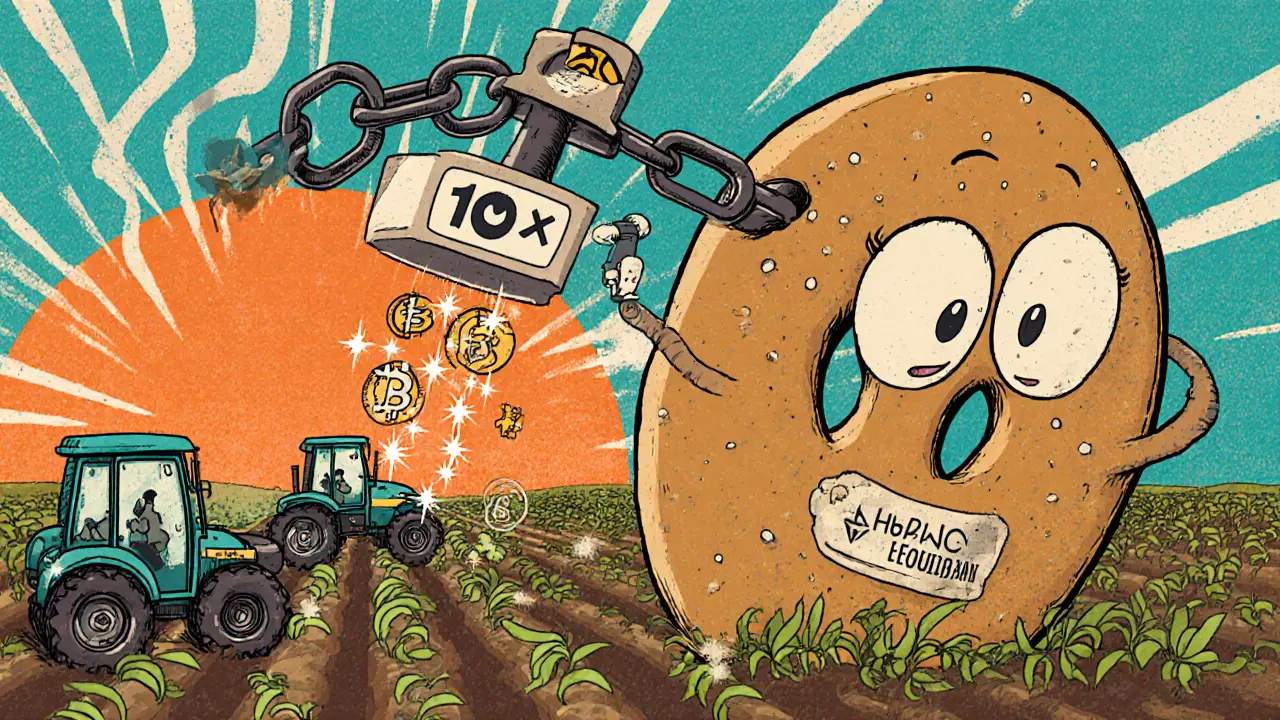

If you’ve been scrolling through crypto news this year, you’ve probably seen the name Bagels Finance pop up alongside promises of high‑leverage farming and a massive airdrop. Below is everything you need to know - from how the platform works to why the token isn’t showing any price on major trackers.

Quick Snapshot

- Bagels Finance launched as the first cross‑chain leveraged yield farming protocol.

- The BAGEL token has a max supply of 110million but reports zero circulating supply on most sites.

- Airdrop: 103,594 BAGEL distributed; program ended April112025.

- Leverage range: 2x‑10x on assets like ETH, WBTC, USDT, DAI, BNB, HT.

- Revenue sharing: 85% of platform fees paid to staked BAGEL holders.

What is Bagels Finance?

When you first encounter the project, you’ll see it described as a Bagels Finance a cross‑chain leveraged yield farming platform that allows users to farm with up to 10× leverage on multiple blockchains. In practice, the protocol lets you deposit popular assets - ETH, WBTC, USDT, DAI, BNB, and HT - into smart contracts that automatically borrow against your position, then farm the borrowed amount for amplified rewards.

How Leveraged Yield Farming Works

Leveraged farming is essentially two steps: you provide collateral, the protocol borrows additional funds, and both your original and borrowed assets earn farming APY. For example, a 5× position on ETH means you lock 1ETH, the protocol borrows 4ETH, and the combined 5ETH earn yield. The upside is higher returns, but the downside is liquidation if the market moves against you.

Bagels Finance uses a custom smart‑contract engine that routes liquidity across Ethereum, Binance Smart Chain, and Huobi Eco‑Chain, aiming for the best APY on each network. The cross‑chain layer also helps balance liquidity, reducing slippage when one chain’s pool gets thin.

BAGEL Tokenomics & Revenue Sharing

The native token, BAGEL a governance and revenue‑sharing token with a capped supply of 110million, serves three purposes: governance, staking rewards, and dividend distribution. Holders can stake BAGEL to receive a share of platform fees - the protocol promises to allocate 85% of revenue to staked token holders as regular dividends.

Governance is handled by a DAO where staked BAGEL gives voting power on proposals such as fee adjustments, new chain integrations, and leverage caps. In theory, active participants could even become board members, shaping the protocol’s roadmap.

Airdrop Program Details

The airdrop was announced on Airdrop.io a platform that tracks crypto airdrop campaigns with a total pool of 103,594 BAGEL. Unlike many airdrops that limit winners, Bagels Finance promised that anyone who met the eligibility criteria would receive a slice of the pool.

Eligibility required completing a few simple steps: follow the project on Twitter, join the Telegram group, and submit a wallet address that had interacted with the protocol before the cut‑off date (July2024). The distribution window closed on April112025, and participants were told to expect token delivery within two weeks.

| Metric | Value |

|---|---|

| Total BAGEL allocated | 103,594 |

| Eligibility actions | Twitter follow, Telegram join, wallet interaction |

| End date | April 11, 2025 |

| Distribution window | ~2 weeks post‑end |

Current Market Status & Price Data

As of October2025, major trackers paint a confusing picture. CoinMarketCap reports a price of $0 and a circulating supply of 0 BAGEL, while Crypto.com lists BAGEL at $0.002047 but provides no volume data. Binance does not list BAGEL at all, with its last update dating back to June2022.

These discrepancies suggest that the airdropped tokens either never made it onto liquid exchanges or that liquidity is extremely thin. Without an active market, the promised revenue‑sharing dividends cannot be realized, because there’s no way to trade or value the token.

Risks & Red Flags

Every crypto project carries risk, but several specific concerns stand out for Bagels Finance:

- Liquidity shortage: Zero reported circulating supply means you likely won’t find a buyer on major DEXes.

- Exchange delisting: Absence from Binance and other top tier exchanges limits exposure.

- Unverified leverage claims: The protocol’s smart contracts have not been publicly audited by a top‑tier firm.

- Revenue‑sharing feasibility: Dividends depend on platform fees, but without users, fees are minimal.

- Data transparency: Last development updates are from 2022; no roadmap or sprint reports have surfaced since the airdrop.

How to Evaluate Before Getting Involved

Use this quick checklist to decide if you want to keep an eye on Bagels Finance or walk away:

- Check the official GitHub - are there recent commits or audit reports?

- Confirm a live trading pair on a reputable DEX (e.g., Uniswap, PancakeSwap).

- Verify that the DAO is active - look for recent governance proposals on snapshot.org.

- Assess the community size - a genuine Telegram or Discord with regular moderator activity is a good sign.

- Calculate realistic APR after accounting for possible liquidation risk at 10× leverage.

If most of these boxes are empty, treat BAGEL as a speculative token rather than a yield‑generating asset.

Frequently Asked Questions

Did I miss the Bagels Finance airdrop?

The official distribution window closed on April112025. If you completed the eligibility steps before that date, you should have received BAGEL in your wallet. There is no public extension announced.

Where can I trade BAGEL?

Currently, BAGEL is not listed on major centralized exchanges like Binance or Coinbase. A few decentralized exchanges have tiny pools, but slippage is extreme. Check the project’s official Discord for any newly added liquidity pools.

How does the 85% revenue‑sharing model work?

The protocol allocates 85% of fees collected from borrowing and trading to a rewards contract. Stakers of BAGEL receive a proportional slice of those rewards on a daily basis. The model only generates payouts when the platform earns fees, so low activity means low or zero dividends.

Is the smart‑contract code audited?

As of the latest public statements, Bagels Finance has not released a third‑party audit from a recognized firm. That lack of audit increases the risk of bugs or exploits, especially with leveraged positions.

Can I still stake BAGEL for governance?

Staking is technically possible if you have BAGEL in a supported wallet, but with near‑zero liquidity the voting power is negligible and proposals rarely pass without a critical mass of participants.

Chris Hayes

August 27, 2025 AT 08:01The airdrop criteria feel overly simplistic, effectively rewarding anyone who merely followed a Twitter account without proving genuine engagement. Still, the promise of 85% revenue sharing is an interesting hook for yield farmers.

Aditya Raj Gontia

August 28, 2025 AT 18:56Bagels’ leverage modules are basically just synthetic exposure layers on top of standard yield farms.

mannu kumar rajpoot

August 30, 2025 AT 05:50Ever wonder why the token never shows up on any major DEX? Some say the devs are funneling fees to hidden wallets, and the whole airdrop might be a front for a pump‑and‑dump scheme.

Tilly Fluf

August 31, 2025 AT 16:45Thank you for sharing this overview; it’s helpful to see a concise breakdown of the eligibility steps and the red‑flag items to watch for.

Darren R.

September 2, 2025 AT 03:39Honestly, the entire narrative feels like a drama unfolding on a stage where the script is written by the marketing team, the actors are the token holders, and the audience is left waiting for a plot twist that never arrives, because, let’s face it, the revenue‑sharing model is just a fancy way of promising dividends that may never be paid out; the lack of audit is like a missing footnote in a thesis, and the zero circulating supply is the ultimate punchline, proving that the whole thing might be less about finance and more about a publicity stunt, which, in my opinion, borders on the absurd, especially when you consider the thin liquidity and the absence of any reputable exchange listing.

Hardik Kanzariya

September 3, 2025 AT 14:34For anyone still curious, I’d suggest checking the GitHub repo for recent commits before putting any capital at risk; a live contract audit would also go a long way toward building trust.

Shanthan Jogavajjala

September 5, 2025 AT 01:29The protocol’s cross‑chain engine is basically a wrapper that bridges liquidity across EVM networks, but without solid audit trails the risk of oracle manipulation remains high.

Jack Fans

September 6, 2025 AT 12:23Quick tip: if you already have BAGEL in your wallet, stake it on the official staking portal, it’ll at least earn you a sliver of the fee pool, albeit a tiny one; just beware of gas fees eating your returns.

Adetoyese Oluyomi-Deji Olugunna

September 7, 2025 AT 23:18The opnionated discourse surrounding BAGEL is oftentimes marked by verbose sesquences that lack substantive evidence, resulting in a climate of bewilderment.

Krithika Natarajan

September 9, 2025 AT 10:12I appreciate the clear checklist; it’s a straightforward way to gauge whether to engage further or step back.

Ayaz Mudarris

September 10, 2025 AT 21:07First, the premise of leveraging yield farms appears attractive only when the underlying assets maintain stability; otherwise, the liquidation risk escalates dramatically. Second, the disclosed revenue‑sharing model presupposes a consistently high throughput of platform fees, which historically has not been demonstrated by the protocol. Third, the absence of a verified audit invites speculation about hidden vulnerabilities that could be exploited at any moment. Fourth, the token’s market exposure is effectively nil, as evidenced by zero listings on major exchanges and negligible liquidity on the few DEX pools that exist. Fifth, governance participation hinges on a token distribution that never materialized for most, rendering the DAO largely inert. Sixth, the cross‑chain architecture, while theoretically innovative, lacks transparent documentation, making it difficult for developers to assess security implications. Seventh, the leveraged positions offered range from 2x to 10x, yet the platform does not provide clear margin call thresholds or liquidation safeguards. Eighth, community engagement appears minimal; the Telegram and Discord channels show sporadic activity with few substantive updates. Ninth, the airdrop eligibility requirements were deliberately low‑bar, potentially inflating participant numbers without corresponding utility. Tenth, the promised 85% fee redistribution implies a high operational cost, leaving only 15% for the protocol’s sustainability. Eleventh, the project’s roadmap has not been updated since 2022, raising concerns about its long‑term viability. Twelfth, the tokenomics indicate a capped supply of 110 million, but the actual circulating supply remains effectively zero, undermining price discovery. Thirteenth, investors seeking real yield should consider alternative platforms with audited contracts and active markets. Fourteenth, any potential stakeholders must conduct thorough due diligence, including code reviews and liquidity assessments. Fifteenth, until these critical gaps are addressed, participation in Bagels Finance should be approached with extreme caution.

Irene Tien MD MSc

September 12, 2025 AT 08:01Oh wow, another project promising sky‑high yields while the token sits on a shelf like an unsold bagel at a coffee shop. One has to wonder if the whole thing is a masterclass in how to build hype with absolutely zero substance, especially when the so‑called ‘revenue sharing’ is just a feel‑good slogan with no real cash flow to back it up.

kishan kumar

September 13, 2025 AT 18:56In contemplating the ontological status of BAGEL, one must query whether a token devoid of liquidity can truly be said to exist in the economic sphere; nevertheless, the attempt at governance through staking remains a commendable, albeit under‑realized, aspiration. :)

Linda Welch

September 15, 2025 AT 05:50Honestly, the whole BAGEL narrative feels like a patriotic sales pitch disguised as crypto innovation, with the usual lazy excuses for why the token isn’t listed yet. It’s as if they think their audience will just trust the hype without any real evidence, which is both condescending and utterly ridiculous.

meredith farmer

September 16, 2025 AT 16:45Sometimes I think the only thing more dramatic than the promises made by BAGEL is the silence that follows when the community asks for real updates. It’s like watching a soap opera where the main character disappears for months and then returns with a vague promise that everything will be fine.

Peter Johansson

September 18, 2025 AT 03:39Hey folks 😊, if you’re still considering BAGEL, remember that staking can at least give you a tiny portion of any fees that might trickle in-just make sure you’re not paying more in gas than you earn!

Cindy Hernandez

September 19, 2025 AT 14:34For anyone looking to dive deeper, the official docs contain a section on fee distribution that’s worth a quick read before committing any capital.

Karl Livingston

September 21, 2025 AT 01:29The lack of liquidity is a real pain point, but on the bright side, the cross‑chain approach could someday attract a broader user base if they manage to secure proper audits and listings.

Kyle Hidding

September 22, 2025 AT 12:23This project reeks of a classic pump‑and‑dump scheme, with jargon thrown around to distract from the fact that there’s basically no market for the token.

Andrea Tan

September 23, 2025 AT 23:18Just a friendly heads‑up: keep an eye on the official Discord for any announcements about new liquidity pools.

Gaurav Gautam

September 25, 2025 AT 10:12Let’s stay positive-if the team can pull off a proper audit and get listed on a reputable DEX, BAGEL could still have a chance to prove its worth.

Robert Eliason

September 26, 2025 AT 21:07Sure, BAGEL might be the next big thing… or just another dead‑coin waiting to be forgotten, but who cares? The market will decide.

Cody Harrington

September 28, 2025 AT 08:01Interesting points, everyone-thanks for the diverse perspectives.